Bond discount rate calculation, the mathematical process to determine the present value of a bond, is a fundamental concept in finance. In real-world scenarios, it helps investors make informed decisions, such as when purchasing a bond at a discount to its face value.

Understanding how to calculate bond discount rate is crucial for investors seeking to maximize their returns and minimize financial risks. It provides a comprehensive view of a bond’s present worth, considering factors like interest rates and the time value of money. Historically, the development of accurate and efficient bond discount rate calculation methods has played a significant role in facilitating the growth and complexity of global financial markets.

This article will explore the detailed steps involved in calculating bond discount rates, providing practical examples and insights into its applications. By understanding these concepts, investors can take advantage of this valuable tool to make informed financial decisions.

How to Calculate Bond Discount Rate

Determining the bond discount rate is crucial for investors, as it helps them evaluate a bond’s present value and make informed investment decisions. Key aspects that influence the bond discount rate calculation include:

- Face value

- Coupon rate

- Current market price

- Time to maturity

- Interest rate environment

- Creditworthiness of the issuer

- Tax implications

- Inflation expectations

These factors collectively impact the bond’s present value, which is calculated using the bond discount rate. Understanding these key aspects empowers investors to accurately assess bond investments and optimize their portfolio returns.

Face value

The face value, also known as the par value or nominal value, represents the principal amount of a bond. It is a crucial factor in calculating the bond discount rate, as it serves as the reference point for determining the bond’s present value and future cash flows. Understanding the different aspects of face value empowers investors to make informed decisions when evaluating bond investments.

- Initial Principal: The face value represents the amount of money the bond issuer initially borrows from investors.

- Maturity Value: Upon the bond’s maturity date, the issuer repays the face value to the bondholder, completing the loan obligation.

- Coupon Payments: Bonds with coupons make periodic interest payments based on a percentage of the face value. The coupon rate determines the amount of these interest payments.

- Discount Rate Impact: The face value acts as the benchmark against which the bond’s present value is calculated. When the bond is issued at a discount, its present value is lower than the face value, resulting in a higher yield to maturity.

In summary, the face value serves as the foundation for calculating the bond discount rate and understanding the bond’s overall financial characteristics. By considering the various aspects of face value, investors can make informed investment choices, assess the potential return on their bond investments, and manage their portfolios effectively.

Coupon rate

The coupon rate plays a pivotal role in calculating the bond discount rate. It represents the annual interest payment made to bondholders, typically expressed as a percentage of the bond’s face value. Understanding the relationship between coupon rate and bond discount rate is crucial for evaluating bond investments.

A higher coupon rate leads to a lower bond discount rate. This is because a bond with a higher coupon rate offers more regular interest payments, making it more attractive to investors. As a result, investors are willing to pay a higher price for the bond, reducing the discount from its face value.

Conversely, a lower coupon rate results in a higher bond discount rate. Bonds with lower coupon rates offer less frequent interest payments, making them less desirable to investors. To entice investors, these bonds are often issued at a discount to their face value, increasing the yield to maturity for investors.

Real-life examples illustrate this relationship. Consider two bonds with the same face value and time to maturity. Bond A has a 5% coupon rate and is trading at $95, while Bond B has a 3% coupon rate and is trading at $85. The higher coupon rate on Bond A results in a lower discount from its face value compared to Bond B, which has a lower coupon rate and a higher discount.

Understanding the connection between coupon rate and bond discount rate empowers investors to analyze bond investments effectively. They can assess the impact of coupon rates on bond prices, calculate yields to maturity, and make informed decisions to optimize their investment portfolios.

Current market price

In the context of calculating bond discount rates, the current market price plays a critical role in determining the present value of a bond. It represents the prevailing price at which a bond is actively traded in the financial markets, influencing the calculation and subsequent investment decisions.

- Traded Value: The current market price reflects the actual value at which a bond is bought or sold in the secondary market. It is determined by supply and demand forces, as well as factors such as interest rate changes, economic conditions, and investor sentiment.

- Face Value Relationship: The current market price can be at a premium, discount, or equal to the bond’s face value. A bond trading at a discount indicates that its current market price is below its face value, while a premium indicates a price higher than the face value.

- Yield to Maturity Impact: The current market price directly affects the yield to maturity (YTM) of a bond. Bonds trading at a discount offer a higher YTM compared to bonds trading at a premium, as investors can purchase them at a lower price and receive the face value at maturity.

- Market Sentiment: The current market price can also provide insights into market sentiment towards a particular bond or issuer. A rising market price may indicate positive sentiment and increased demand, while a falling price may suggest negative sentiment and reduced demand.

By considering the current market price in bond discount rate calculations, investors can assess the fair value of a bond, evaluate its potential return, and make informed investment decisions. It is a crucial factor that helps investors navigate the bond market and achieve their financial goals.

Time to Maturity

Time to maturity, a pivotal aspect in calculating bond discount rates, represents the duration remaining until a bond’s maturity date, when the principal amount is repaid to investors. Understanding its components and implications is crucial for accurate bond valuation and informed investment decisions.

