Understanding Coupon Bond Pricing: A Comprehensive Guide

Calculating the price of a coupon bond involves determining its present value based on factors like its face value, coupon rate, maturity date, and current market interest rates. Coupon bonds, which represent debt obligations with regular interest payments (coupons), play a crucial role in financial markets. They provide investors with a steady stream of income, while offering borrowers a way to raise capital. Historically, the advent of coupon bonds has revolutionized financial transactions and facilitated the flow of investment. This article delves into the intricacies of coupon bond pricing, empowering readers with the knowledge to navigate bond markets effectively.

How to Calculate Price of Coupon Bond

Understanding the essential aspects of calculating coupon bond prices is crucial for informed investment decisions. These key factors influence the present value of a bond and include:

- Face Value

- Coupon Rate

- Maturity Date

- Current Market Interest Rates

- Yield to Maturity

- Present Value of Coupon Payments

- Present Value of Face Value

- Bond Price Formula

- Accrued Interest

- Bond Value with Accrued Interest

These aspects are interconnected, with each playing a role in determining the overall price of a coupon bond. By considering these factors, investors can accurately assess the value of bonds and make informed decisions about their investments.

Face Value

In the context of calculating coupon bond prices, face value holds significant importance. It represents the principal amount borrowed by the issuer and serves as the basis for determining both coupon payments and the eventual repayment of the bond at maturity.

- Nominal Value: Face value, also known as nominal value, signifies the amount that will be repaid to the bondholder upon maturity.

- Par Value: When a bond trades at its face value, it is said to be trading at par. This implies that the current market interest rates align with the bond’s coupon rate.

- Bond Certificate: The face value is prominently displayed on the bond certificate, along with other essential details like the coupon rate and maturity date.

- Implication for Bond Pricing: Face value directly influences the calculation of coupon payments and the present value of the bond. It serves as a benchmark against which the bond’s market price is compared.

Understanding the concept of face value and its implications is crucial for accurately calculating coupon bond prices. It provides a foundational element for further analysis and informed investment decisions.

Coupon Rate

Within the context of calculating coupon bond prices, the coupon rate holds significant importance as a key factor that directly influences the bond’s value. It represents the annual interest payment made to bondholders as a percentage of the bond’s face value.

- Fixed Rate: Coupon bonds typically offer a fixed coupon rate, which remains constant throughout the bond’s life.

- Floating Rate: In certain cases, bonds may have a floating coupon rate, which adjusts periodically based on a predetermined benchmark, such as a market interest rate.

- Zero-Coupon Rate: Some bonds, known as zero-coupon bonds, do not pay periodic interest payments. Instead, they are sold at a deep discount to their face value and redeemed at maturity for the full face value.

- Implication for Bond Pricing: The coupon rate has a direct impact on the bond’s present value. Higher coupon rates generally lead to higher bond prices, as investors are willing to pay more for bonds with higher interest payments.

Understanding the various aspects of coupon rates and their implications is essential for accurately calculating coupon bond prices. By considering the type of coupon rate, investors can better assess the bond’s value and make informed investment decisions.

Maturity Date

In the context of calculating coupon bond prices, the maturity date plays a critical role as it determines the duration of the bond and the timeline for repayment of principal. It directly influences the present value of the bond and is an essential component in any accurate calculation.

The maturity date represents the specific future date on which the bond issuer is obligated to repay the face value of the bond to the bondholder. As the bond approaches its maturity date, its present value gradually converges towards its face value, assuming no default or other unforeseen circumstances.

Real-life examples illustrate the practical significance of the maturity date in bond pricing. Consider two bonds with identical face values and coupon rates but different maturity dates. The bond with a longer maturity date will typically have a lower present value compared to the bond with a shorter maturity date, as investors demand higher returns for committing their funds for a more extended period. Understanding the relationship between maturity date and bond pricing enables investors to make informed decisions about the appropriate bonds to include in their portfolios, aligning with their investment goals and risk tolerance.

In summary, the maturity date is a crucial element in calculating coupon bond prices. It determines the time horizon for the bond investment and directly affects the present value of the bond. By considering the maturity date, investors can accurately assess the value of bonds and make informed decisions about their fixed income investments.

Current Market Interest Rates

In the realm of fixed income securities, current market interest rates wield significant influence on the calculation of coupon bond prices. These rates serve as a benchmark against which the attractiveness of a bond’s yield is measured, directly impacting its present value.

