Discount factor calculation in Excel has become an indispensable tool for investors seeking to understand the present value of their future cash flows. This guide will explore the methodologies utilized to calculate discount factors within Microsoft Excel, providing practical knowledge and applicable steps.

A discount factor, expressed as a decimal, signifies the current worth of a future sum of money. Particularly crucial in capital budgeting, this factor enables investors to weigh the time value of money. The discount rate, a key historical development, reflects the required rate of return on the underlying investment.

The forthcoming sections of this article will delineate the formulas, functions, and applications of Excel for discount factor calculations. Step-by-step instructions and illustrative examples will empower readers to confidently conduct these computations.

How to Calculate a Discount Factor in Excel

Calculating discount factors in Excel is a crucial skill for financial professionals and investors. It enables them to determine the present value of future cash flows, which is essential for making sound investment decisions.

- Definition

- Formula

- Functions

- Applications

- Discount Rate

- Time Value of Money

- Capital Budgeting

- Investment Analysis

- Excel Functions

- Step-by-Step Guide

These aspects are interconnected and provide a comprehensive understanding of how to calculate discount factors in Excel. By mastering these concepts, individuals can effectively evaluate investment opportunities and make informed financial decisions.

Definition

In the context of calculating discount factors in Excel, the term “Definition” encompasses several key aspects:

- Formula: The mathematical equation used to calculate the discount factor, typically expressed as DF = 1 / (1 + r)^n, where r is the discount rate and n is the number of periods.

- Function: The Excel function used to calculate the discount factor, which is “=PV(rate, nper, 0, -value)” where rate is the discount rate, nper is the number of periods, and value is the future cash flow.

- Components: The individual elements that make up the discount factor, including the discount rate and the number of periods.

- Purpose: The reason for calculating the discount factor, which is to determine the present value of a future cash flow.

These facets collectively provide a comprehensive understanding of the definition of discount factor calculation in Excel. By grasping these concepts, individuals can effectively utilize Excel’s capabilities to evaluate investment opportunities and make informed financial decisions.

Formula

The formula for calculating a discount factor is a crucial component of the process, as it establishes the mathematical relationship between the discount rate, the number of periods, and the present value of a future cash flow. Without the formula, it would not be possible to determine the discount factor, which is essential for evaluating investment opportunities and making sound financial decisions.

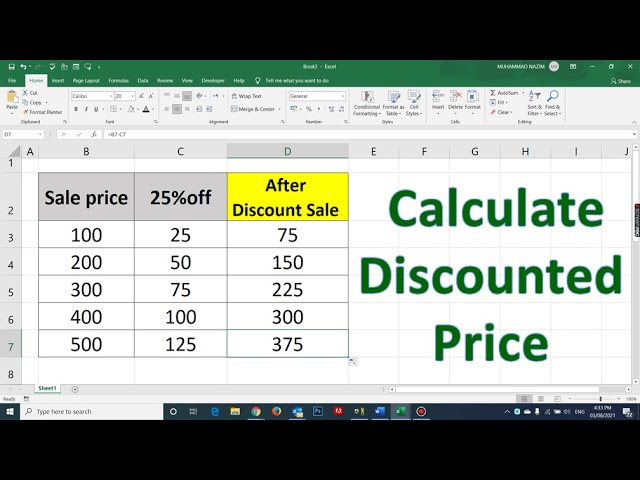

In practice, the formula is applied using the Excel function “=PV(rate, nper, 0, -value)”, where “rate” represents the discount rate, “nper” represents the number of periods, and “value” represents the future cash flow. By inputting these values into the function, Excel automatically calculates the discount factor, which can then be used to determine the present value of the future cash flow.

Understanding the formula and its application in Excel empower individuals to perform complex financial calculations with accuracy and efficiency. This understanding is particularly valuable in capital budgeting, investment analysis, and other financial planning scenarios where the time value of money plays a critical role.

Functions

Within the realm of “how to calculate a discount factor in Excel,” functions play a pivotal role, establishing the practical link between theoretical concepts and real-world applications. Functions in Excel are pre-defined formulas that perform specific calculations, streamlining complex operations and enhancing efficiency.

In the context of discount factor calculation, the “=PV()” function stands out as a crucial component. This function takes as its arguments the discount rate, the number of periods, and the future cash flow, returning the present value of the cash flow. By leveraging this function, users can effortlessly determine the present value of future cash flows, a fundamental step in various financial analyses.

