Calculating the coupon of a bond is a fundamental aspect of fixed-income investments. A bond’s coupon rate represents the fixed interest payment it makes to investors annually, expressed as a percentage of its face value.

Understanding how to calculate a bond’s coupon is crucial for investors to determine the potential income and overall value of their investment. The coupon payment directly impacts the bond’s yield and can influence its market price. Historically, bond coupons were physical certificates attached to the bond itself, but today, they are typically paid electronically.

This article will provide a comprehensive guide on how to calculate the coupon of a bond, covering the formula, factors involved, and practical examples to ensure a thorough understanding of this essential bond characteristic.

How to Calculate Coupon of a Bond

Calculating the coupon of a bond is crucial for bond investors to determine the potential income and value of their investments. Key aspects to consider when calculating a bond’s coupon include:

- Face Value

- Coupon Rate

- Payment Frequency

- Maturity Date

- Present Value

- Yield to Maturity

- Callable Feature

- Credit Rating

Understanding these aspects is critical for accurate coupon calculation and informed investment decisions. For example, the face value represents the principal amount borrowed, the coupon rate determines the interest payment, and the payment frequency specifies how often the interest is paid. Additionally, the maturity date indicates when the bond expires, while the present value and yield to maturity provide insights into the bond’s current worth and return potential. Callable features and credit ratings can also impact the coupon calculation and overall bond value.

Face Value

In the context of calculating a bond’s coupon, the face value plays a pivotal role. It represents the principal amount of the bond, which is the amount borrowed by the issuer and repaid to the investor at maturity.

- Principal Amount: The face value is simply the amount of money that is lent to the bond issuer.

- Benchmark for Interest Payments: The coupon rate, which determines the interest payments made on the bond, is calculated as a percentage of the face value.

- Maturity Value: Upon reaching maturity, the bond issuer repays the face value to the investor, fulfilling their obligation under the bond agreement.

- Bond Valuation: The face value serves as a reference point for valuing the bond, as it represents the amount that the investor will ultimately receive at maturity.

Understanding the face value is essential for accurately calculating a bond’s coupon and assessing its overall value. It provides a basis for determining the interest payments, maturity proceeds, and the bond’s overall return on investment.

Coupon Rate

The coupon rate is a crucial aspect of bond calculations, representing the fixed interest rate that the bond issuer promises to pay to investors. Understanding the coupon rate is essential for determining the bond’s yield and overall value.

- Nominal Rate: The coupon rate is typically expressed as a nominal annual percentage of the bond’s face value.

- Coupon Payment: The total interest payment made to bondholders each year is calculated by multiplying the coupon rate by the face value.

- Yield-to-Maturity: The yield-to-maturity (YTM) of a bond considers the coupon rate along with other factors to determine the annual return an investor can expect to receive.

- Bond Valuation: The coupon rate influences the bond’s price in the secondary market, with higher coupon rates generally leading to higher bond prices.

In conclusion, the coupon rate is a key factor that directly impacts the interest payments, yield, and valuation of a bond. Investors should carefully consider the coupon rate when evaluating bond investments to make informed decisions that align with their financial goals.

Payment Frequency

In the context of calculating a bond’s coupon, payment frequency plays a crucial role in determining the timing and amount of interest payments received by investors. Different bonds may have varying payment schedules, which directly impact the overall yield and value of the investment.

- Annual: The most common payment frequency, where interest is paid once a year.

- Semi-Annual: Interest payments are made twice a year, providing investors with more frequent income.

- Quarterly: Interest is paid every three months, resulting in a more consistent cash flow for investors.

- Monthly: Some bonds offer monthly interest payments, providing investors with a predictable and regular income stream.

Payment frequency can have significant implications for investors. Bonds with more frequent payments may be more attractive to investors seeking regular income, while those with less frequent payments may offer a higher yield to compensate for the longer waiting period between payments. Understanding the payment frequency of a bond is essential for accurately calculating the coupon and assessing the overall investment potential.

Maturity Date

Within the context of calculating a bond’s coupon, the maturity date holds significant importance. It represents the predetermined date on which the bond issuer is obligated to repay the principal amount borrowed to the bondholders.

- Repayment of Principal: At maturity, the bond issuer repays the face value of the bond to the investor, fulfilling their financial obligation.

- Coupon Payment Cessation: Upon reaching maturity, the issuer ceases making coupon payments, as the principal amount has been repaid.

- Bond Expiration: The maturity date effectively marks the expiration of the bond, as it signifies the end of the loan period and the return of the principal.

- Investment Horizon: For investors, the maturity date determines the length of time they will be committed to the bond investment.

Understanding the maturity date is crucial for accurately calculating a bond’s coupon, as it establishes the duration over which interest payments will be received. It also provides investors with a clear understanding of the investment horizon and helps them make informed decisions based on their financial goals and risk tolerance.

