Calculating the discount factor in Excel is a crucial skill for financial analysis. A discount factor represents the present value of a future cash flow, factoring in the time value of money and the relevant discount rate.

Understanding and applying the discount factor is essential for tasks such as valuing stocks, bonds, and real estate investments. It enables accurate projections of future cash flows, allowing informed decision-making. Historically, the concept of discounting future cash flows has roots in the work of 18th-century economist Irving Fisher.

This article provides a comprehensive guide on calculating the discount factor in Excel, covering various methods, applications, and considerations to ensure accurate and insightful financial analysis.

How to Calculate the Discount Factor in Excel

Understanding the essential aspects of calculating the discount factor in Excel is crucial for accurate financial analysis and decision-making.

- Formula

- Discount Rate

- Time Period

- Present Value

- Future Value

- Annuity

- Perpetuity

- Applications

- Limitations

- Best Practices

These aspects encompass the core concepts, methods, and considerations involved in calculating the discount factor in Excel. Understanding each aspect ensures a comprehensive grasp of this essential financial tool.

Formula

The formula for calculating the discount factor in Excel is a crucial aspect, determining the accuracy and reliability of the result. It encompasses several key components that work together to translate future cash flows into their present value equivalents.

- Discount Rate: The rate used to discount future cash flows, reflecting the time value of money and the risk associated with the investment.

- Time Period: The number of periods over which the cash flows occur, typically measured in years.

- Present Value: The current value of a future cash flow, calculated by multiplying the cash flow by the discount factor.

- Future Value: The value of a current investment at a future point in time, calculated by multiplying the present value by the future value factor.

Understanding these components and their interrelationships is essential for correctly applying the discount factor formula in Excel. By considering the appropriate discount rate, time period, and cash flow values, financial analysts can accurately assess the present value of future cash flows, enabling informed investment decisions.

Discount Rate

The discount rate plays a critical role in calculating the discount factor in Excel. It represents the rate at which future cash flows are discounted to determine their present value. The discount rate is a crucial component of the discount factor formula, which is used to translate future cash flows into their present value equivalents. By incorporating the discount rate, financial analysts can account for the time value of money and the risk associated with the investment.

The discount rate is typically determined based on several factors, including the prevailing market interest rates, the riskiness of the investment, and the investor’s required rate of return. A higher discount rate results in a lower present value for future cash flows, while a lower discount rate leads to a higher present value. This relationship highlights the importance of carefully considering the appropriate discount rate when calculating the discount factor in Excel.

In real-world applications, the discount rate is used in various financial scenarios, such as valuing stocks, bonds, and real estate investments. It is also employed in capital budgeting decisions to assess the profitability of long-term projects. By understanding the connection between the discount rate and the discount factor, financial professionals can make informed decisions about investments and project evaluations, ensuring accurate and reliable financial analysis.

Time Period

In calculating the discount factor in Excel, the “Time Period” holds significant importance. It represents the duration over which the cash flows occur, typically measured in years. The time period directly influences the calculation of the discount factor and the resulting present value of future cash flows.

The time period is a critical component in determining the appropriate discount factor. A longer time period generally leads to a lower discount factor, resulting in a lower present value for future cash flows. Conversely, a shorter time period typically results in a higher discount factor and a higher present value. This relationship underscores the crucial role of the time period in assessing the value of future cash flows.

In real-life applications, the time period is a fundamental consideration in various financial scenarios. For instance, when valuing a bond, the time period represents the remaining life of the bond until its maturity date. Similarly, in capital budgeting decisions, the time period encompasses the duration of the project being evaluated.

Understanding the connection between the time period and the discount factor is essential for accurate financial analysis and decision-making. By considering the appropriate time period, financial professionals can reliably assess the present value of future cash flows, enabling informed investment choices and project evaluations.

Present Value

In the realm of financial analysis, the concept of “Present Value” stands as a pivotal pillar, and its connection to “how to calculate the discount factor in excel” is of paramount importance. The discount factor, a crucial element in valuing future cash flows, finds its very essence in the calculation of Present Value.

