Coupon yield to maturity is the annual rate of return an investor can expect to receive from a coupon-paying bond if held until its maturity date. For example, a bond with a face value of $1,000, a 5% coupon rate, and a 10-year maturity would have a coupon yield to maturity of 5%.

Coupon yield to maturity is an important metric for investors to consider when making investment decisions, as it provides a way to compare the yields of different bonds. It is also used as a benchmark to measure the performance of other fixed income investments.

The concept of coupon yield to maturity was first developed by the English mathematician Thomas Simpson in the 18th century.

How to Calculate Coupon Yield to Maturity

Coupon yield to maturity (CYTM) is an important metric for investors to consider when making investment decisions. It provides a way to compare the yields of different bonds and is used as a benchmark to measure the performance of other fixed income investments.

- Face Value

- Coupon Rate

- Maturity Date

- Present Value

- Future Value

- Yield to Maturity

- Time to Maturity

- Frequency of Coupon Payments

These factors are all used in the calculation of CYTM. By understanding the relationship between these factors, investors can make more informed investment decisions.

Face Value

Face Value (FV) is the nominal or principal amount of a bond that is repaid to the bondholder at maturity. It is a critical component of how to calculate coupon yield to maturity (CYTM) because it represents the amount of money that the investor will receive back at the end of the bond’s life. FV is used to calculate the bond’s present value (PV), which is then used to calculate the bond’s yield to maturity (YTM).

For example, consider a bond with a $1,000 FV, a 5% coupon rate, and a 10-year maturity. The bond’s PV is $863.84, and its YTM is 5.73%. If the bond’s FV was $2,000, its PV would be $1,727.68, and its YTM would be 5.36%. This shows that the FV of a bond has a direct impact on its YTM.

FV is also important for calculating the bond’s duration and convexity. Duration is a measure of a bond’s price sensitivity to changes in interest rates. Convexity is a measure of how much the duration of a bond changes in response to changes in interest rates. Both duration and convexity are important factors to consider when making investment decisions.

Coupon Rate

Coupon Rate (CR) is the annual interest rate that is paid to bondholders. It is a critical component of how to calculate coupon yield to maturity (CYTM) because it is used to calculate the bond’s present value (PV). PV is then used to calculate the bond’s YTM. A higher CR will result in a higher PV and a lower YTM. Conversely, a lower CR will result in a lower PV and a higher YTM.

For example, consider two bonds with the same FV, maturity date, and frequency of coupon payments. The only difference between the two bonds is that Bond A has a 5% CR and Bond B has a 10% CR. The PV of Bond A will be lower than the PV of Bond B, and the YTM of Bond A will be higher than the YTM of Bond B.

CR is also important for calculating the bond’s duration and convexity. Duration is a measure of a bond’s price sensitivity to changes in interest rates. Convexity is a measure of how much the duration of a bond changes in response to changes in interest rates. Both duration and convexity are important factors to consider when making investment decisions.

Understanding the relationship between CR and CYTM is essential for investors who want to make informed investment decisions. By understanding how these two factors interact, investors can better assess the value of a bond and its potential return.

Maturity Date

Maturity Date (MD) is the date on which a bond matures and the principal is repaid to the bondholder. It is a critical component of how to calculate coupon yield to maturity (CYTM) because it is used to calculate the bond’s present value (PV). PV is then used to calculate the bond’s YTM. A longer MD will result in a lower PV and a higher YTM. Conversely, a shorter MD will result in a higher PV and a lower YTM.

For example, consider two bonds with the same FV, CR, and frequency of coupon payments. The only difference between the two bonds is that Bond A has a 10-year MD and Bond B has a 20-year MD. The PV of Bond A will be higher than the PV of Bond B, and the YTM of Bond A will be lower than the YTM of Bond B.

Understanding the relationship between MD and CYTM is essential for investors who want to make informed investment decisions. By understanding how these two factors interact, investors can better assess the value of a bond and its potential return.

Present Value

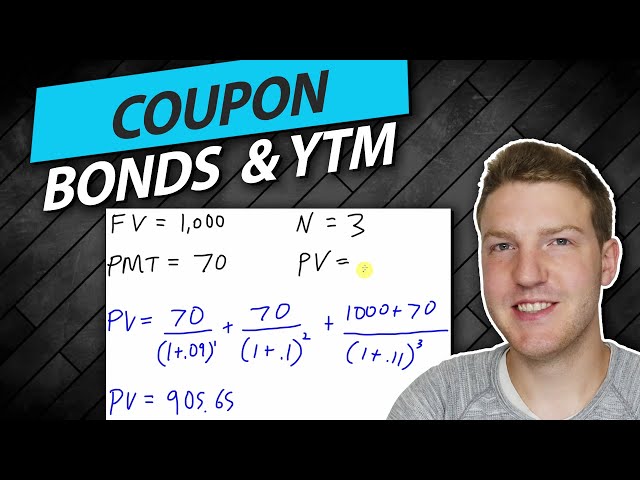

Present Value (PV) is a critical component of how to calculate coupon yield to maturity (CYTM). It represents the current value of a bond’s future cash flows, including both coupon payments and the repayment of principal at maturity. By understanding the various facets of PV, investors can gain a deeper understanding of how CYTM is calculated and how it can be used to make informed investment decisions.