The integration of functions within Excel empowers users to transcend the limitations of manual calculations, fostering accuracy and efficiency. Moreover, functions facilitate the exploration of complex financial scenarios, enabling users to make informed decisions based on reliable data analysis.

Applications

Within the realm of “how to calculate a discount factor in Excel,” the aspect of “Applications” holds immense significance, as it encompasses the practical implications and real-world uses of this calculation. Understanding these applications empowers individuals to leverage the power of Excel for informed decision-making and effective financial planning.

- Capital Budgeting: Discount factors play a critical role in capital budgeting, enabling businesses to evaluate the present value of future cash flows associated with potential investment projects. This evaluation aids in determining whether the expected returns justify the initial investment.

- Investment Analysis: Discount factors are essential for investment analysis, allowing investors to compare the present values of different investment options. By comparing the present values, investors can make informed decisions about which investments align best with their financial goals and risk tolerance.

- Loan and Mortgage Calculations: Discount factors are used in loan and mortgage calculations to determine the present value of future payments. This information is crucial for evaluating the affordability of a loan or mortgage and for making informed decisions about borrowing.

- Project Evaluation: Discount factors are employed in project evaluation to assess the present value of future benefits and costs associated with a particular project. This evaluation helps decision-makers determine the project’s feasibility and potential return on investment.

In summary, the applications of discount factor calculation in Excel span a wide range of financial domains, including capital budgeting, investment analysis, loan and mortgage calculations, and project evaluation. By understanding these applications, individuals can harness the power of Excel to make well-informed financial decisions and achieve their financial objectives.

Discount Rate

Within the domain of “how to calculate a discount factor in Excel,” the concept of “Discount Rate” holds fundamental importance. The discount rate represents the required rate of return on an investment, serving as a critical component in determining the present value of future cash flows. A higher discount rate implies a greater required return, resulting in a lower present value of future cash flows, and vice versa.

In the context of Excel, the discount rate is incorporated into the discount factor calculation formula as a key parameter. The formula for calculating the discount factor, DF, is DF = 1 / (1 + r)^n, where “r” represents the discount rate and “n” represents the number of periods. By adjusting the discount rate, users can assess the impact of different required rates of return on the present value of future cash flows, enabling informed decision-making in capital budgeting and investment analysis.

Real-life examples aptly demonstrate the significance of the discount rate. In capital budgeting, businesses employ the discount rate to evaluate the present value of expected future cash flows associated with potential investment projects. A higher discount rate would lead to a lower present value, potentially affecting the decision to proceed with the investment. Similarly, in investment analysis, investors use the discount rate to compare the present values of alternative investment options, aiding in the selection of investments that align with their financial goals and risk tolerance.

Time Value of Money

In exploring “how to calculate a discount factor in Excel,” we cannot overlook the fundamental concept of “Time Value of Money.” This principle asserts that the value of money today differs from its value in the future due to its earning potential over time. It forms the cornerstone of calculating discount factors, which are essential for evaluating the present worth of future cash flows.

The discount factor calculation in Excel utilizes the formula DF = 1 / (1 + r)^n, where “r” represents the discount rate and “n” represents the number of periods. The discount rate, in turn, is closely tied to the Time Value of Money. A higher discount rate implies a greater required return on investment, resulting in a lower present value of future cash flows. Conversely, a lower discount rate yields a higher present value.

In real-life scenarios, the Time Value of Money plays a pivotal role. For instance, in capital budgeting, businesses employ discount factors to assess the present value of anticipated future cash flows from potential investment projects. A project with higher expected returns in the future will have a higher present value at a given discount rate, making it more attractive to investors.

Understanding the connection between Time Value of Money and discount factor calculation in Excel is crucial for making informed financial decisions. It allows investors to compare investment options, evaluate the impact of different discount rates, and make sound judgments about the viability of investment projects. By grasping this concept, individuals can effectively navigate the complexities of financial planning and achieve their long-term financial goals.

Capital Budgeting

In the realm of calculating discount factors in Excel, capital budgeting stands out as a crucial application, enabling businesses to evaluate the present worth of future cash flows associated with potential investment projects. By incorporating discount factors into their analysis, businesses can make informed decisions about capital expenditures and optimize their financial strategies.

- Project Evaluation: Discount factors play a central role in project evaluation, allowing businesses to assess the present value of expected cash inflows and outflows over the project’s lifespan, providing a comprehensive view of the project’s potential profitability.

