Calculating Discounts Accurately with Excel: A Comprehensive Guide

Calculating discounts is a fundamental skill for financial professionals and everyday consumers alike. Excel, a versatile spreadsheet software, offers powerful tools to perform these calculations with ease. Whether you’re a business owner determining discounts for customers or an individual seeking savings on purchases, this guide will provide comprehensive instructions on leveraging Excel’s capabilities for precise discount calculations.

Historically, discounts have played a significant role in commerce, with the practice dating back to ancient civilizations. Today, discounts continue to drive economic activity, influencing consumer spending patterns and stimulating market competition. Understanding how to calculate discounts is crucial for both businesses and individuals to optimize financial outcomes and maximize savings.

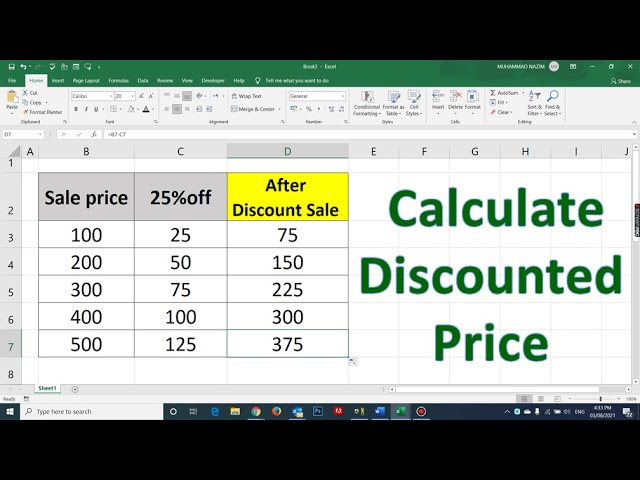

How to Calculate Discount in Excel Sheet

Calculating discounts accurately is essential for maximizing savings and optimizing financial outcomes. Excel, a versatile spreadsheet software, provides powerful tools to perform these calculations with ease. Understanding the key aspects of discount calculation in Excel is crucial for leveraging its capabilities effectively.

- Formula Syntax: Understanding the correct syntax and arguments for discount formulas in Excel.

- Discount Types: Distinguishing between different types of discounts, such as percentage discounts, fixed amount discounts, and tiered discounts.

- Cell Referencing: Referencing specific cells in formulas to calculate discounts based on input values.

- Conditional Discounts: Applying discounts based on specific conditions, such as purchase quantity or customer loyalty. li>

Multiple Discounts: Calculating discounts when multiple discounts are applicable, such as combining percentage and fixed amount discounts. Error Handling: Troubleshooting and resolving errors that may arise during discount calculations. Data Validation: Ensuring the accuracy of input values and preventing invalid entries. Automation: Automating discount calculations using macros or add-ins to save time and improve efficiency. Presentation: Formatting and presenting discount calculations in a clear and professional manner.

These key aspects provide a comprehensive understanding of discount calculation in Excel. By mastering these aspects, individuals and businesses can harness the power of Excel to optimize their financial decision-making and maximize savings.

Formula Syntax

Formula syntax plays a critical role in calculating discounts accurately in Excel. The syntax defines the structure and order of elements within a formula, including the function name, arguments, and operators. Understanding the correct syntax is essential to ensure that the formula calculates the discount as intended.

For example, the basic formula for calculating a percentage discount is “=A1*B1”, where A1 represents the original price and B1 represents the discount percentage. If the syntax is incorrect, such as “=A1B1”, Excel will not recognize the formula and will display an error. Therefore, it is crucial to follow the correct syntax when creating discount formulas in Excel.

Mastering formula syntax provides several practical benefits. It enables users to create complex discount calculations that involve multiple variables and conditions. Additionally, understanding syntax allows users to troubleshoot and debug errors in their formulas, ensuring accurate results. Moreover, a solid understanding of syntax empowers users to customize and adapt discount formulas to meet specific business or personal needs.

In conclusion, formula syntax is a foundational aspect of calculating discounts in Excel. By understanding the correct syntax and arguments, users can create accurate and efficient discount formulas, optimize their financial decision-making, and unlock the full potential of Excel’s calculation capabilities.