The discount factor serves as the bridge between future cash flows and their Present Value, reflecting the time value of money. By incorporating the appropriate discount rate and time period into the discount factor formula, financial professionals can effectively translate future cash flows into their current worth. In this way, Present Value becomes a critical component of “how to calculate the discount factor in excel”, providing a reliable means to assess the value of future financial obligations or investments.

Real-life examples abound where Present Value plays a central role. Consider the valuation of a bond, where the Present Value of its future coupon payments and principal repayment determines its fair market value. Similarly, in capital budgeting decisions, the Present Value of a project’s future cash flows guides investment choices by revealing its profitability potential.

Understanding this connection empowers financial professionals with the ability to make informed decisions, accurately assessing the value of future cash flows. It facilitates the comparison of investment alternatives, evaluation of project viability, and strategic planning for financial success. By mastering the calculation of the discount factor in excel and its relationship with Present Value, individuals can navigate the complexities of financial analysis with confidence and precision.

Future Value

In the realm of finance and investment analysis, the concept of “Future Value” occupies a prominent position, and its relationship with “how to calculate the discount factor in excel” is both fundamental and consequential. The discount factor, a crucial element in valuing future cash flows, finds its very essence in the calculation of Future Value.

The discount factor serves as the bridge between present value and Future Value, reflecting the time value of money. By incorporating the appropriate discount rate and time period into the discount factor formula, financial professionals can effectively translate present value into its future worth. In this way, Future Value becomes a critical component of “how to calculate the discount factor in excel”, providing a reliable means to assess the potential growth or depreciation of investments over time.

Real-life examples abound where Future Value plays a central role. Consider the planning of a retirement fund, where the Future Value of regular contributions and investment returns determines the accumulated wealth at retirement age. Similarly, in project financing, the Future Value of projected cash flows guides investment decisions by revealing the potential return on investment.

Understanding this connection empowers financial professionals with the ability to make informed decisions, accurately assessing the potential growth or decline in the value of investments or financial obligations over time. It facilitates the comparison of investment alternatives, evaluation of project viability, and strategic planning for financial success. By mastering the calculation of the discount factor in excel and its relationship with Future Value, individuals can navigate the complexities of financial analysis with confidence and precision.

Annuity

An annuity is a series of regular, equal payments made at equal intervals, typically over a fixed period. In the context of “how to calculate the discount factor in Excel,” annuities play a significant role as they represent a common type of cash flow that needs to be discounted to determine its present value.

- Payment Amount: The fixed amount paid at each interval.

- Payment Frequency: The interval between payments, such as monthly, quarterly, or annually.

- Number of Payments: The total number of payments to be made.

- Discount Rate: The rate used to discount the future payments back to their present value.

Understanding these facets of an annuity is crucial for accurately calculating the discount factor in Excel. By considering the payment amount, frequency, number of payments, and discount rate, financial professionals can effectively determine the present value of an annuity, enabling informed decision-making and accurate financial analysis.

Perpetuity

Understanding “Perpetuity” is crucial in calculating the discount factor in Excel. A perpetuity represents a constant stream of payments that continues indefinitely, and its valuation requires careful consideration of its specific characteristics.

- Infinite Duration: Perpetuities have no fixed end date, resulting in an infinite number of payments.

- Constant Payments: The payments in a perpetuity remain constant throughout its duration, ensuring a predictable cash flow.

- Discount Rate: The discount rate plays a critical role in perpetuity valuation, as it determines the present value of the infinite future payments.

- Applications: Perpetuities are commonly used in the valuation of financial instruments like bonds and preferred stocks that pay regular dividends in perpetuity.

In the context of calculating the discount factor in Excel, perpetuities require a tailored approach due to their unique characteristics. By considering the infinite duration, constant payments, and appropriate discount rate, financial analysts can accurately determine the present value of a perpetuity using the discount factor formula. This understanding empowers them to make informed decisions regarding investments and financial planning.

Applications

The applications of calculating the discount factor in Excel extend beyond theoretical understanding, finding practical relevance in various financial and investment scenarios.