- Final Maturity Date: The predetermined date on which a bond reaches its maturity and the principal amount becomes due and payable.

- Calculation: Time to maturity is typically measured in years from the current date to the final maturity date.

- Impact on Discount Rate: Longer time to maturity generally leads to a higher bond discount rate, as investors require a higher return to compensate for the extended period of investment.

- Callable Bonds: Some bonds have a call feature, allowing the issuer to redeem the bond before maturity. This can impact the effective time to maturity and the calculation of the bond discount rate.

Time to maturity is a crucial factor in bond pricing and yield calculations. It influences the present value of future cash flows, including coupon payments and the repayment of principal. By considering the components and implications of time to maturity, investors can assess the risk and return profile of bonds and make informed investment decisions.

Interest rate environment

The interest rate environment is a crucial factor in determining bond discount rates, as it influences the present value of future cash flows from bond investments. Understanding its various aspects is essential for accurate bond valuation and informed investment decisions.

- Current Interest Rates: Prevailing interest rates in the market, set by central banks or influenced by economic conditions, directly impact the discount rate calculation. Higher interest rates lead to higher discount rates, making bonds less attractive and resulting in lower prices.

- Expected Future Rates: Anticipated changes in interest rates can also affect bond discount rates. If future rates are expected to rise, investors may demand a higher discount rate to compensate for the potential decrease in bond prices.

- Inflation Expectations: Inflation expectations play a role in determining discount rates. Bonds with higher coupons may be more attractive in inflationary environments, leading to lower discount rates.

- Risk-Free Rate: The risk-free rate, often represented by government bond yields, serves as a benchmark for calculating bond discount rates. Bonds with higher risk premiums will have higher discount rates compared to risk-free investments.

By considering the interest rate environment in bond discount rate calculations, investors can assess the impact of interest rate changes on bond prices and yields. This enables them to make informed investment decisions, manage risk, and optimize their investment portfolios.

Creditworthiness of the issuer

Creditworthiness of the issuer plays a pivotal role in calculating bond discount rates, as it directly affects the perceived risk of the investment and the required rate of return demanded by investors. A bond issuer’s creditworthiness is assessed based on various factors, including financial stability, debt-to-equity ratio, profitability, and management quality.

Issuers with higher credit ratings, indicating lower perceived risk, generally have lower bond discount rates. This is because investors are more confident in the issuer’s ability to make timely interest payments and repay the principal amount at maturity. Consequently, they are willing to accept a lower return for a lower level of risk.

Conversely, issuers with lower credit ratings, indicating higher perceived risk, typically have higher bond discount rates. In these cases, investors demand a higher return to compensate for the increased risk of default or delayed payments. The higher discount rate reflects the additional risk premium required by investors to hold the bond.

In summary, the creditworthiness of the issuer is a critical component in calculating bond discount rates, as it directly influences the perceived risk and required rate of return. Investors should carefully consider the creditworthiness of the issuer when making bond investment decisions, as it can significantly impact the return and risk profile of their investments.

Tax implications

Tax implications are an essential aspect to consider when calculating bond discount rates, as they can significantly impact the overall return and investment strategy. Understanding the various tax implications associated with bond investments is crucial for informed decision-making.

- Tax-Exempt Bonds: Certain bonds, such as municipal bonds, may offer tax-exempt status, meaning that the interest earned is not subject to federal income tax. This can result in a higher after-tax return compared to taxable bonds.

- Capital Gains Tax: When a bond is sold for a profit, the capital gains are subject to taxation. The tax rate depends on the holding period of the bond and the investor’s tax bracket.

- Original Issue Discount (OID): For bonds issued at a discount, the difference between the purchase price and the maturity value is considered OID and is taxed as ordinary income over the life of the bond.

- Tax-Loss Harvesting: Investors may strategically sell bonds at a loss to offset capital gains from other investments, reducing their overall tax liability.

By carefully considering the tax implications associated with bond investments, individuals can optimize their returns and minimize their tax burden. Understanding these tax implications empowers investors to make informed decisions and tailor their investment strategies accordingly, maximizing the potential benefits of bond investments.

Inflation expectations

In the context of bond markets, inflation expectations play a crucial role in determining bond discount rates. Inflation expectations refer to market participants’ forecasts of future inflation rates. These expectations significantly influence investors’ decisions and the pricing of bonds.

When inflation expectations are high, investors anticipate a decrease in the purchasing power of money in the future. Consequently, they demand a higher return on their investments to compensate for the potential erosion of their returns due to inflation. This leads to an increase in bond discount rates. Higher discount rates make bonds less attractive, resulting in lower prices and higher yields.

Real-life examples illustrate the impact of inflation expectations on bond discount rates. During periods of high inflation, such as in the 1970s and 1980s, bond discount rates soared as investors sought higher returns to protect their investments from inflation. Conversely, in periods of low and stable inflation, bond discount rates tend to be lower, as investors are less concerned about the erosive effects of inflation on their returns.

