Discovering the Formula: A Guide to Calculating Bond’s Nominal Coupon Interest Rate

Determining a bond’s nominal coupon interest rate, the fixed percentage amount paid annually to bondholders, is fundamental in bond market analysis. Consider a bond with a $1,000 face value and a 5% nominal coupon rate. Each year, the bondholder receives $50 in interest, which is calculated as $1,000 x 5%. This information helps investors assess investment decisions, manage portfolios, and analyze market trends.

Understanding the nominal coupon interest rate’s significance extends beyond individual investors. Central banks frequently utilize bond issuance to influence monetary policy and regulate financial markets. Historically, the introduction of government bonds in the 17th century marked a pivotal moment in this field.

This article presents a comprehensive guide to calculating a bond’s nominal coupon interest rate, discussing key formula components, real-world applications, and exploring practical implications.

How to Calculate Bond’s Nominal Coupon Interest Rate

Understanding the intricacies of bond calculations is essential for informed decision-making in the financial realm. Key aspects of calculating a bond’s nominal coupon interest rate include:

- Face Value

- Coupon Rate

- Maturity Date

- Bond Price

- Accrued Interest

- Yield to Maturity

- Present Value

- Future Value

These factors interweave to determine the nominal coupon interest rate, which represents the fixed percentage return paid to bondholders annually. By considering the face value, coupon rate, and maturity date, investors can calculate the annual interest payment. The bond price and accrued interest provide insights into the market value and interest earned since the last payment date. Yield to maturity, present value, and future value offer comprehensive assessments of the bond’s overall return and investment potential.

Face Value

In the realm of bond calculations, the face value holds significant importance. It serves as the principal amount borrowed by the bond issuer and represents the sum that the bondholder will receive upon the bond’s maturity date. This value plays a crucial role in determining the bond’s nominal coupon interest rate, which is the fixed percentage return paid to bondholders annually.

- Principal Amount: The face value signifies the principal amount borrowed by the bond issuer, which forms the basis for interest rate calculations and repayment at maturity.

- Par Value: When a bond is issued at its face value, it is said to be issued at par. This value serves as a benchmark for bond pricing and interest calculations.

- Bond Maturity: The face value represents the amount that the bond issuer must repay to the bondholder at the end of the bond’s term, known as the maturity date.

- Bond Price: The face value provides a reference point for determining the bond’s price in the market. Bonds may trade above or below their face value, depending on market conditions.

These facets of face value collectively contribute to the calculation of the bond’s nominal coupon interest rate. By understanding the interplay between face value and other factors such as coupon rate and maturity date, investors can accurately assess the potential returns and risks associated with bond investments.

Coupon Rate

Coupon rate, a pivotal determinant in bond calculations, exerts a profound impact on the nominal coupon interest rate, the fixed percentage return paid to bondholders annually. This rate, expressed as a percentage of the bond’s face value, serves as a crucial factor in gauging a bond’s attractiveness to investors and its overall market value.

Consider a bond with a $1,000 face value and a 5% coupon rate. The nominal coupon interest rate is directly influenced by the coupon rate, resulting in an annual interest payment of $50 ($1,000 x 5%). This payment remains constant throughout the bond’s life, providing a steady stream of income for bondholders.

Real-life examples abound, showcasing the practical applications of coupon rate in bond calculations. Corporate bonds often carry varying coupon rates to entice investors and align with the issuer’s financial objectives. Government bonds, on the other hand, typically feature lower coupon rates due to their perceived lower risk.

Understanding the interplay between coupon rate and nominal coupon interest rate is paramount for investors and financial professionals alike. This knowledge empowers them to make informed decisions, assess investment opportunities, and navigate the complexities of bond markets.

Maturity Date

Maturity date, a pivotal aspect in bond calculations, exerts a profound impact on the nominal coupon interest rate, the fixed percentage return paid to bondholders annually. Understanding its facets is essential for accurate bond valuation and informed investment decisions.

- Bond Term: Maturity date signifies the end of a bond’s lifespan, determining the period over which interest payments are made and the principal is repaid.

- Coupon Payment Schedule: It influences the timing and frequency of coupon payments, affecting the overall return and cash flow predictability for bondholders.

- Bond Price: Maturity date plays a crucial role in determining the bond’s market price, with longer-term bonds generally carrying higher interest rates to compensate for the extended investment period.

- Callable and Puttable Bonds: Some bonds grant issuers the option to call (redeem) the bond before maturity or allow investors to put (sell) the bond back to the issuer, potentially altering the expected maturity date and nominal coupon interest rate.

These facets of maturity date underscore its significance in bond calculations. By considering the bond term, coupon payment schedule, and potential for early redemption or put options, investors can accurately assess the nominal coupon interest rate and make informed decisions about bond investments.

Bond Price

In the realm of bond calculations, bond price holds immense significance in determining the nominal coupon interest rate. It represents the current market value of a bond and influences various aspects of bond valuation and investment decisions.

- Par Value: The bond’s face value or principal amount, which serves as a benchmark for bond pricing.