- Valuation of Bonds: The discount factor plays a critical role in valuing bonds, as it helps determine the present value of future coupon payments and the principal repayment at maturity.

- Capital Budgeting: In capital budgeting, the discount factor aids in assessing the profitability of long-term projects by discounting future cash flows back to their present value.

- Investment Analysis: The discount factor is essential for evaluating the potential return on investments, enabling investors to compare different investment opportunities based on their present value.

- Financial Planning: Retirement planning and other long-term financial goals rely on the accurate calculation of the discount factor to determine the present value of future financial obligations or savings.

These applications underscore the practical significance of calculating the discount factor in Excel, making it a fundamental tool for financial professionals and investors alike. By leveraging its versatility and accuracy, individuals can make informed decisions, plan for the future, and achieve their financial goals.

Limitations

Understanding the limitations of calculating the discount factor in Excel is essential for accurate financial analysis. Despite its versatility, several factors can impact the reliability and applicability of the results.

- Assumptions: Discount factor calculations rely on assumptions about future cash flows, discount rates, and time periods. In reality, these factors can be uncertain and subject to change, potentially affecting the accuracy of the results.

- Reliance on Historical Data: Discount rates are often derived from historical data, which may not fully capture future market conditions. This can lead to underestimation or overestimation of the present value of future cash flows.

- Complexity: Calculating the discount factor for complex cash flow patterns or scenarios can be challenging. Additional considerations, such as inflation or taxes, may need to be incorporated, increasing the complexity and potential for errors.

- Sensitivity to Inputs: The discount factor is sensitive to changes in input variables, particularly the discount rate. Small variations in the discount rate can lead to significant differences in the present value of future cash flows, highlighting the importance of carefully selecting and justifying the discount rate used.

Recognizing these limitations enables financial professionals to approach discount factor calculations with caution, considering the underlying assumptions and potential uncertainties. By carefully evaluating the applicability and reliability of the results, informed and prudent financial decisions can be made.

Best Practices

In the realm of finance, adhering to best practices is paramount when calculating the discount factor in Excel. Best practices provide a framework for ensuring accuracy, reliability, and consistency in financial analysis. By following these guidelines, professionals can minimize errors and enhance the credibility of their work.

One crucial aspect of best practices is selecting an appropriate discount rate. The discount rate significantly impacts the present value of future cash flows, and its determination should be based on sound judgment and careful consideration of relevant factors such as market conditions, risk assessment, and the specific investment or project being evaluated.

Another best practice involves meticulous attention to detail when inputting data and applying formulas in Excel. Errors in data entry or formula construction can lead to incorrect discount factor calculations, potentially resulting in misleading or inaccurate financial analysis. Regular verification and cross-checking of calculations are essential to ensure the integrity of the results.

Furthermore, best practices dictate that financial analysts clearly document their assumptions and methodologies. This documentation serves as a valuable reference point for future review or collaboration, ensuring transparency and accountability in the calculation process. By adhering to these best practices, financial professionals can enhance the reliability and credibility of their discount factor calculations, leading to more informed and effective decision-making.

Frequently Asked Questions

This FAQ section addresses common questions and clarifications related to calculating the discount factor in Excel, providing additional insights for better understanding and application.

Question 1: What factors should be considered when selecting the discount rate?

Answer: When selecting the discount rate, consider the time value of money, risk assessment, market conditions, and the specific investment or project being evaluated. A higher discount rate indicates a higher cost of capital and a lower present value, while a lower discount rate has the opposite effect.

Question 2: How does the time period impact the discount factor?

Answer: The time period represents the duration over which the cash flows occur. A longer time period typically leads to a lower discount factor and a lower present value, as the cash flows are further into the future and subject to more uncertainty.

Question 3: What are the limitations of using the discount factor in Excel?

Answer: Discount factor calculations rely on assumptions about future cash flows, discount rates, and time periods, which may not always be accurate or reliable. Additionally, the calculations can be sensitive to changes in input variables, particularly the discount rate.

Question 4: How can I ensure the accuracy of my discount factor calculations?