Understanding the relationship between inflation expectations and bond discount rates is crucial for investors seeking to make informed investment decisions. By considering inflation forecasts, investors can adjust their bond investment strategies accordingly. For instance, during periods of high inflation expectations, they may opt for bonds with inflation-linked returns or shorter maturities to mitigate the impact of inflation on their investments.

Frequently Asked Questions on Bond Discount Rate Calculation

This section aims to address common queries and provide clarity on key aspects of bond discount rate calculation.

Question 1: What is the significance of bond discount rate calculation?

Answer: Bond discount rate calculation is crucial for determining the present value of a bond, which helps investors assess its fair value and potential return. It considers factors like coupon rate, time to maturity, and prevailing interest rates.

Question 2: How does the coupon rate affect the bond discount rate?

Answer: A higher coupon rate typically leads to a lower bond discount rate, as it offers more regular interest payments, making the bond more attractive to investors. Conversely, a lower coupon rate results in a higher bond discount rate.

Question 3: Why is the current market price relevant in calculating bond discount rates?

Answer: The current market price reflects the prevailing value of a bond in the market. It influences the calculation of the bond’s present value and yield to maturity. Bonds trading at a discount offer higher yields compared to those trading at a premium.

Question 4: How does the time to maturity impact bond discount rate calculation?

Answer: Generally, longer time to maturity leads to a higher bond discount rate. This is because investors require a higher return to compensate for the extended investment period and associated risks.

Question 5: What role does the creditworthiness of the issuer play in bond discount rate calculation?

Answer: The creditworthiness of the issuer directly affects the perceived risk of the bond investment. Bonds issued by issuers with higher credit ratings typically have lower discount rates due to lower perceived risk, while those with lower credit ratings have higher discount rates to compensate for the increased risk.

Question 6: How can inflation expectations influence bond discount rate calculation?

Answer: Inflation expectations can impact bond discount rates. When inflation expectations are high, investors demand a higher return to protect against the potential erosion of their returns due to inflation. This leads to an increase in bond discount rates.

These FAQs provide a concise overview of key aspects of bond discount rate calculation. By understanding these concepts, investors can make informed investment decisions and effectively manage their bond portfolios.

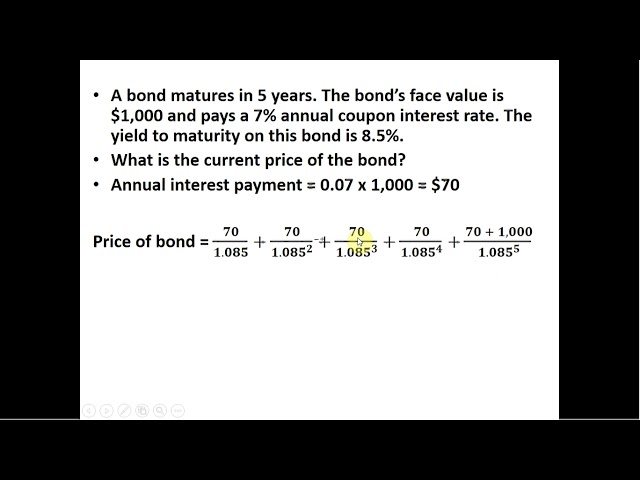

The next section delves into practical examples of bond discount rate calculation, further illustrating its application in real-world scenarios.

Tips for Calculating Bond Discount Rates

Understanding the nuances of bond discount rate calculation is crucial for informed investment decisions. Here are some practical tips to guide you:

Tip 1: Determine the bond’s face value: This is the principal amount of the bond, which is repaid at maturity.

Tip 2: Consider the coupon rate: The coupon rate determines the regular interest payments made on the bond.

Tip 3: Find the current market price: This is the prevailing price at which the bond is traded in the market.

Tip 4: Calculate the time to maturity: This is the period until the bond’s maturity date, when the principal is repaid.

Tip 5: Assess the interest rate environment: Prevailing interest rates influence the discount rate used in the calculation.

Tip 6: Evaluate the issuer’s creditworthiness: The perceived risk of the issuer affects the discount rate.

Tip 7: Consider tax implications: Tax-exempt bonds and capital gains tax impact the calculation.

Tip 8: Factor in inflation expectations: Anticipated inflation rates can influence the discount rate.

Following these tips will enhance your understanding of bond discount rate calculation, empowering you to make informed investment decisions.

In the concluding section, we will explore advanced strategies for bond discount rate calculation, taking your knowledge to the next level.

Conclusion

This article has delved into the intricacies of bond discount rate calculation, exploring its significance, components, and implications. By understanding the interplay between factors such as coupon rate, time to maturity, and interest rate environment, investors can accurately assess the present value and potential return of bond investments.

Key takeaways include the recognition that higher coupon rates lead to lower discount rates, longer time to maturity generally results in higher discount rates, and the creditworthiness of the issuer directly impacts the perceived risk and required rate of return. These elements collectively influence the calculation of bond discount rates, enabling investors to make informed investment decisions.