- Face Value: The nominal or principal amount of a bond that is repaid to the bondholder at maturity. It is the foundation for calculating the present value of the bond.

- Coupon Rate: The annual interest rate that is paid to bondholders. It determines the amount of coupon payments that will be received over the life of the bond.

- Maturity Date: The date on which a bond matures and the principal is repaid to the bondholder. It influences the time value of money and the calculation of the present value.

- Yield to Maturity: The annual rate of return that an investor can expect to receive from a bond if held until its maturity date. It is the ultimate goal of the CYTM calculation.

By understanding the relationship between these facets and PV, investors can gain a deeper understanding of how CYTM is calculated and how it can be used to make informed investment decisions.

Future Value

Future Value (FV) plays a critical role in the calculation of Coupon Yield to Maturity (CYTM). FV represents the value of a bond’s future cash flows, including both coupon payments and the repayment of principal at maturity, discounted back to the present using a specified yield rate. Understanding the relationship between FV and CYTM is essential for investors seeking to accurately assess the potential return of a bond investment.

FV is a critical component of CYTM because it represents the total amount of money that an investor will receive from a bond if held until maturity. By comparing the FV of a bond to its purchase price, investors can determine the potential return on their investment. A higher FV indicates a higher potential return, while a lower FV indicates a lower potential return.

In real-world scenarios, FV is used extensively in the calculation of CYTM for various types of bonds. For instance, in the case of a zero-coupon bond, which pays no periodic coupon payments, the FV at maturity is the same as the bond’s purchase price. Conversely, for a bond with regular coupon payments, the FV is calculated as the sum of the present value of each future coupon payment and the present value of the principal repayment at maturity.

Understanding the relationship between FV and CYTM enables investors to make informed investment decisions. By accurately calculating CYTM, investors can compare the yields of different bonds and determine which bonds offer the most attractive return for their investment goals and risk tolerance. Additionally, FV can be used to assess the impact of changes in interest rates on the value of a bond investment, providing insights into potential risks and opportunities.

Yield to Maturity

Yield to Maturity (YTM) is a crucial concept in the realm of fixed income investments. It plays a central role in determining the potential return an investor can expect from a bond if held until maturity. YTM is closely intertwined with the calculation of Coupon Yield to Maturity (CYTM), and understanding its various facets provides a comprehensive perspective on bond valuation and investment analysis.

- Annual Coupon Payments: Annual coupon payments represent periodic interest payments made to bondholders. YTM takes into account the present value of all future coupon payments until the bond’s maturity date.

- Maturity Value: The maturity value refers to the face value or principal amount of the bond that is repaid at maturity. YTM incorporates the present value of the maturity value into its calculation, providing a measure of the total return on the investment.

- Time to Maturity: Time to maturity is the remaining period until a bond reaches its maturity date. YTM considers the time value of money, discounting future cash flows based on the prevailing interest rates and the time until maturity.

- Market Price: The market price of a bond can deviate from its face value due to factors such as changes in interest rates and market conditions. YTM is calculated using the current market price, providing an indication of the implied yield if the bond is purchased at that price and held to maturity.

In summary, YTM encompasses various facets that collectively influence the calculation of CYTM. By comprehending the role of annual coupon payments, maturity value, time to maturity, and market price, investors can gain a deeper understanding of bond valuation and make informed investment decisions. YTM serves as a benchmark for comparing different bond investments and assessing their potential returns.

Time to Maturity

Time to Maturity (TTM) is a critical factor in calculating Coupon Yield to Maturity (CYTM), as it represents the remaining period until a bond reaches its maturity date and the investor receives the principal repayment. TTM influences the present value of future cash flows, directly impacting the calculation of CYTM.

- Holding Period: TTM determines the length of time an investor plans to hold the bond, affecting the duration and risk profile of their investment.

- Interest Rate Risk: Bonds with longer TTM are more sensitive to interest rate fluctuations, as changes in interest rates have a greater impact on the present value of their future cash flows.

- Market Volatility: TTM can influence a bond’s price volatility, as bonds with longer TTM are more exposed to market conditions and potential price fluctuations.

- Investment Strategy: TTM plays a role in an investor’s overall investment strategy, as it aligns with their risk tolerance and financial goals.

In summary, TTM is a multifaceted concept that encompasses holding period, interest rate risk, market volatility, and investment strategy, all of which impact the calculation of CYTM and the overall investment decision-making process.

Frequency of Coupon Payments

Frequency of Coupon Payments refers to the number of times per year that a bondholder receives interest payments from a bond issuer. It is a critical component of how to calculate coupon yield to maturity (CYTM), as it directly affects the present value of the bond’s future cash flows, including both coupon payments and the repayment of principal at maturity.