Present Value

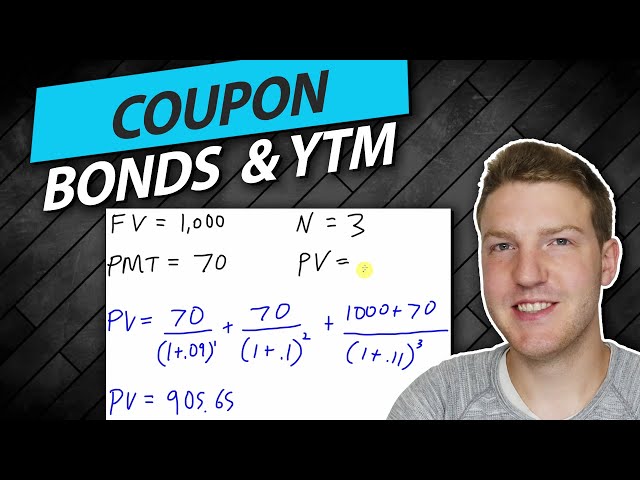

When calculating the coupon of a bond, it is essential to consider the present value. The present value represents the current worth of future cash flows, factoring in the time value of money and the prevailing interest rates. Understanding the present value is crucial for accurately determining the bond’s value and return on investment.

- Discount Rate: The discount rate used in present value calculations is typically the bond’s yield to maturity or an appropriate risk-free rate. It represents the rate at which future cash flows are discounted back to the present.

- Time to Maturity: The time to maturity is the period until the bond’s maturity date. It influences the present value, as longer maturities result in a greater discounting effect.

- Coupon Payments: The present value of the bond’s coupon payments represents the sum of the discounted future coupon payments over the life of the bond.

- Face Value: The present value of the bond’s face value is the discounted value of the principal amount repaid at maturity.

In summary, the present value plays a critical role in calculating the coupon of a bond by considering the time value of money and the various cash flows associated with the bond. It provides investors with a comprehensive assessment of the bond’s worth and helps them make informed investment decisions.

Yield to Maturity

Yield to Maturity (YTM) holds immense significance in the realm of bond calculations, particularly when determining a bond’s coupon. YTM represents the annualized rate of return an investor can expect to receive if they hold the bond until maturity, considering both coupon payments and the repayment of the principal amount.

- Market Price: YTM is heavily influenced by the bond’s market price. A higher market price leads to a lower YTM, and vice versa.

- Coupon Rate: The coupon rate, which determines the fixed interest payments, is a key component in calculating YTM.

- Maturity Date: The time remaining until the bond’s maturity date impacts the YTM calculation.

- Interest Rate Environment: YTM is sensitive to changes in interest rates. Rising interest rates generally lead to lower YTMs, while falling rates result in higher YTMs.

In summary, understanding YTM is crucial for accurately calculating a bond’s coupon. Investors can use YTM to compare different bonds, assess their potential returns, and make informed investment decisions aligned with their financial goals and risk tolerance.

Callable Feature

In the context of calculating a bond’s coupon, the callable feature warrants careful consideration. It empowers the bond issuer with the right to redeem the bond before its maturity date, potentially affecting the coupon payments and overall return on investment.

- Call Protection Period: Bonds may have a call protection period during which the issuer cannot redeem them, ensuring investors receive coupon payments for a certain duration.

- Call Premium: If a bond is called, the issuer typically pays a call premium to bondholders, which compensates them for the loss of future coupon payments.

- Impact on Coupon Calculation: The callable feature can influence the calculation of the bond’s coupon rate. Bonds with a callable feature may have a higher coupon rate to compensate investors for the potential early redemption risk.

- Yield to Call: For callable bonds, the yield to call measures the return an investor can expect if the bond is redeemed at the first call date.

Understanding the callable feature and its implications is crucial for accurately calculating a bond’s coupon and making informed investment decisions. Investors should carefully assess the call provisions, including the call protection period, call premium, and potential impact on the coupon payments, to determine how these factors may affect their overall return on investment.

Credit Rating

When calculating the coupon of a bond, considering the credit rating of the issuer is imperative. A credit rating serves as an assessment of the issuer’s ability to meet its financial obligations, which directly influences the coupon rate and overall value of the bond.

- Issuer Reliability: Credit rating agencies evaluate the financial strength, stability, and track record of the bond issuer, providing insights into their ability to make timely interest payments and repay the principal at maturity.

- Default Risk: The credit rating indicates the likelihood of the issuer defaulting on its debt obligations. A higher credit rating signifies a lower default risk, while a lower credit rating suggests a greater risk of default.