- Central Bank Policy: Monetary policy decisions by central banks, such as the Federal Reserve in the United States, can significantly affect market interest rates, influencing the overall demand for and supply of bonds.

- Economic Conditions: The state of the economy, including factors like inflation, unemployment, and GDP growth, can impact market interest rates, as investors adjust their risk appetite and seek safe havens.

- Bond Market Sentiment: Market sentiment, driven by factors like investor confidence and expectations about future economic conditions, can influence demand for bonds, thereby affecting interest rates.

- Supply and Demand: The balance between the supply of new bond issuances and the demand for bonds from investors directly impacts market interest rates.

Understanding the intricacies of current market interest rates is paramount in accurately calculating coupon bond prices. By considering these factors, investors can assess the relative value of bonds, make informed investment decisions, and navigate the complexities of the fixed income market.

Yield to Maturity

Yield to maturity (YTM) plays a critical role in calculating the price of a coupon bond. It represents the annual rate of return an investor can expect to receive if they hold the bond until its maturity date and make all scheduled coupon payments. YTM is a crucial metric for evaluating the attractiveness of a bond investment.

- Coupon Payments: YTM considers the present value of all future coupon payments until the bond’s maturity.

- Face Value: The face value, or principal amount, of the bond is also factored into the YTM calculation, representing the final payment received at maturity.

- Time to Maturity: The time remaining until the bond matures is a key determinant of YTM. Longer-term bonds generally have higher YTMs due to the increased uncertainty and risk associated with longer investment horizons.

- Current Market Interest Rates: YTM is closely linked to current market interest rates, as it reflects the opportunity cost of investing in a bond versus other fixed-income securities.

Understanding the components of YTM is essential for accurately calculating coupon bond prices. By considering these factors, investors can assess the relative value of bonds, make informed investment decisions, and effectively navigate the fixed income market.

Present Value of Coupon Payments

When calculating the price of a coupon bond, the present value of coupon payments represents the sum of the discounted future coupon payments that the bondholder will receive until the bond’s maturity date. This aspect plays a critical role in determining the overall value of the bond.

- Discount Rate: The discount rate used to calculate the present value is typically the current market interest rate or YTM. It reflects the time value of money and the opportunity cost of investing in the bond.

- Coupon Payment Frequency: The frequency of coupon payments, whether annually, semi-annually, or quarterly, affects the calculation of the present value. More frequent payments result in a higher present value.

- Time to Maturity: The time remaining until the bond matures determines the number of coupon payments to be discounted. Longer-term bonds have a greater number of payments to be discounted, leading to a lower present value.

- Default Risk: The creditworthiness of the bond issuer can impact the present value of coupon payments. Bonds issued by higher-risk issuers may have a lower present value due to the increased likelihood of default.

Understanding these facets of the present value of coupon payments is crucial for accurately calculating coupon bond prices. By considering the discount rate, coupon payment frequency, time to maturity, and default risk, investors can assess the relative value of bonds and make informed investment decisions.

Present Value of Face Value

In the context of calculating the price of a coupon bond, the present value of the face value holds significant importance as it represents the final payment received by the bondholder upon maturity. It directly contributes to the overall value of the bond and is a critical component in determining its price.

The present value of the face value is calculated by discounting the face value back to the present date using the appropriate discount rate, typically the current market interest rate or yield to maturity (YTM). This discounting process accounts for the time value of money and the opportunity cost of investing in the bond. The present value of the face value represents the current worth of the future payment, taking into consideration the time remaining until maturity and the prevailing interest rates.

Real-life examples illustrate the practical significance of the present value of face value in bond pricing. Consider a bond with a face value of $1,000 and a maturity date 10 years from now. If the current market interest rate is 5%, the present value of the face value would be approximately $613.91. This discounted value reflects the fact that the investor would need to invest less than the face value today to receive $1,000 at maturity, given the potential earnings from reinvesting the interest payments at the current market rate.

Understanding the present value of the face value empowers investors to accurately calculate coupon bond prices and make informed investment decisions. It helps them assess the relative value of bonds, compare them to other investment options, and manage their fixed income portfolios effectively. By considering the time value of money and prevailing interest rates, investors can determine the true worth of the bond’s future payment and make strategic investment choices.