Discount Types

When calculating discounts in Excel, understanding the different types of discounts is essential. Each discount type has its own unique characteristics and implications, and choosing the right type can significantly impact the final discount amount.

- Percentage Discounts:

Percentage discounts are calculated as a percentage of the original price. They are commonly used in retail and e-commerce to offer a specific percentage off the regular price. For example, a 20% discount on a $100 item would result in a discount of $20, bringing the final price down to $80.

- Fixed Amount Discounts:

Fixed amount discounts are calculated as a fixed dollar amount off the original price. They are often used when a business wants to offer a specific reduction in price, regardless of the original price. For example, a $10 discount on a $100 item would result in a final price of $90.

- Tiered Discounts:

Tiered discounts offer different discount percentages based on the purchase quantity. They are commonly used to encourage bulk purchases and increase customer loyalty. For example, a business may offer a 5% discount for purchases over $50, a 10% discount for purchases over $100, and a 15% discount for purchases over $200.

Understanding the different discount types is crucial for accurately calculating discounts in Excel. By choosing the appropriate discount type and applying the correct formula, users can ensure that they are calculating discounts correctly and maximizing their savings or optimizing their pricing strategies.

Cell Referencing

Cell referencing is a fundamental aspect of calculating discounts in Excel, as it allows formulas to access and use values stored in specific cells. By referencing cells, users can create dynamic and flexible discount calculations that can adjust automatically based on changes in the input values.

For example, if the original price of an item is stored in cell A1 and the discount percentage is stored in cell B1, the formula “=A1*B1” can be used to calculate the discount amount. When the original price or discount percentage changes, the formula will automatically recalculate the discount amount, ensuring accuracy and efficiency.

Cell referencing also enables users to create complex discount scenarios. For instance, a business may offer tiered discounts based on purchase quantity. By referencing the purchase quantity in a specific cell, a formula can automatically apply the appropriate discount percentage, providing a customized discount for each customer.

Understanding cell referencing is crucial for effectively calculating discounts in Excel. By referencing specific cells, users can create accurate, dynamic, and flexible discount formulas, streamlining their financial calculations and optimizing their decision-making.

Conditional Discounts

Within the realm of discount calculation in Excel, conditional discounts hold significant importance. They enable businesses and individuals to apply discounts based on specific criteria, such as purchase quantity or customer loyalty, adding flexibility and customization to the discount calculation process.

- Purchase Quantity Discounts:

These discounts are offered when customers purchase a certain quantity of items. By incentivizing bulk purchases, businesses can increase sales volume and clear inventory more efficiently.

- Customer Loyalty Discounts:

Businesses reward repeat customers with loyalty discounts to foster long-term relationships. These discounts acknowledge customer loyalty and encourage continued patronage.

- Tiered Discounts:

This strategy involves offering different discount percentages based on purchase. By creating tiers, businesses can encourage customers to spend more to unlock higher discounts.

- Conditional Discounts Based on Product Category:

Discounts can be applied based on specific product categories. For example, a business may offer a discount on all electronics or clothing items.

Conditional discounts provide numerous benefits in Excel-based discount calculations. They allow businesses to implement targeted promotions, increase customer satisfaction, and optimize their pricing strategies. By incorporating conditional discounts into Excel formulas, users can enhance the accuracy and flexibility of their financial calculations.

Error Handling

Error handling is an integral aspect of calculating discounts in Excel, as it enables users to identify and resolve errors that may arise during the calculation process. By understanding the potential errors and implementing effective error handling techniques, users can ensure the accuracy and reliability of their discount calculations.

- Syntax Errors:

Syntax errors occur when the formula is not structured correctly, such as missing parentheses or incorrect cell references. These errors can be identified by the #VALUE! error message. - Circular References:

Circular references occur when a formula directly or indirectly references its own cell, creating a loop. These errors can be identified by the #REF! error message. - Data Type Errors:

Data type errors occur when a formula attempts to perform a calculation on cells that contain incompatible data types, such as text in a numeric calculation. These errors can be identified by the #VALUE! error message. - Division by Zero Errors:

Division by zero errors occur when a formula attempts to divide a number by zero, which is undefined in mathematics. These errors can be identified by the #DIV/0! error message.