The relationship between frequency of coupon payments and CYTM can be explained by the concept of time value of money. The more frequently coupon payments are made, the shorter the time between each payment, resulting in a higher present value of the future cash flows. This is because the money received sooner is worth more than the same amount of money received later, due to the effect of compounding interest. For example, a bond with semi-annual coupon payments will have a higher CYTM than an otherwise identical bond with annual coupon payments, as the present value of the more frequent coupon payments is higher.

In real-life applications, frequency of coupon payments can have significant implications for investors. Bonds with more frequent coupon payments are generally more attractive to investors, as they provide a more steady stream of income. Additionally, bonds with shorter time between coupon payments are less sensitive to interest rate changes, as the present value of their future cash flows is less affected by changes in interest rates.

Understanding the relationship between frequency of coupon payments and CYTM enables investors to make informed investment decisions. By considering the frequency of coupon payments in conjunction with other factors such as coupon rate, maturity date, and current market conditions, investors can select bonds that align with their investment goals and risk tolerance.

Frequently Asked Questions on Coupon Yield to Maturity

This section aims to address common questions and provide clarity on various aspects of coupon yield to maturity (CYTM) calculations.

Question 1: What is the difference between coupon yield and yield to maturity?

Answer: Coupon yield represents the annual interest payment divided by the face value of the bond, while yield to maturity considers the present value of all future cash flows, including coupon payments and the repayment of principal at maturity.

Question 2: How does the frequency of coupon payments affect CYTM?

Answer: More frequent coupon payments result in a higher CYTM due to the shorter time between each payment and the higher present value of the future cash flows.

Question 3: What is the relationship between CYTM and the market price of a bond?

Answer: CYTM and the market price of a bond have an inverse relationship. When interest rates rise, bond prices fall, leading to a higher CYTM. Conversely, when interest rates fall, bond prices rise, resulting in a lower CYTM.

Question 4: How can I calculate CYTM using a financial calculator?

Answer: Enter the face value, coupon rate, number of coupon payments per year, number of years to maturity, and the current market price into the calculator to obtain the CYTM.

Question 5: What are the limitations of using CYTM to evaluate bonds?

Answer: CYTM assumes that the bond will be held until maturity, which may not always be the case. Additionally, it does not consider the impact of potential changes in interest rates or the creditworthiness of the bond issuer.

Question 6: How is CYTM used in bond portfolio management?

Answer: CYTM is a key metric used to compare the yields of different bonds and to construct bond portfolios that meet specific return and risk objectives.

In summary, understanding CYTM is crucial for making informed investment decisions. It provides insights into the potential return and risk associated with bond investments and serves as a valuable tool for bond portfolio management.

For further insights into coupon yield to maturity, let’s explore the factors that influence its calculation.

Tips for Calculating Coupon Yield to Maturity

This section provides practical tips to assist in the accurate calculation of coupon yield to maturity (CYTM). By following these guidelines, investors can enhance their understanding of bond valuation and make informed investment decisions.

Tip 1: Gather accurate data. Ensure the availability of accurate figures for face value, coupon rate, maturity date, and current market price before initiating CYTM calculations.

Tip 2: Consider frequency of coupon payments. Determine the number of times per year that coupon payments are made, as this directly impacts the present value of the future cash flows.

Tip 3: Utilize a financial calculator. Employ a financial calculator specifically designed for bond calculations to simplify the CYTM calculation process and minimize errors.

Tip 4: Understand the relationship between CYTM and market price. Recognize that CYTM and bond prices have an inverse relationship, with rising interest rates leading to lower bond prices and higher CYTM.

Tip 5: Interpret CYTM in context. Evaluate CYTM in conjunction with other bond characteristics, such as credit rating and maturity, to gain a comprehensive view of the investment’s risk and return profile.

Tip 6: Consider the limitations of CYTM. Be aware that CYTM assumes the bond will be held until maturity, which may not always be the case. Additionally, it does not account for potential changes in interest rates or issuer creditworthiness.

By adhering to these tips, investors can enhance the accuracy and reliability of their CYTM calculations, leading to better-informed investment decisions.

Moving forward, the final section of this article will explore advanced techniques for bond valuation, building upon the foundation established by these tips.

Conclusion

This comprehensive exploration of coupon yield to maturity (CYTM) has illuminated the intricate relationship between bond characteristics, market dynamics, and investment returns. By delving into the factors that influence CYTM, investors have gained valuable insights into the complexities of bond valuation.

Key takeaways include the inverse relationship between CYTM and bond prices, the impact of coupon payment frequency on present value calculations, and the limitations of CYTM in capturing all aspects of bond risk. Understanding these interconnections empowers investors to make informed decisions when navigating the bond market.

In the ever-evolving world of finance, staying abreast of advanced bond valuation techniques is crucial. By embracing these insights, investors can unlock the full potential of CYTM calculations and make strategic investment choices that align with their financial goals.