- Interest Rate Impact: Bonds with lower credit ratings typically carry higher coupon rates to compensate investors for the increased risk of default. Conversely, bonds with higher credit ratings may offer lower coupon rates due to their perceived safety and reliability.

- Investment Grade vs. Junk Bonds: Bonds are often classified as investment grade or junk bonds based on their credit ratings. Investment-grade bonds have higher credit ratings and are considered less risky, while junk bonds have lower credit ratings and are deemed more speculative.

Understanding the credit rating of a bond issuer is crucial for accurately calculating the bond’s coupon and assessing its overall risk and return profile. Investors should carefully consider the credit rating in conjunction with other factors, such as the bond’s maturity date, coupon rate, and market conditions, to make informed investment decisions.

Frequently Asked Questions

The following FAQs provide concise answers to common queries related to calculating the coupon of a bond, clarifying key concepts and addressing potential concerns.

Question 1: What is the formula for calculating the bond coupon?

The coupon is calculated by multiplying the bond’s face value by the annual coupon rate. For instance, a $1,000 bond with a 5% coupon rate would have an annual coupon payment of $50 (1,000 x 0.05).

Question 2: How does the frequency of coupon payments affect the bond’s value?

More frequent coupon payments generally lead to a higher bond price. This is because investors receive interest payments more often, resulting in a higher yield-to-maturity (YTM).

Question 3: What factors influence the coupon rate of a bond?

The coupon rate is primarily determined by the issuer’s creditworthiness, the prevailing interest rate environment, and the bond’s maturity date. Higher-rated bonds typically have lower coupon rates due to their perceived lower risk, while longer-term bonds generally offer higher coupon rates to compensate for the increased interest rate risk.

Question 4: Can the coupon rate of a bond change over time?

In the case of floating-rate bonds, the coupon rate is not fixed and adjusts periodically based on a reference interest rate, such as LIBOR. This helps protect investors from interest rate fluctuations.

Question 5: How is the bond coupon used in calculating the yield to maturity (YTM)?

The coupon payments are a key component in the YTM calculation, along with the bond’s current market price and time to maturity. YTM represents the annualized rate of return an investor can expect to receive if they hold the bond until maturity.

Question 6: What is the relationship between the coupon rate and the call feature of a bond?

Bonds with a call feature may have higher coupon rates to compensate investors for the possibility of early redemption. If interest rates decline, the issuer may call the bond and refinance it at a lower rate, potentially reducing the investor’s overall return.

These FAQs provide a concise overview of the key aspects related to calculating a bond’s coupon. Understanding these concepts is crucial to accurately assess the value and potential returns of bond investments.

In the next section, we will delve into more advanced topics related to bond coupon calculations, including the impact of taxes, the role of credit ratings, and strategies for optimizing bond portfolio returns.

Tips for Calculating Bond Coupons Accurately

In this section, we present a comprehensive set of tips to assist you in accurately calculating bond coupons, ensuring a thorough understanding of this crucial aspect of bond investing.

Tip 1: Confirm the bond’s face value, coupon rate, and payment frequency to obtain the necessary inputs for the coupon calculation.

Tip 2: Utilize the formula: Coupon = Face Value x Coupon Rate to determine the annual coupon payment.

Tip 3: Consider the time value of money by discounting future coupon payments to their present value using an appropriate discount rate.

Tip 4: Account for the potential impact of a callable feature on the bond’s coupon payments and overall return.

Tip 5: Understand the relationship between credit ratings and coupon rates, as higher-rated bonds typically have lower coupon rates due to lower perceived risk.

Tip 6: Utilize reputable sources and online calculators to verify your calculations and ensure accuracy.

Tip 7: Analyze historical coupon payment data to gain insights into the stability and reliability of the issuer’s coupon payments.

Tip 8: Consult with a financial advisor or investment professional for personalized guidance and support in calculating bond coupons.

By following these tips, you can enhance the accuracy and efficiency of your bond coupon calculations, leading to informed investment decisions.

In the concluding section of this article, we will explore advanced strategies for optimizing bond portfolio returns, building upon the foundation established in this section on accurate coupon calculation.

Conclusion

In this comprehensive guide, we have explored the intricacies of calculating bond coupons, providing a solid foundation for informed investment decisions. Key takeaways include:

- Understanding the formula, inputs, and factors involved in coupon calculation is essential for accuracy.

- Consideration of time value of money, callable features, credit ratings, and historical data enhances the reliability of calculations.

- Accurate coupon calculations empower investors to assess bond values, yields, and overall portfolio returns effectively.

Calculating bond coupons accurately is not merely a technical exercise but a crucial step towards successful bond investing. It enables investors to make well-informed choices, navigate market complexities, and maximize their returns. As the bond market continues to evolve, staying abreast of these calculation methods will empower investors to adapt and thrive in the ever-changing financial landscape.