Determining the discount date, a noun phrase, involves calculating the date on which a discount or reduction in price is applied. Imagine purchasing a product with a 10% discount that expires in 30 days. Calculating the discount date helps determine the exact day the reduced price applies.

Calculating the discount date is crucial for businesses and consumers. It ensures accurate invoicing, prevents overpayments, and helps track discounts effectively. Historically, the concept of discounting dates back to ancient civilizations where merchants offered price reductions to encourage early payments.

This article delves into the intricacies of calculating discount dates, providing step-by-step instructions, exploring industry practices, and highlighting common pitfalls to avoid.

How to Calculate Discount Date

Calculating the discount date is essential for businesses and consumers, ensuring accurate invoicing, preventing overpayments, and tracking discounts effectively.

- Discount Percentage

- Original Price

- Discount Period

- Invoice Date

- Payment Terms

- Early Payment Discount

- Late Payment Penalty

- Net Price

- Discounted Price

These aspects are interconnected, influencing the calculation of the discount date. For instance, knowing the discount percentage, original price, and discount period is crucial for determining the discounted price. Similarly, understanding the invoice date, payment terms, and early payment discounts helps calculate the applicable discount. A clear grasp of these aspects ensures accurate discount date calculations, preventing errors and optimizing financial transactions.

Discount Percentage

Discount Percentage plays a crucial role in calculating the discount date, as it determines the amount of reduction applied to the original price. Understanding its various facets helps businesses and consumers accurately assess the impact of discounts on their financial transactions.

- Fixed Percentage: A predetermined percentage discount, such as 5% or 10%, applied to the original price.

- Tiered Discounts: Discounts that vary based on the quantity purchased, with higher discounts for larger purchases.

- Seasonal Discounts: Discounts offered during specific seasons or holidays to promote sales.

- Promotional Discounts: Discounts provided for a limited time to attract new customers or boost sales.

These facets of Discount Percentage impact the calculation of the discount date by influencing the discounted price. Businesses need to consider the type of discount, its magnitude, and the applicable conditions to accurately determine the date on which the discount can be applied. This ensures that both parties involved in the transaction benefit from the discount as intended.

Original Price

Original Price, a fundamental aspect of calculating discount dates, significantly influences the determination of discounted prices. Understanding their relationship is vital for businesses and consumers to accurately assess the impact of discounts on their financial transactions.

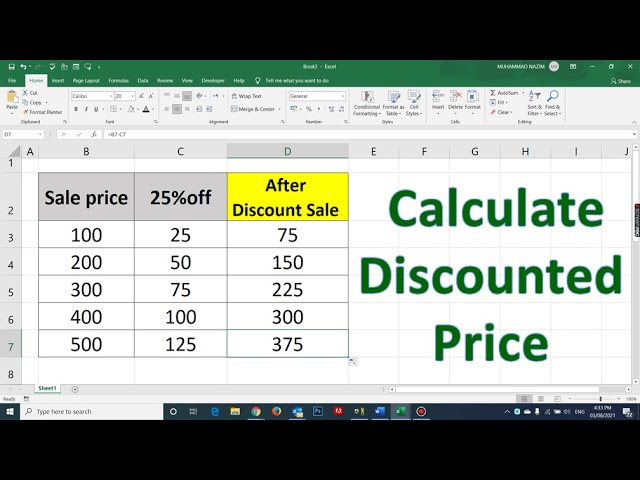

Original Price serves as the basis for calculating the discounted price. The discount percentage is applied to the original price to determine the amount of reduction. For instance, if an item originally priced at $100 has a 10% discount, the discounted price becomes $90. Therefore, knowing the original price is essential for calculating the discount date.

Real-life examples further illustrate this connection. Consider a clothing store offering a 20% discount on all items during a sale. To calculate the discount date, the original price of each item must be known to determine the discounted price. This information is crucial for customers to make informed decisions about their purchases and for the store to accurately track sales and revenue.

In summary, Original Price is a critical component of calculating discount dates, as it directly affects the determination of discounted prices. Understanding this relationship empowers businesses and consumers to effectively manage their finances, optimize transactions, and make well-informed decisions in the context of discounts.

Discount Period

In the context of calculating discount dates, the Discount Period holds significant importance, influencing the timeline for applying discounts. Understanding its various facets helps businesses and consumers navigate the complexities of discount transactions effectively.

- Fixed Duration: A predetermined duration, such as 10 days or 30 days, during which the discount can be applied from the invoice date.

- Early Payment Discount: A discount offered for payments made within a specific time frame, incentivizing prompt payments.

- End-of-Period Discount: A discount provided if the entire invoice is paid by the end of the billing period, encouraging timely settlement.

- Seasonal Discount: A discount offered during a particular season or holiday, often used to boost sales during slower periods.