Addressing error handling in Excel is crucial for accurate discount calculations. By implementing robust error handling techniques, users can identify and correct errors quickly, ensuring the reliability and accuracy of their financial calculations.

Data Validation

Data validation is a critical component of calculating discounts accurately in Excel. By ensuring the accuracy of input values and preventing invalid entries, data validation helps to maintain the integrity of discount calculations and prevents errors that could lead to incorrect results.

One of the primary benefits of data validation is that it helps to eliminate human error. When inputting data manually, it is easy to make mistakes, such as entering the wrong numbers or using the wrong format. Data validation rules can be set up to check the validity of input values, such as ensuring that they are within a specific range or that they meet certain criteria. This helps to prevent invalid entries from being used in discount calculations, which can lead to incorrect results.

For example, if a business is offering a 10% discount on all purchases over $100, a data validation rule can be set up to ensure that the inputted purchase amount is greater than or equal to $100. This prevents users from entering invalid amounts, such as negative values or values that are less than $100, which would result in incorrect discount calculations.

Data validation is also important for maintaining consistency and standardization in discount calculations. By setting up data validation rules, businesses can ensure that all users are entering data in the same format and using the same criteria. This helps to prevent errors and inconsistencies that could lead to incorrect discount calculations.

Automation

Automating discount calculations using macros or add-ins plays a significant role in the broader context of “how to calculate discount in excel sheet.” By leveraging automation, businesses and individuals can streamline the discount calculation process, saving time and improving efficiency, which are crucial factors in today’s fast-paced business environment.

Macros and add-ins are powerful tools within Excel that allow users to automate repetitive tasks, including discount calculations. For instance, if a business needs to apply a 10% discount to a large number of invoices, a macro can be created to automatically apply the discount to each invoice, eliminating the need for manual calculation and reducing the risk of errors.

Real-life examples of automation within discount calculations are prevalent in various industries. In the retail sector, automated discount calculations help businesses quickly and accurately apply discounts during checkout, ensuring that customers receive the correct discounts and improving the overall customer experience. Similarly, in the finance industry, automated discount calculations are used to streamline loan processing and ensure accurate interest calculations, reducing the risk of errors and delays.

Understanding the connection between automation and discount calculations in Excel is essential for businesses and individuals looking to optimize their financial processes. By leveraging automation, they can free up valuable time, improve accuracy, and enhance overall efficiency, leading to increased productivity and cost savings.

Presentation

In the context of “how to calculate discount in excel sheet,” presentation plays a critical role in communicating the results of discount calculations effectively. Formatting and presenting discount calculations in a clear and professional manner ensures that the information is easy to understand, visually appealing, and suitable for various stakeholders.

Clear presentation involves organizing discount calculations logically, using appropriate headings, and providing concise explanations. Professional formatting includes using consistent fonts, colors, and styles, as well as aligning numbers and currencies correctly. By adhering to these principles, businesses and individuals can present discount calculations in a way that is both informative and visually appealing.

Real-life examples of clear and professional presentation of discount calculations abound. In the retail sector, receipts often include a detailed breakdown of discounts applied, making it easy for customers to understand how their discounts were calculated. Similarly, in the finance industry, loan agreements clearly outline the interest rate and discount calculations used to determine monthly payments, ensuring transparency and clarity for borrowers.

Understanding the connection between presentation and discount calculations in Excel is essential for anyone involved in financial analysis or reporting. By presenting discount calculations in a clear and professional manner, businesses and individuals can enhance the credibility and impact of their financial communications.

Frequently Asked Questions

This FAQ section provides answers to common questions and clarifies aspects of “how to calculate discount in excel sheet.” It addresses concerns, misconceptions, and practical considerations to enhance your understanding of discount calculations in Excel.

Question 1: What is the formula for calculating a percentage discount in Excel?

Answer: To calculate a percentage discount, use the formula “=original_price discount_percentage.” For example, to calculate a 10% discount on a $100 item, enter “=100 0.1″ into an Excel cell.

Question 2: How do I apply a discount to multiple items in Excel?