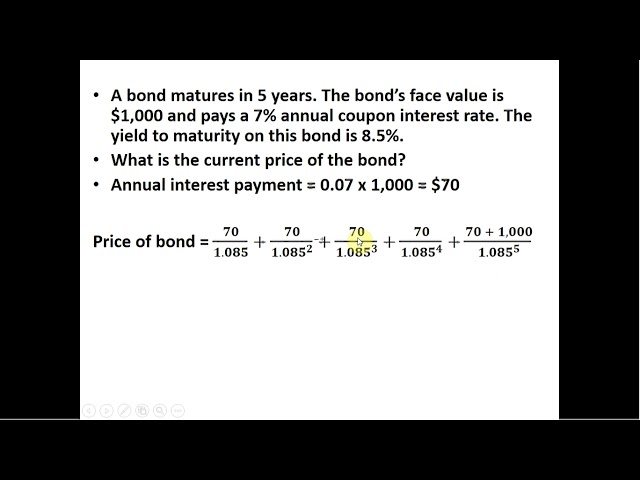

Bond Price Formula

The bond price formula is a mathematical equation used to calculate the present value of a coupon bond, considering various factors that influence its worth. Understanding this formula is crucial for determining the fair price of a bond and making informed investment decisions.

- Face Value: The face value, or principal amount, of the bond represents the final payment received at maturity. It serves as the base value upon which interest payments and the bond’s price are calculated.

- Coupon Rate: The coupon rate is the fixed annual interest payment made to bondholders, expressed as a percentage of the face value. It directly influences the bond’s attractiveness and contributes to its present value.

- Time to Maturity: The time remaining until the bond matures determines the number of coupon payments to be received and the duration of the investment. Longer-term bonds have a higher risk profile and generally offer higher yields.

- Yield to Maturity (YTM): The YTM represents the annual rate of return an investor expects to receive if they hold the bond until maturity. It serves as the discount rate used to calculate the present value of future cash flows.

The bond price formula incorporates these factors to determine the present value of a bond, which reflects its fair market price. By understanding the components and implications of this formula, investors can accurately assess the value of bonds, compare them to other investment options, and make informed decisions that align with their financial goals.

Accrued Interest

Accrued interest is a critical component in calculating the price of a coupon bond. It represents the interest that has accumulated on the bond since the last coupon payment date but has not yet been paid to the bondholder. Understanding accrued interest is essential for accurate bond pricing and informed investment decisions.

In practical terms, accrued interest directly affects the bond’s price. When a bond is purchased between coupon payment dates, the buyer is responsible for paying the accrued interest to the seller. This amount is added to the bond’s quoted price, increasing the total cost of the investment. Conversely, if a bond is sold before the next coupon payment date, the seller is entitled to receive the accrued interest from the buyer, which reduces the proceeds of the sale.

Real-life examples illustrate the significance of accrued interest in bond pricing. Consider a bond with a face value of $1,000, a coupon rate of 5%, and a semi-annual coupon payment schedule. If the bond is purchased 90 days after the last coupon payment date, the accrued interest would be $12.50 (90 days / 180 days * $50 semi-annual coupon payment). This amount would be added to the bond’s quoted price, resulting in a higher purchase price for the investor.

Understanding the relationship between accrued interest and bond pricing empowers investors to make informed decisions about bond purchases and sales. By considering accrued interest, investors can accurately calculate the total cost or proceeds of a bond transaction and assess the bond’s overall value in relation to market conditions and their investment goals.

Bond Value with Accrued Interest

In the realm of bond pricing, the concept of ‘Bond Value with Accrued Interest’ holds significant importance. Accrued interest represents the accumulated interest on a bond that has not yet been paid to the bondholder. Understanding this aspect is crucial for calculating the accurate price of a coupon bond.

- Clean Price: The clean price of a bond is its price excluding accrued interest. It represents the intrinsic value of the bond, without considering the accumulated interest.

- Dirty Price: The dirty price, also known as the full price, is the price of a bond including accrued interest. It reflects the total amount an investor must pay to purchase the bond.

- Accrual Period: The accrual period refers to the time elapsed since the last coupon payment date. It determines the amount of accrued interest that has accumulated on the bond.

- Settlement Date: The settlement date is the date on which the buyer of a bond pays the seller and takes ownership of the bond. The accrued interest is calculated up to the settlement date.

Comprehending the relationship between bond value and accrued interest is essential for investors and traders. It allows them to accurately determine the total cost or proceeds of a bond transaction, enabling informed decision-making in the bond market.

