Calculating discounts is a common task in various industries, and Excel is a powerful tool for performing these calculations efficiently. A 25% discount is a reduction of 25% from the original price, and calculating it in Excel involves applying a simple formula.

Understanding how to calculate a 25% discount in Excel is essential for businesses, accountants, and individuals who frequently deal with discounts and pricing. It helps in determining the discounted price of products or services, managing budgets, and making informed financial decisions.

This article will provide a step-by-step guide on how to calculate a 25% discount in Excel, covering the formula and its application in various scenarios. We will also explore some tips and tricks for working with discounts in Excel.

How to Calculate a 25% Discount in Excel

Calculating discounts is a common task in various industries, and Excel is a powerful tool for performing these calculations efficiently. Understanding the essential aspects of calculating a 25% discount in Excel is crucial for businesses, accountants, and individuals who frequently deal with discounts and pricing.

- Formula

- Percentage

- Original Price

- Discounted Price

- Worksheet Functions

- Data Validation

- Conditional Formatting

- Scenario Analysis

- Error Handling

- Automation

These aspects cover various dimensions related to calculating a 25% discount in Excel, from understanding the underlying formula to leveraging advanced features for efficiency and accuracy. By mastering these aspects, users can effectively manage discounts, optimize pricing strategies, and make informed financial decisions.

Formula

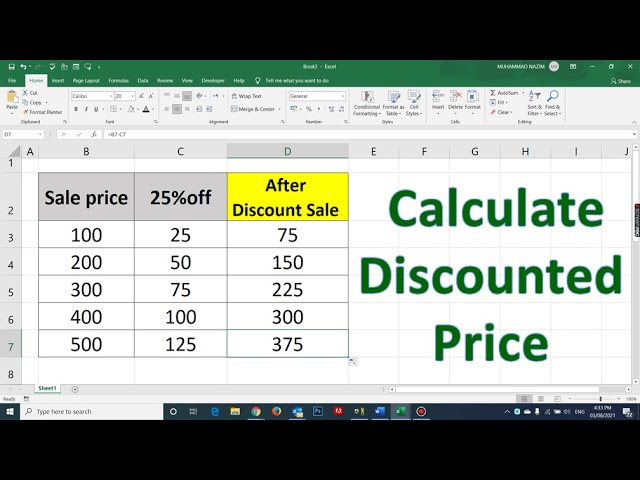

In “how to calculate a 25 discount in excel,” the formula is a critical component that enables the calculation of discounted prices accurately. The formula subtracts 25% of the original price from the original price itself. This mathematical operation forms the core of discount calculation in Excel.

Understanding the formula empowers users to perform calculations manually or through automated functions. It allows them to adjust the discount percentage or original price as needed, ensuring flexibility in handling various discount scenarios. Moreover, the formula provides a transparent and auditable trail of calculations, facilitating error checking and verification.

In practice, the formula finds applications in diverse domains, including retail, finance, and inventory management. Businesses use it to determine discounted prices for sales and promotions, calculate rebates and allowances, and analyze pricing strategies. Accountants leverage it for financial reporting and budgeting purposes, while individuals utilize it for personal finance management and informed purchasing decisions.

Percentage

Percentage plays a critical role in calculating a 25% discount in Excel. It represents the proportion of the discount applied to the original price. Understanding the concept of percentage is essential for accurately determining the discounted price.

The formula for calculating a 25% discount in Excel involves multiplying the original price by 0.25, which represents 25% as a decimal. This calculation effectively subtracts 25% of the original price, resulting in the discounted price. Therefore, a thorough understanding of percentages is crucial for applying the formula correctly and obtaining accurate results.

In practice, percentages find wide application in various fields, including finance, retail, and inventory management. Businesses use percentages to determine discounts, calculate taxes, and analyze profit margins. Accountants leverage percentages for financial reporting and budgeting purposes. Individuals utilize percentages for personal finance management, investment analysis, and informed purchasing decisions.

Original Price

Original price, often referred to as the “list price” or “sticker price,” serves as a crucial foundation for calculating a 25% discount in Excel. It represents the initial, undiscounted price of a product or service before any reductions are applied.