These facets collectively impact the calculation of discount dates by defining the time frame within which discounts can be applied. Businesses can leverage this information to optimize their cash flow, manage inventory levels, and plan for future purchases. Consumers, on the other hand, can use this knowledge to identify the most favorable deals and payment options, maximizing their savings.

Invoice Date

Understanding the connection between Invoice Date and how to calculate discount date holds significant importance in various business and financial transactions. The Invoice Date serves as a critical component in determining the eligibility and application of discounts, directly influencing the ultimate discounted price.

In most cases, the discount period commences from the Invoice Date. By knowing the Invoice Date, businesses can calculate the last date on which the discount can be applied. This information is crucial for both the buyer and the seller, as it ensures timely payments, accurate invoicing, and efficient cash flow management.

Real-life examples further illustrate the practical significance of the Invoice Date in calculating discount dates. Consider a scenario where a supplier offers a 5% discount on all purchases made within 10 days of the Invoice Date. If the Invoice Date is January 1st, the customer has until January 10th to take advantage of the discount. Understanding this connection empowers businesses to optimize their financial planning, negotiate favorable payment terms, and make informed decisions regarding purchases and payments.

Payment Terms

In the intricate world of financial transactions, “Payment Terms” and “how to calculate discount date” share an inseparable bond, with one influencing the other’s determination. Payment Terms dictate the conditions under which a buyer settles their dues to the seller, directly impacting the calculation of discount dates.

Consider an example where a supplier offers a 5% discount if the invoice is paid within 10 days of its issuance. The discount date, in this case, is contingent upon the buyer adhering to the specified Payment Terms. If the Payment Terms stipulate that the invoice is due 30 days from the Invoice Date, the discount period effectively becomes redundant. Understanding this connection empowers businesses to align their payment strategies with their financial goals, optimizing cash flow and maximizing savings.

The practical significance of Payment Terms in calculating discount dates extends to various industries. In the retail sector, for instance, businesses often negotiate Payment Terms with their suppliers to secure favorable discounts. By understanding the relationship between these two factors, retailers can optimize their inventory management, reduce carrying costs, and increase profitability.

In summary, Payment Terms play a pivotal role in determining the discount date, offering businesses opportunities to enhance their financial performance. Understanding this connection is essential for effective cash flow management, strategic decision-making, and maximizing the benefits of discounts in various business contexts.

Early Payment Discount

Early Payment Discount, a prominent aspect of calculating discount dates, offers businesses and consumers a financial incentive for prompt payment. Understanding its mechanics and implications is vital for optimizing cash flow and maximizing savings.

- Discount Percentage: The amount or percentage of reduction in the total invoice amount offered for early payment, motivating timely settlements.

- Discount Period: The specific time frame, typically calculated from the Invoice Date, during which the Early Payment Discount can be applied, encouraging prompt payment.

- Payment Terms: The conditions set forth by the seller regarding the timing and method of payment, often including the Early Payment Discount terms, influencing the calculation of the discount date.

- Net Price: The final amount due after deducting any applicable discounts, including Early Payment Discounts, helping businesses manage their expenses and cash flow.

Early Payment Discounts play a significant role in calculating discount dates, as they affect the Net Price and the timing of payments. By understanding these facets, businesses can tailor their payment strategies to take advantage of discounts, improve their cash flow, and maintain positive relationships with suppliers. Conversely, suppliers can leverage Early Payment Discounts to incentivize timely payments, reduce credit risk, and enhance their financial stability.

Late Payment Penalty

In the context of how to calculate discount date, understanding Late Payment Penalty is essential. It plays a crucial role in determining the financial consequences of delayed payments, incentivizing timely settlements.

- Penalty Charges: Additional fees or interest levied on overdue payments, serving as a disincentive for late payments and encouraging prompt settlement.

- Impact on Credit Rating: Late payments can negatively affect a business’s credit rating, making it more challenging and expensive to secure future financing.

- Legal Implications: Persistent late payments may lead to legal action, involving additional costs and potential damage to the business’s reputation.

- Supplier-Customer Relationship: Late payments can strain supplier-customer relationships, potentially leading to order cancellations or restrictions on future purchases.

These factors underscore the significance of considering Late Payment Penalty when calculating discount dates. By understanding the potential consequences and implications, businesses can develop effective payment strategies that balance the benefits of discounts with the risks of late payments.

Net Price

Understanding the connection between “Net Price” and “how to calculate discount date” is crucial in various business and financial transactions. Net Price, the final amount due after deducting applicable discounts and rebates, plays a significant role in determining the actual cost of a purchase and the timing of payments.