Answer: To enhance accuracy, carefully select the discount rate, meticulously input data and formulas, and document your assumptions and methodologies. Regularly verifying and cross-checking calculations is also recommended.

Question 5: What are some best practices for calculating the discount factor in Excel?

Answer: Best practices include selecting an appropriate discount rate, paying close attention to detail when inputting data and applying formulas, and clearly documenting assumptions and methodologies.

Question 6: How is the discount factor used in financial analysis?

Answer: The discount factor is widely used in financial analysis, including the valuation of bonds, capital budgeting, investment analysis, and financial planning. It helps determine the present value of future cash flows, enabling informed decision-making and accurate financial projections.

These FAQs provide practical guidance and address common concerns, fostering a deeper understanding of how to calculate the discount factor in Excel. The following section explores advanced applications and considerations.

Transition to the Next Section: By mastering these foundational concepts, you can effectively utilize the discount factor in Excel to analyze financial scenarios, make informed decisions, and achieve your financial objectives.

Tips for Calculating the Discount Factor in Excel

This section provides practical tips to enhance the accuracy, efficiency, and reliability of your discount factor calculations in Excel.

Tip 1: Carefully Consider the Discount Rate: Select the discount rate that aligns with the specific investment or project, taking into account factors like risk assessment and market conditions.

Tip 2: Verify Input Data and Formulas: Ensure the accuracy of your calculations by meticulously verifying the input data and formulas used. Double-checking is crucial to avoid errors.

Tip 3: Document Assumptions and Methodology: Clearly document the assumptions and methodology behind your discount factor calculations. This enhances transparency and enables future review or collaboration.

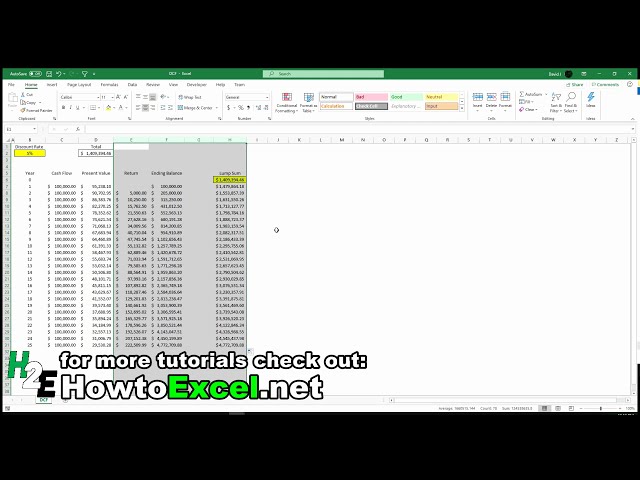

Tip 4: Utilize Excel Functions and Tools: Leverage Excel’s built-in functions like PV, FV, and NPV to simplify and expedite discount factor calculations.

Tip 5: Consider Sensitivity Analysis: Conduct sensitivity analysis to assess the impact of changes in discount rate and other input variables on the present value of future cash flows.

Tip 6: Seek Professional Guidance: If necessary, consult with a financial professional or expert to ensure the accuracy and appropriateness of your discount factor calculations, especially for complex scenarios.

By implementing these tips, you can refine your approach to calculating the discount factor in Excel, leading to more precise financial analysis and informed decision-making.

The following section delves into advanced applications and considerations related to discount factor calculations, building upon these foundational tips.

Conclusion

This article has provided a comprehensive guide to calculating the discount factor in Excel, exploring its essential aspects, applications, limitations, and best practices. Understanding the discount factor’s role in determining the present value of future cash flows is crucial for accurate financial analysis and informed decision-making.

Key points to remember include the formula, discount rate, and time period involved in the calculation. Additionally, the applications in bond valuation, capital budgeting, and investment analysis highlight its versatility. However, it’s essential to consider the limitations and adhere to best practices to ensure accuracy and reliability.

Mastering the calculation of the discount factor in Excel empowers financial professionals and investors alike to make informed decisions, plan for the future, and achieve their financial goals. It’s an invaluable tool that provides a solid foundation for effective financial management and analysis.