In the context of calculating a 25% discount in Excel, the original price acts as the base value from which the discount is calculated. The formula for calculating a 25% discount involves subtracting 25% of the original price from the original price itself. This mathematical operation relies heavily on the accuracy of the original price to ensure a correct discounted price.

In practice, the original price plays a vital role in various business and financial scenarios. Businesses use the original price to determine profit margins, analyze sales trends, and make informed pricing decisions. Accountants leverage the original price for inventory valuation, financial reporting, and budgeting purposes. Understanding the connection between original price and discount calculation is essential for accurate financial analysis and decision-making.

Discounted Price

Discounted price stands as the cornerstone of “how to calculate a 25 discount in excel”. It represents the final price of a product or service after applying a discount, typically expressed as a percentage reduction from the original price. Understanding discounted price is pivotal in various business and financial contexts.

The discounted price is a direct result of calculating a 25% discount in Excel. The formula subtracts 25% of the original price from the original price, effectively reducing the price by 25%. This calculation plays a critical role in determining the discounted price accurately.

Real-life examples of discounted price abound in retail, e-commerce, and service industries. Businesses offer discounts to attract customers, clear inventory, or promote specific products or services. Customers benefit from discounted prices by saving money on their purchases.

Practically, understanding discounted price is essential for businesses to optimize pricing strategies, manage inventory, and analyze sales performance. Accountants use discounted price for financial reporting, budgeting, and tax calculations. Consumers leverage discounted price to make informed purchasing decisions and maximize their savings.

Worksheet Functions

Worksheet functions in Microsoft Excel play a pivotal role in the process of calculating a 25% discount. These built-in functions provide a powerful and efficient way to automate calculations and enhance productivity in spreadsheet-based tasks like discount calculations.

The PERCENTILE function, in particular, is a critical component of calculating a 25% discount in Excel. This function allows users to determine the value at a specified percentile within a range of values. In the context of discount calculation, the PERCENTILE function is used to find the value that represents 25% of the original price. The formula involves using the PERCENTILE function with the original price range as the input and 0.25 as the percentile value.

Real-life examples of using worksheet functions to calculate a 25% discount abound in various industries. In retail, businesses use Excel to calculate discounted prices for sales and promotions. Accountants leverage worksheet functions to automate discount calculations for financial reporting and budgeting purposes. Individuals utilize Excel to calculate discounts when making purchasing decisions and managing personal finances.

Understanding the connection between worksheet functions and calculating a 25% discount in Excel is essential for maximizing the efficiency and accuracy of spreadsheet-based tasks. By leveraging the power of worksheet functions, users can streamline their calculations, save time, and minimize the risk of errors.

Data Validation

In the realm of “how to calculate a 25 discount in excel”, data validation stands as a critical component, ensuring the accuracy and reliability of discount calculations. Data validation involves a set of rules and checks that ensure that data entered into a spreadsheet meets specific criteria, thereby minimizing errors and maintaining data integrity.

When calculating a 25% discount in Excel, data validation plays a crucial role in verifying the input values, such as the original price. By implementing data validation rules, users can restrict the input to numeric values, ensuring that non-numeric characters or invalid data are not entered. This validation process helps prevent errors that could lead to incorrect discount calculations and impact financial decisions.

Real-life examples of data validation in the context of calculating a 25% discount in Excel abound in various industries. In retail, businesses use data validation to ensure that the original prices entered for products are valid and consistent, minimizing the risk of incorrect discounts being applied. Accountants leverage data validation to verify the accuracy of financial data used in discount calculations, ensuring the reliability of financial reports and budgets. Individuals utilize data validation when managing personal finances, ensuring that the input values for purchases and expenses are correct, leading to accurate discount calculations and informed financial decisions.

Understanding the practical applications of data validation in calculating a 25% discount in Excel is essential for maximizing the accuracy and efficiency of spreadsheet-based tasks. By implementing data validation rules, users can enhance the reliability of their calculations, minimize errors, and make informed decisions based on accurate data.

Conditional Formatting

In the realm of “how to calculate a 25 discount in excel”, conditional formatting emerges as a powerful tool that enhances the visual representation and interpretation of discount calculations. It involves applying specific formatting rules to cells based on certain conditions, enabling users to quickly identify and analyze discounts.