- Market Value: The prevailing price of a bond in the secondary market, which may deviate from its par value due to factors like interest rate fluctuations.

- Coupon Rate: The fixed percentage return paid to bondholders annually, which directly affects the bond’s price.

- Maturity Date: The date on which the bond matures and the principal is repaid, influencing the bond’s price and duration risk.

Understanding the interplay between bond price and these facets is crucial for calculating the nominal coupon interest rate accurately. By considering the bond’s par value, market value, coupon rate, and maturity date, investors can assess the bond’s overall value and make informed decisions about bond investments.

Accrued Interest

Within the realm of bond calculations, accrued interest plays a pivotal role in determining the nominal coupon interest rate. Accrued interest represents the interest earned on a bond since the last coupon payment date but not yet paid to the bondholder. It arises due to the time lag between the coupon payment schedule and the actual interest accrual.

Accrued interest directly impacts the calculation of the nominal coupon interest rate as it forms part of the total interest payment received by the bondholder. To determine the accrued interest, the bondholder considers the annual coupon rate, the face value of the bond, and the number of days since the last coupon payment. This accrued interest is then added to the regular coupon payment to arrive at the total interest payment for the period.

Real-life examples abound to illustrate the significance of accrued interest. Suppose an investor purchases a bond with a $1,000 face value and a 5% annual coupon rate on January 15th, just 15 days after the last coupon payment. As of that date, the bond has accrued $2.50 in interest ([($1,000 x 5% x 15 days)/360 days]). This accrued interest will be added to the next coupon payment, ensuring that the bondholder receives the full interest earned for the period.

Understanding the connection between accrued interest and the nominal coupon interest rate is crucial for accurate bond valuation and investment decisions. It empowers bondholders to ascertain the total interest earned and make informed choices about bond purchases, sales, or holding strategies.

Yield to Maturity

In the realm of bond calculations, Yield to Maturity (YTM) stands as a crucial concept closely intertwined with the calculation of a bond’s nominal coupon interest rate. YTM represents the annualized rate of return an investor can expect to receive if they hold the bond until its maturity date, taking into account both the coupon payments and the bond’s price.

- Bond Price: YTM is heavily influenced by the bond’s price. A higher bond price will result in a lower YTM, and vice versa.

- Coupon Rate: The coupon rate, which determines the fixed interest payments made to bondholders, is a key factor in calculating YTM.

- Maturity Date: The time remaining until the bond matures affects YTM. Longer-term bonds typically have higher YTMs to compensate for the extended investment period.

- Interest Rate Environment: YTM is influenced by prevailing interest rates in the market. Rising interest rates can lead to lower YTMs, while falling interest rates can result in higher YTMs.

Understanding the relationship between YTM and the nominal coupon interest rate is essential for bond investors and analysts. YTM provides a comprehensive measure of a bond’s return potential, enabling informed decisions about bond purchases, sales, and portfolio management.

Present Value

Present Value (PV) plays a critical role in calculating a bond’s nominal coupon interest rate. PV represents the current worth of future cash flows, discounted back to the present at a given rate. In the context of bond calculations, PV is used to determine the value of the bond’s future coupon payments and the principal repayment at maturity.

The nominal coupon interest rate is directly related to the PV of the bond’s cash flows. A higher nominal coupon rate results in a higher PV, as the future cash flows are worth more in present value terms. Conversely, a lower nominal coupon rate leads to a lower PV. The relationship between nominal coupon interest rate and PV is inverse, meaning as one increases, the other decreases.

Real-life examples illustrate the practical significance of PV in bond calculations. Consider a bond with a face value of $1,000, a 5% nominal coupon rate, and a maturity of 10 years. Using a discount rate of 4%, the PV of the bond’s cash flows is approximately $900. This PV represents the current value of the bond, taking into account the time value of money and the nominal coupon rate.

Understanding the connection between Present Value and nominal coupon interest rate is essential for accurate bond valuation and investment decisions. It allows investors to assess the present value of future cash flows and make informed choices about bond purchases, sales, or holding strategies.

Future Value

Future Value (FV) holds a significant place in calculating a bond’s nominal coupon interest rate. FV represents the value of a bond’s future cash flows, discounted back to the present at a given rate. In the context of bond calculations, FV is used to determine the value of the bond’s maturity date.

The nominal coupon interest rate directly affects the FV of the bond. A higher nominal coupon rate results in a higher FV, as the future cash flows are worth more in present value terms. Conversely, a lower nominal coupon rate leads to a lower FV. The relationship between nominal coupon interest rate and FV is direct, meaning as one increases, the other increases.

Real-life examples illustrate the practical significance of FV in bond calculations. Consider a bond with a face value of $1,000, a 5% nominal coupon rate, and a maturity of 10 years. Using a discount rate of 4%, the FV of the bond’s cash flows at maturity is approximately $1,558. This FV represents the value of the bond at the end of its term, taking into account the time value of money and the nominal coupon rate.