Answer: Use the “IF” function to apply different discounts based on conditions. For example, “=IF(quantity>10, 0.1, 0.05)” applies a 10% discount if the quantity is greater than 10, and a 5% discount otherwise.

Question 3: Can I use Excel to calculate tiered discounts?

Answer: Yes, use the “VLOOKUP” function to look up the discount percentage based on the purchase amount. Create a table with purchase amount ranges and corresponding discounts, and use “VLOOKUP” to retrieve the appropriate discount for each purchase.

Question 4: How do I handle errors when calculating discounts in Excel?

Answer: Use error handling functions like “IFERROR” to trap and handle errors. For example, “=IFERROR(discount_formula, “Error”)” displays “Error” if the discount formula results in an error.

Question 5: Can I automate discount calculations in Excel?

Answer: Yes, use macros or add-ins to automate repetitive discount calculations. Record a macro that performs the calculation steps, and assign it to a button or keyboard shortcut for easy use.

Question 6: How do I present discount calculations clearly in Excel?

Answer: Use clear formatting, such as headings, borders, and consistent number formatting. Insert comments or notes to explain the calculations and assumptions used.

These FAQs provide a deeper understanding of discount calculations in Excel, addressing common questions and clarifying practical considerations. By leveraging the techniques discussed, you can confidently and accurately calculate discounts, optimize your financial analysis, and streamline your business processes.

Moving forward, we will explore advanced techniques for complex discount scenarios, including dynamic discounts and conditional discounts based on multiple criteria. Stay tuned for further insights and practical examples to enhance your Excel skills.

Tips for Calculating Discounts in Excel

To enhance the accuracy, efficiency, and presentation of discount calculations in Excel, consider implementing these practical tips:

Tip 1: Use Clear and Consistent Formulas: Ensure formulas are easy to read and understand by using descriptive cell references and avoiding complex nesting. This promotes transparency and simplifies troubleshooting.

Tip 2: Validate Input Data: Implement data validation rules to restrict invalid entries and maintain the integrity of calculations. This prevents errors and ensures the accuracy of discount calculations.

Tip 3: Leverage Conditional Formatting: Use conditional formatting to highlight cells based on discount values. This provides visual cues, making it easier to identify and analyze discounts.

Tip 4: Automate Calculations: Utilize macros or add-ins to automate repetitive discount calculations. This saves time, reduces errors, and improves overall efficiency.

Tip 5: Create Discount Tables: For complex or tiered discounts, create tables that map purchase amounts to corresponding discounts. This simplifies calculations and enhances accuracy.

Tip 6: Use Error Handling Functions: Implement error handling functions, such as IFERROR, to trap and handle errors gracefully. This ensures calculations are not interrupted by invalid inputs.

Tip 7: Document Assumptions: Clearly document the assumptions and logic behind discount calculations. This facilitates understanding and reduces the risk of errors.

Tip 8: Present Results Professionally: Format and present discount calculations in a clear and visually appealing manner. Use headings, borders, and appropriate number formatting for easy readability.

By adopting these tips, you can streamline discount calculations, improve accuracy, and enhance the overall effectiveness of your Excel-based financial analysis.

Moving forward, we will explore advanced techniques for handling complex discount scenarios, such as dynamic discounts and conditional discounts based on multiple criteria. These techniques will further empower you to tackle complex financial calculations with confidence and precision.

Conclusion

Throughout this article, we have delved into the topic of “how to calculate discount in excel sheet,” exploring various aspects and techniques to enhance the accuracy, efficiency, and presentation of discount calculations in Excel. Key takeaways include:

- Understanding different discount types, formula syntax, and cell referencing techniques enables precise discount calculations.

- Advanced features like conditional discounts, error handling, and automation streamline complex calculations and improve accuracy.

- Clear presentation, data validation, and documentation ensure transparency, reliability, and ease of understanding.

Mastering these techniques empowers individuals and businesses to optimize financial analysis, make informed decisions, and maximize savings or revenue through accurate discount calculations. As the business landscape evolves, leveraging Excel’s capabilities for discount calculations will remain a valuable skill for financial professionals and anyone seeking to manage discounts effectively.