Conditional formatting plays a crucial role in making discount calculations more intuitive and actionable. By highlighting cells that meet specific criteria, such as discounts above or below a certain threshold, users can easily identify exceptions, trends, and patterns in their data. This visual representation simplifies the analysis process, allowing for informed decision-making based on the calculated discounts.

Real-life examples of conditional formatting in “how to calculate a 25 discount in excel” abound in various industries. In retail, businesses use conditional formatting to highlight discounted products that are below a certain price point, making it easier for customers to identify bargains. Accountants leverage conditional formatting to visually identify unusual or erroneous discounts in financial reports, ensuring the accuracy of financial statements. Individuals utilize conditional formatting to track expenses and identify areas where discounts can be applied, helping them make informed financial decisions.

Understanding the practical applications of conditional formatting in calculating a 25% discount in Excel empowers users to enhance the efficiency and effectiveness of their spreadsheet-based tasks. By leveraging conditional formatting, they can quickly identify and analyze discounts, optimize pricing strategies, and make informed decisions based on the visual representation of their data.

Scenario Analysis

In the realm of “how to calculate a 25 discount in excel”, scenario analysis emerges as a critical tool that enables users to explore the impact of different assumptions and variables on discount calculations. It involves creating and evaluating multiple scenarios, each with its own set of input values, to assess the potential outcomes and make informed decisions.

Scenario analysis plays a vital role in understanding the sensitivity of discount calculations to changes in input parameters. By varying the original price or the discount percentage, users can observe how the discounted price changes. This analysis helps businesses optimize pricing strategies, identify potential risks and opportunities, and make data-driven decisions about discounts.

Real-life examples of scenario analysis in “how to calculate a 25 discount in excel” abound in various industries. In retail, businesses use scenario analysis to evaluate the impact of different discount levels on sales volume and profit margins. Accountants leverage scenario analysis to assess the sensitivity of financial projections to changes in economic conditions or market trends. Individuals utilize scenario analysis to compare different investment options and make informed financial decisions.

Error Handling

In the realm of “how to calculate a 25 discount in excel”, error handling stands as a critical component, ensuring the accuracy and reliability of discount calculations. Error handling involves anticipating and managing potential errors that may occur during the calculation process, thereby minimizing their impact on the overall results.

Errors can arise from various sources, such as invalid input values, incorrect formulas, or circular references. Without proper error handling, these errors can lead to incorrect discounts, misleading financial statements, and flawed decision-making. Therefore, implementing robust error handling mechanisms is essential to ensure the integrity of discount calculations and the reliability of the results.

Real-life examples of error handling in “how to calculate a 25 discount in excel” abound in various industries. In retail, businesses use error handling to identify and correct errors in product pricing, ensuring accurate discounts are applied at the checkout. Accountants leverage error handling to validate financial data used in discount calculations, minimizing the risk of errors in financial reporting. Individuals utilize error handling when managing personal finances, ensuring that incorrect input values do not lead to erroneous discount calculations and impact financial decisions.

Automation

In the realm of “how to calculate a 25 discount in excel,” automation emerges as a transformative force, streamlining the calculation process and enhancing efficiency. Automation involves using computer software or scripts to perform repetitive tasks automatically, reducing the need for manual calculations and minimizing the risk of errors.

The connection between automation and “how to calculate a 25 discount in excel” is profound. Automation allows users to create macros or scripts that can perform the calculation steps automatically, eliminating the need for manual data entry and formula application. This automation can significantly reduce the time and effort required to calculate discounts, especially when dealing with large datasets or complex calculations.

Real-life examples of automation in “how to calculate a 25 discount in excel” abound in various industries. In retail, businesses use automated scripts to calculate discounts for bulk orders or loyalty programs, ensuring accurate and consistent pricing. Accountants leverage automation to streamline the calculation of discounts for financial reporting and budgeting purposes, reducing the risk of errors and saving valuable time.

Understanding the practical applications of automation in “how to calculate a 25 discount in excel” empowers users to optimize their workflow, improve accuracy, and make informed decisions. By leveraging automation, they can focus on more strategic tasks, such as analyzing discount trends or optimizing pricing strategies, rather than spending excessive time on manual calculations.