Net Price directly influences the calculation of the discount date. Discounts, such as early payment discounts or volume discounts, are typically applied to the original price of goods or services. The Net Price is calculated by subtracting the discount amount from the original price. Knowing the Net Price is essential for determining the last date on which the discount can be applied. For instance, if a supplier offers a 5% discount for payments made within 10 days of the invoice date, the discount date is calculated based on the Net Price, ensuring timely payments and accurate invoicing.

In real-life scenarios, Net Price is widely used in various industries. In the retail sector, Net Price is often displayed on price tags, reflecting the final cost after applying discounts or markdowns. This information helps customers make informed purchasing decisions and compare prices across different retailers.

Understanding the connection between Net Price and discount date calculation empowers businesses and consumers to optimize their financial strategies. By considering Net Price, businesses can effectively manage cash flow, negotiate favorable payment terms, and maximize savings. Consumers, on the other hand, can identify the most advantageous deals, plan their purchases accordingly, and avoid late payment penalties.

Discounted Price

In calculating discount dates, determining the “Discounted Price” is of paramount importance. It represents the final price after applying discounts, rebates, or other price reductions, and is directly influenced by the discount terms offered.

- Original Price: The price of an item or service before any discounts are applied. It serves as the basis for calculating the discounted price.

- Discount Percentage: The percentage or amount of reduction offered on the original price. This directly affects the magnitude of the discount.

- Discount Type: The nature of the discount, such as a fixed amount, percentage discount, or tiered pricing. Different discount types have varying implications on the discounted price.

- Discount Period: The specific time frame during which the discount is valid. This influences the timing of the discounted price calculation.

Understanding these facets of “Discounted Price” is crucial for calculating discount dates accurately. By considering the Original Price, Discount Percentage, Discount Type, and Discount Period, businesses and consumers can optimize their financial transactions, maximize savings, and avoid potential errors.

{Frequently Asked Questions

This FAQ section provides answers to common questions and clarifies key aspects related to calculating discount dates.

Question 1: What is the purpose of calculating discount dates?

Answer: Calculating discount dates helps businesses and consumers determine the last day on which they can take advantage of discounts offered on purchases or payments.

Question 2: What factors influence the calculation of discount dates?

Answer: Discount dates are influenced by factors such as the invoice date, payment terms, discount period, and type of discount offered.

Question 3: How do I calculate the discount date if the invoice date is February 10th and the payment terms are net 30 with a 5% discount for early payment?

Answer: To calculate the discount date, add the discount period (usually 10 days) to the invoice date. In this case, the discount date would be February 20th.

Question 4: What happens if I miss the discount date?

Answer: Missing the discount date means you will no longer be eligible for the discount, and you will have to pay the full price.

Question 5: Can I negotiate the discount date with the supplier?

Answer: In some cases, you may be able to negotiate the discount date with the supplier, but this will depend on their policies and the specific circumstances.

Question 6: How can I ensure accurate calculation of discount dates?

Answer: To ensure accuracy, carefully review the invoice, payment terms, and discount details, and use a calendar to calculate the discount date.

These FAQs provide a comprehensive understanding of how to calculate discount dates, empowering you to optimize your financial transactions.

In the next section, we will delve into advanced techniques for calculating discount dates in complex scenarios, such as when multiple discounts are offered or when payments are made in installments.

Tips for Calculating Discount Dates Accurately

This section provides a collection of practical tips to help you calculate discount dates accurately and optimize your financial transactions.

Tip 1: Understand the payment terms and discount period specified on the invoice.

Tip 2: Calculate the discount date by adding the discount period to the invoice date.

Tip 3: Consider any grace period or additional days offered by the supplier.

Tip 4: Double-check your calculations to avoid errors.

Tip 5: If there are multiple discounts, apply them in the correct order.

Tip 6: When making partial payments, ensure they are applied to the correct invoices.

Tip 7: Keep a record of all discount calculations for future reference.

Tip 8: Consult with a financial professional if you have complex discount scenarios.

By following these tips, you can ensure accurate calculation of discount dates, optimize your cash flow, and avoid potential penalties.

In the conclusion, we will discuss the importance of accurate discount date calculation in maintaining healthy supplier relationships and preserving your creditworthiness.

Conclusion

Accurately calculating discount dates is crucial for maintaining healthy supplier relationships, preserving creditworthiness, and optimizing cash flow. Understanding the various factors that influence discount dates, such as invoice dates, payment terms, and discount periods, is essential. By employing the tips and techniques outlined in this article, businesses and consumers can ensure accurate calculations and maximize the benefits of discounts.

Remember, timely payments not only allow you to take advantage of discounts but also demonstrate your reliability as a customer. Maintaining a positive payment history can lead to improved credit terms and stronger relationships with suppliers. Conversely, late payments can result in penalties, damage your credit rating, and strain supplier relationships.