- Investment Appraisal: Discount factors serve as a valuable tool in investment appraisal, assisting businesses in comparing the present values of alternative investment options, considering both the timing and magnitude of future cash flows, enabling informed decisions.

- Risk Analysis: When evaluating capital projects, businesses often incorporate risk analysis into their decision-making process. Discount factors, when combined with risk-adjusted discount rates, allow businesses to account for the potential variability in future cash flows, providing a more realistic assessment of project viability.

- Capital Rationing: In scenarios where capital is limited, discount factors assist businesses in prioritizing and selecting the most promising investment projects, ensuring optimal allocation of available funds and maximizing returns.

In summary, capital budgeting is an integral part of financial planning and investment decision-making, and the calculation of discount factors in Excel plays a vital role in this process. By considering the timing and risk associated with future cash flows, businesses can make informed choices that contribute to long-term financial success.

Investment Analysis

Investment analysis, an indispensable pillar of financial decision-making, is inextricably linked to the calculation of discount factors in Excel. Discount factors, serving as a bridge between future cash flows and their present value, empower investors with the ability to assess and compare investment opportunities, making informed choices that align with their financial objectives.

Within the realm of investment analysis, the calculation of discount factors holds paramount importance. It enables investors to account for the time value of money, recognizing that the value of a dollar today outweighs its value in the future. By incorporating discount factors into their analysis, investors can accurately determine the present worth of future cash flows, providing a comprehensive evaluation of an investment’s potential profitability.

Real-life examples abound, showcasing the practical applications of discount factor calculation in investment analysis. Consider a scenario where an investor is contemplating two investment options: a stock promising a dividend of $100 in one year and a bond offering a coupon payment of $50 in six months and a face value of $100 at maturity in two years. Employing Excel’s discount factor calculation capabilities, the investor can determine the present value of each investment, considering the appropriate discount rate, to make an informed decision that aligns with their investment goals.

In summary, the calculation of discount factors in Excel is not merely a technique but an essential component of investment analysis. It empowers investors with the means to evaluate and compare investment opportunities, accounting for the time value of money and making informed decisions that maximize their financial returns. Embracing this understanding enables investors to navigate the complexities of financial markets, pursue their investment objectives, and achieve long-term financial success.

Excel Functions

In the context of calculating discount factors in Excel, functions play a pivotal role, establishing the practical link between theoretical concepts and real-world applications. Functions in Excel are pre-defined formulas that perform specific calculations, streamlining complex operations and enhancing efficiency.

Among the array of Excel functions, the “=PV()” function stands out as the cornerstone for calculating discount factors. This function takes as its arguments the discount rate, the number of periods, and the future cash flow, returning the present value of the cash flow. By leveraging this function, users can effortlessly determine the present value of future cash flows, a fundamental step in various financial analyses.

The integration of functions within Excel empowers users to transcend the limitations of manual calculations, fostering accuracy and efficiency. Moreover, functions facilitate the exploration of complex financial scenarios, enabling users to make informed decisions based on reliable data analysis.

In summary, Excel functions are not merely a collection of tools but an indispensable component of discount factor calculation in Excel. They provide a structured and efficient approach to performing complex calculations, enabling users to make informed financial decisions and achieve their financial objectives.

Step-by-Step Guide

A step-by-step guide serves as a structured and detailed roadmap for calculating discount factors in Excel. By breaking down the process into manageable steps, it empowers users to navigate complex financial calculations with accuracy and efficiency.

- Components: A step-by-step guide typically comprises individual steps or components, each focusing on a specific aspect of the calculation. These components may include identifying the discount rate, determining the number of periods, and inputting the future cash flow into the appropriate Excel function.

- Real-life Examples: To enhance understanding and practical applicability, a step-by-step guide often incorporates real-life examples. These examples illustrate how the guide can be applied in various financial scenarios, such as capital budgeting, investment analysis, and loan calculations.

- Formula and Function: A crucial component of a step-by-step guide is the inclusion of the discount factor formula and the corresponding Excel function. This provides users with the necessary technical knowledge to perform the calculations independently.

- Accuracy and Efficiency: By following a step-by-step guide, users can minimize errors and enhance the accuracy of their discount factor calculations. Moreover, the structured approach promotes efficiency, allowing users to complete the calculations in a timely manner.

In essence, a comprehensive step-by-step guide equips users with the knowledge, examples, and practical steps necessary to confidently calculate discount factors in Excel. By embracing this structured approach, users can make informed financial decisions and achieve their financial objectives.