Frequently Asked Questions

This section provides answers to commonly asked questions related to calculating a 25% discount in Excel. These FAQs aim to clarify concepts, address potential difficulties, and enhance your understanding of the process.

Question 1: Can I calculate a 25% discount without using Excel?

Yes, you can calculate a 25% discount manually by multiplying the original price by 0.25. However, using Excel simplifies the process and minimizes the risk of errors, especially when dealing with large datasets or complex calculations.

Question 2: How do I handle negative values when calculating a discount?

Negative values should be treated as absolute values before applying the discount formula. This ensures that the discount is calculated correctly, regardless of whether the original price is positive or negative.

Question 3: Can I apply multiple discounts to a single item?

Yes, you can apply multiple discounts to a single item by nesting the discount formulas. However, the order of application can affect the final discounted price.

Question 4: How do I calculate a discount based on a specific percentage other than 25%?

To calculate a discount based on a different percentage, simply replace the value 0.25 in the discount formula with the desired percentage expressed as a decimal.

Question 5: Can I use Excel to calculate discounts for a range of products?

Yes, using Excel’s array formulas, you can calculate discounts for a range of products simultaneously. This can be useful for automating discount calculations and saving time when working with large datasets.

Question 6: How can I ensure the accuracy of my discount calculations in Excel?

To ensure accuracy, verify the formulas used, check for errors in the input data, and use error handling techniques to identify and resolve any potential issues.

These FAQs provide a solid foundation for understanding how to calculate a 25% discount in Excel. By addressing common concerns and clarifying key concepts, they empower you to perform accurate and efficient discount calculations using Excel.

The next section will delve deeper into advanced techniques for calculating discounts in Excel, including conditional formatting, scenario analysis, and automation.

Tips for Calculating Discounts in Excel

This section provides a collection of practical tips to enhance your proficiency in calculating discounts using Microsoft Excel. By implementing these tips, you can improve accuracy, streamline your workflow, and make more informed decisions.

Tip 1: Utilize Formula Auditing: Use the Formula Auditing toolbar to trace the flow of formulas and identify any errors or inconsistencies. This ensures the accuracy of your discount calculations.

Tip 2: Employ Conditional Formatting: Apply conditional formatting to visually highlight cells that meet specific discount criteria. This helps you quickly identify exceptions, trends, and patterns in your data.

Tip 3: Leverage Scenario Analysis: Create multiple scenarios with different discount percentages to analyze the impact on your bottom line. This enables you to make data-driven decisions about pricing and promotions.

Tip 4: Automate Calculations with Macros: Record macros to automate repetitive discount calculations. Macros save time, reduce errors, and improve efficiency.

Tip 5: Use the PMT Function for Loan Discounts: Calculate loan discounts accurately using the PMT function, which considers interest rates and loan terms.

Tip 6: Apply Custom Number Formatting: Format cells to display discounts as percentages, currency amounts, or other desired formats. This enhances readability and clarity.

Tip 7: Protect Formulas and Data: Protect your formulas and data from accidental changes by locking cells or using Excel’s protection features. This maintains the integrity of your calculations.

Tip 8: Proofread and Verify Results: Always proofread your calculations and verify the results to ensure accuracy. Use Excel’s built-in error checking tools to identify any potential issues.

By following these tips, you can enhance the accuracy, efficiency, and effectiveness of your discount calculations in Excel. These tips empower you to make informed decisions, optimize pricing strategies, and streamline your financial operations.

The concluding section of this article will provide additional insights into advanced techniques for discount calculation in Excel, such as using pivot tables, creating dynamic discount schedules, and integrating with other applications.

Conclusion

This article has delved into the various aspects of calculating a 25% discount in Excel, providing a comprehensive guide for professionals and individuals alike. Key takeaways include the formula, use of percentages, understanding original price and discounted price, leveraging worksheet functions, data validation, conditional formatting, scenario analysis, error handling, and automation techniques.

By mastering these concepts, users can accurately and efficiently calculate discounts, optimize pricing strategies, make informed decisions, and streamline their financial operations. Excel’s robust capabilities empower users to handle complex discount calculations with ease, ensuring accurate results and data integrity.