Frequently Asked Questions (FAQs) about Calculating Coupon Bond Prices

These FAQs aim to address common queries or clarify aspects related to calculating the price of coupon bonds.

Question 1: What is the significance of the bond’s face value in pricing?

The face value represents the principal amount borrowed by the issuer and serves as the basis for calculating both coupon payments and the eventual repayment of the bond at maturity. It directly influences the bond’s present value and overall price.

Question 2: How does the coupon rate affect bond pricing?

The coupon rate is the fixed annual interest payment made to bondholders. Higher coupon rates generally lead to higher bond prices, as investors are willing to pay more for bonds with higher interest payments.

Question 3: Why is the maturity date crucial in bond pricing?

The maturity date determines the duration of the bond and the timeline for repayment of principal. As the bond approaches maturity, its present value gradually converges towards its face value, assuming no default or other unforeseen circumstances.

Question 4: How do current market interest rates impact bond prices?

Current market interest rates serve as a benchmark against which the attractiveness of a bond’s yield is measured. Bonds with coupons below the prevailing market interest rates are typically priced at a discount, while bonds with coupons above market rates are priced at a premium.

Question 5: What role does yield to maturity (YTM) play in bond pricing?

YTM represents the annual rate of return an investor can expect to receive if they hold the bond until maturity and make all scheduled coupon payments. It is closely linked to current market interest rates and directly influences the bond’s present value and price.

Question 6: How is accrued interest incorporated into bond pricing?

Accrued interest represents the interest that has accumulated on the bond since the last coupon payment date but has not yet been paid to the bondholder. It is added to the quoted price of the bond when purchased and subtracted when sold, affecting the total cost or proceeds of the transaction.

These FAQs provide a concise overview of key factors and considerations involved in calculating coupon bond prices. For a more comprehensive understanding, refer to the detailed article sections that follow.

Moving forward, we will delve deeper into practical applications, including numerical examples and case studies, to further enhance your understanding of coupon bond pricing.

Tips for Calculating Coupon Bond Prices

To enhance your practical understanding, here are several actionable tips to guide you in calculating coupon bond prices:

Tip 1: Understand the Bond’s Key Features

Begin by familiarizing yourself with the bond’s face value, coupon rate, maturity date, and current market interest rates.

Tip 2: Determine Present Value of Coupon Payments

Calculate the present value of all future coupon payments until maturity, using the appropriate discount rate.

Tip 3: Calculate Present Value of Face Value

Determine the present value of the face value by discounting it back to the present using the same discount rate.

Tip 4: Sum the Present Values

Add the present values of coupon payments and face value to obtain the bond’s total present value.

Tip 5: Consider Accrued Interest

If purchasing a bond between coupon payment dates, add accrued interest to the bond’s price.

Tip 6: Use a Bond Pricing Calculator

Utilize online bond pricing calculators for quick and accurate calculations.

Tip 7: Compare to Market Prices

Compare your calculated bond price to market prices to assess its fairness.

Tip 8: Monitor Market Conditions

Stay informed about changes in interest rates and economic conditions that may impact bond prices.

Following these tips can significantly enhance your ability to calculate coupon bond prices accurately. By considering these factors, you can make informed investment decisions and effectively navigate the fixed income market.

In the concluding section, we will discuss advanced strategies for bond pricing, including the use of yield curves and duration analysis, to further empower you in your bond investment journey.

Conclusion

This comprehensive exploration of coupon bond pricing has illuminated the intricacies of calculating the fair value of these fixed-income securities. By understanding the interplay between face value, coupon rate, maturity date, current market interest rates, yield to maturity, and accrued interest, investors can accurately determine bond prices and make informed investment decisions.

The key insights gained from this analysis include:

- Present Value Calculations: Coupon bond prices are determined by calculating the present value of future coupon payments and the face value, using appropriate discount rates.

- Impact of Market Conditions: Interest rate fluctuations and economic conditions significantly influence bond prices, making it crucial to monitor market dynamics.

- Role of Accrued Interest: Accrued interest must be considered when purchasing bonds between coupon payment dates, as it affects the total cost of the investment.

Understanding these concepts empowers investors to navigate the fixed income market effectively, capitalize on opportunities, and manage their bond portfolios strategically. Remember, accurate bond pricing is a cornerstone of successful fixed-income investing, enabling informed decision-making and maximizing returns.