Frequently Asked Questions

This section provides answers to commonly asked questions regarding the calculation of a bond’s nominal coupon interest rate, clarifying key concepts and addressing potential areas of confusion.

Question 1: What is the nominal coupon interest rate?

Answer: The nominal coupon interest rate is the fixed percentage return paid to bondholders annually, typically expressed as a percentage of the bond’s face value.

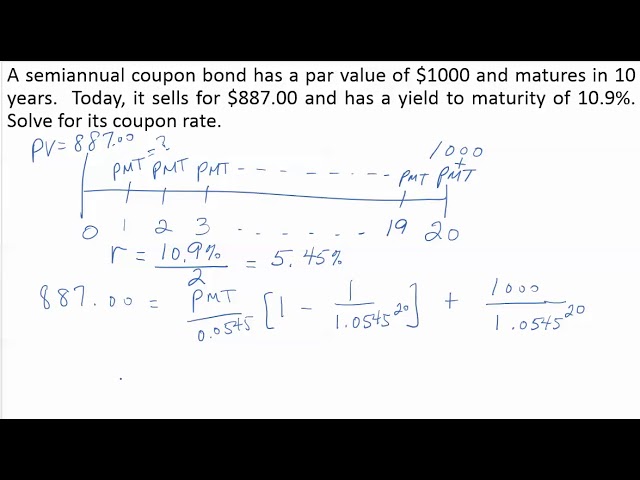

Question 2: How is the nominal coupon interest rate calculated?

Answer: The nominal coupon interest rate is calculated by dividing the annual coupon payment by the bond’s face value and multiplying by 100.

Question 3: What factors affect the nominal coupon interest rate?

Answer: The nominal coupon interest rate is primarily influenced by market conditions, the creditworthiness of the issuer, and the bond’s maturity date.

Question 4: How does the nominal coupon interest rate differ from the yield to maturity?

Answer: The nominal coupon interest rate represents the fixed return paid to bondholders, while the yield to maturity reflects the actual return an investor can expect to receive if they hold the bond until maturity.

Question 5: What is the relationship between the nominal coupon interest rate and the bond price?

Answer: The nominal coupon interest rate and the bond price are inversely related, meaning that an increase in the nominal coupon interest rate typically leads to a decrease in the bond price.

Question 6: How can I use the nominal coupon interest rate to evaluate bonds?

Answer: By comparing the nominal coupon interest rate of different bonds, investors can assess their relative attractiveness based on the level of return they offer.

These FAQs provide a concise overview of the key aspects of calculating a bond’s nominal coupon interest rate. For further insights into bond valuation and analysis, please refer to the following section.

Transition to the next section: Understanding the nominal coupon interest rate is crucial for informed bond investment decisions. In the next section, we will delve deeper into advanced concepts related to bond pricing and yield calculations.

Tips for Calculating Bond’s Nominal Coupon Interest Rate

This section presents practical tips to assist you in accurately calculating a bond’s nominal coupon interest rate, ensuring precise analysis and informed investment decisions.

Tip 1:Identify the Bond’s Face Value: Determine the principal amount borrowed by the issuer, which serves as the basis for interest calculations and repayment at maturity.

Tip 2:Confirm the Coupon Rate: Establish the fixed percentage return paid to bondholders annually, expressed as a percentage of the bond’s face value.

Tip 3:Calculate the Annual Coupon Payment: Multiply the bond’s face value by the coupon rate to determine the annual interest payment received by bondholders.

Tip 4:Consider Accrued Interest: Account for interest earned since the last coupon payment date but not yet paid, adding it to the regular coupon payment for a complete interest calculation.

Tip 5:Understand the Bond’s Maturity Date: Determine the date when the bond matures and the principal is repaid, as it influences the bond’s price and duration risk.

Tip 6:Calculate the Bond’s Price: Establish the current market value of the bond, which affects the nominal coupon interest rate and overall investment return.

Tip 7:Determine the Yield to Maturity: Calculate the annualized rate of return an investor can expect if they hold the bond until maturity, considering coupon payments and bond price.

Tip 8:Use a Bond Calculator or Spreadsheet: Utilize available tools to simplify and expedite the bond calculation process, ensuring accuracy and efficiency.

These tips provide a practical framework for calculating a bond’s nominal coupon interest rate with precision and confidence. By following these steps, investors can enhance their understanding of bond valuation and make informed decisions in the financial markets.

In the concluding section of this article, we will explore advanced strategies for bond analysis, enabling investors to navigate complex financial landscapes and maximize their investment potential.

Conclusion

In this comprehensive guide, we have explored the intricacies of calculating a bond’s nominal coupon interest rate, a fundamental aspect of bond valuation and investment analysis. Understanding this calculation empowers investors to assess the return potential of bonds, compare different investment options, and make informed financial decisions.

Key points to remember include the direct relationship between the coupon rate and nominal coupon interest rate, the impact of market conditions and issuer creditworthiness on these rates, and the inverse relationship between nominal coupon interest rate and bond price. These concepts are interconnected and essential for accurate bond analysis.