Frequently Asked Questions (FAQs)

This FAQ section provides answers to common questions and clarifies aspects of discount factor calculation in Excel. These questions anticipate reader queries and aim to enhance understanding.

Question 1: What is the formula for calculating a discount factor in Excel?

The formula for calculating a discount factor in Excel is DF = 1 / (1 + r)^n, where DF represents the discount factor, r denotes the discount rate, and n signifies the number of periods.

Question 2: Which Excel function is used to calculate the present value of a future cash flow?

The “=PV()” function in Excel is used to calculate the present value of a future cash flow. It takes as its arguments the discount rate, the number of periods, and the future cash flow.

Question 3: How do I account for risk when calculating a discount factor?

To account for risk when calculating a discount factor, a risk-adjusted discount rate can be used. This involves adjusting the discount rate upward to reflect the perceived level of risk associated with the cash flow.

Question 4: What is the difference between a discount factor and a present value?

A discount factor is a multiplier used to calculate the present value of a future cash flow. The present value, on the other hand, is the current worth of a future cash flow, taking into account the time value of money.

Question 5: How can I use discount factors to evaluate investment opportunities?

Discount factors can be used to evaluate investment opportunities by calculating the present value of the expected future cash flows. This allows investors to compare different investments and make informed decisions based on their financial goals.

Question 6: What are some real-world applications of discount factor calculation in Excel?

Discount factor calculation in Excel has numerous real-world applications, including capital budgeting, investment analysis, loan calculations, and project evaluation.

These FAQs provide essential insights into the calculation of discount factors in Excel. Understanding these concepts empowers individuals to make informed financial decisions and achieve their financial objectives.

In the subsequent section, we will explore advanced techniques for discount factor calculation in Excel, including scenario analysis and sensitivity analysis.

Tips for Calculating Discount Factors in Excel

This section presents a comprehensive set of tips to enhance the accuracy and efficiency of your discount factor calculations in Excel.

Tip 1: Understand the Formula and Function: Grasp the underlying formula (DF = 1 / (1 + r)^n) and the corresponding Excel function (“=PV()”). This knowledge empowers you to customize calculations for specific scenarios.

Tip 2: Utilize Absolute Cell References: Employ absolute cell references ($A$1) to maintain static inputs, preventing unintended changes during formula replication.

Tip 3: Incorporate Risk-Adjusted Discount Rates: Account for risk by adjusting the discount rate upward. This ensures a more realistic assessment of future cash flow uncertainty.

Tip 4: Sensitivity Analysis: Perform sensitivity analysis by varying discount rates and future cash flows. This assesses the impact of these variables on the present value, providing valuable insights.

Tip 5: Scenario Analysis: Create multiple scenarios with different assumptions (e.g., optimistic, pessimistic). This enables comprehensive evaluation of potential outcomes.

Tip 6: Leverage Excel Tables: Utilize Excel tables to organize and manage input data. Tables facilitate formula replication and dynamic updates, minimizing errors.

Tip 7: Audit Your Calculations: Implement sanity checks and reasonableness tests to verify the validity of your results. This ensures confidence in the accuracy of your discount factor calculations.

Tip 8: Seek Professional Assistance: When facing complex or high-stakes calculations, consider consulting with a qualified financial professional. Their expertise can provide valuable guidance and ensure the reliability of your analysis.

By following these tips, you will significantly enhance the accuracy, efficiency, and reliability of your discount factor calculations in Excel. This empowers you to make informed financial decisions and achieve your financial objectives.

In the next section, we will delve into advanced techniques for discount factor calculation, including macros and VBA programming. These techniques further extend the capabilities of Excel and enable even more sophisticated financial analysis.

Conclusion

Throughout this article, we have explored the intricacies of “how to calculate a discount factor in excel”. We have delved into the concept of discount factors, examined the formula and Excel functions used in their calculation, and discussed advanced techniques such as scenario analysis and VBA programming. Understanding these concepts is essential for accurate and efficient financial analysis.

Key points to remember include:

- Discount factors allow us to determine the present value of future cash flows, considering the time value of money.

- Excel provides powerful functions and tools for calculating discount factors, including the “=PV()” function and scenario analysis.

- Advanced techniques extend the capabilities of Excel, enabling more sophisticated financial modeling and analysis.

By mastering these techniques, you will be well-equipped to tackle complex financial calculations, make informed investment decisions, and achieve your financial objectives. Embrace the power of Excel and continue exploring the world of financial analysis to unlock its full potential.