The discount rate on commercial paper, a financial instrument, is a vital factor in determining its market value. It represents the annualized interest rate at which the paper’s future cash flows are discounted to calculate its present value.

Understanding how to calculate this rate is crucial for investors and businesses. It allows them to make informed decisions about purchasing or issuing commercial paper, ensuring they receive fair returns or secure funding at competitive rates. Historically, the discount rate has played a significant role in shaping financial markets, influencing the flow of capital and economic growth.

This article delves into the intricacies of calculating the discount rate on commercial paper, providing a comprehensive guide for financial professionals, business owners, and anyone seeking to enhance their understanding of this critical financial concept.

How to Calculate Discount Rate on Commercial Paper

Understanding the essential aspects of calculating the discount rate on commercial paper is paramount for informed decision-making in financial markets.

- Maturity Date

- Face Value

- Coupon Rate

- Market Price

- Time to Maturity

- Risk-Free Rate

- Default Risk Premium

- Liquidity Premium

- Tax Implications

These aspects determine the attractiveness of commercial paper as an investment and influence its price. For instance, a longer maturity date typically leads to a higher discount rate, reflecting the increased risk associated with longer-term investments. Similarly, a lower credit rating of the issuer results in a higher default risk premium, increasing the discount rate. Understanding these factors enables investors to accurately assess the value of commercial paper and make sound investment decisions.

Maturity Date

Maturity date plays a crucial role in calculating the discount rate on commercial paper, as it determines the length of time until the investor receives the face value of the paper. This, in turn, influences the risk associated with the investment and the appropriate discount rate.

- Time to Maturity: The time remaining until the maturity date directly affects the discount rate. Longer maturities typically command higher discount rates due to the increased risk and uncertainty associated with longer-term investments.

- Rollover Risk: Commercial paper is typically issued with short maturities, ranging from a few days to a few months. As such, investors need to consider the rollover risk associated with reinvesting the proceeds at maturity, which can impact the effective discount rate.

- Market Conditions: The maturity date of commercial paper can also be influenced by prevailing market conditions. In periods of economic uncertainty or rising interest rates, investors may prefer shorter-term paper to minimize interest rate risk.

- Issuer Creditworthiness: The creditworthiness of the issuer can also impact the maturity date of commercial paper. Issuers with lower credit ratings may need to offer shorter maturities to attract investors, as there is a higher risk of default.

In summary, the maturity date of commercial paper is a key factor in determining the discount rate, as it influences the time to maturity, rollover risk, market conditions, and issuer creditworthiness. Understanding the implications of maturity date is essential for investors to make informed decisions and accurately assess the value of commercial paper investments.

Face Value

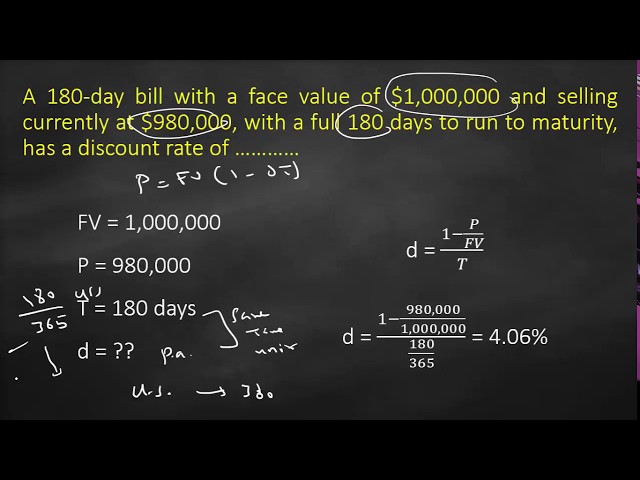

The face value, or principal amount, of commercial paper is a fundamental aspect in calculating its discount rate. It represents the amount that will be repaid to the investor at maturity and serves as a benchmark for determining the paper’s yield.

- Nominal Value: The face value represents the nominal or stated value of the commercial paper, which is the amount initially borrowed by the issuer.

- Maturity Value: The face value is also the maturity value, which is the amount that the investor will receive upon the paper’s maturity.

- Discount Basis: The face value forms the basis for calculating the discount, which is the difference between the face value and the present value of the paper.

- Market Impact: Changes in the face value can impact the paper’s marketability and liquidity, which in turn can influence its discount rate.

Understanding the face value is crucial for investors to accurately calculate the discount rate and assess the paper’s value. It provides a reference point for evaluating the return on investment and making informed decisions in the commercial paper market.

Coupon Rate

The coupon rate is a crucial aspect in calculating the discount rate on commercial paper, as it represents the periodic interest payments made to the investor. It influences the attractiveness and value of the paper, and plays a role in determining the overall return on investment.

- Fixed vs. Floating Rate: Commercial paper can have either fixed or floating coupon rates. Fixed rates remain constant throughout the paper’s life, while floating rates are tied to a benchmark interest rate, such as LIBOR, and fluctuate accordingly.

- Market Conditions: The coupon rate is influenced by prevailing market conditions, including interest rate levels and economic outlook. In periods of low interest rates, coupon rates tend to be lower, while in periods of high interest rates, coupon rates tend to be higher.

- Creditworthiness of Issuer: The creditworthiness of the issuer also impacts the coupon rate. Issuers with lower credit ratings typically offer higher coupon rates to compensate investors for the increased risk of default.

- Liquidity of the Paper: The liquidity of the commercial paper market can affect the coupon rate. More liquid paper, which can be easily bought and sold, typically has lower coupon rates compared to less liquid paper.

Understanding these facets of the coupon rate enables investors to make informed decisions when evaluating commercial paper investments. It allows them to assess the trade-off between yield and risk, and calculate the discount rate accurately to determine the fair value of the paper.

Market Price

The market price of commercial paper plays a pivotal role in the calculation of its discount rate. It represents the current value of the paper in the secondary market, influenced by various factors that reflect the paper’s attractiveness and risk profile.

- Supply and Demand: The market price of commercial paper is primarily driven by the interplay of supply and demand. When the supply of paper exceeds demand, prices tend to fall, leading to a lower discount rate. Conversely, when demand exceeds supply, prices rise, resulting in a higher discount rate.

- Issuer Creditworthiness: The creditworthiness of the issuer significantly impacts the market price of commercial paper. Issuers with higher credit ratings are perceived as less risky and, therefore, their paper tends to trade at higher prices and lower discount rates.

- Maturity Date: The maturity date of commercial paper also affects its market price. Longer-term paper typically trades at lower prices and higher discount rates compared to shorter-term paper, as investors demand a higher premium for the increased risk associated with longer maturities.

- Market Conditions: General market conditions can influence the market price of commercial paper. During periods of economic uncertainty or rising interest rates, investors tend to favor shorter-term, higher-quality paper, which can drive up prices and lower discount rates.

Understanding the factors that influence the market price of commercial paper is crucial for investors and issuers alike. It enables them to make informed decisions about buying or issuing paper, ensuring they receive fair returns or secure funding at competitive rates within the dynamic commercial paper market.

Time to Maturity

Time to maturity is a critical component of calculating the discount rate on commercial paper. It represents the length of time until the paper matures and the investor receives the face value. The relationship between time to maturity and the discount rate is inversely proportional, meaning that the longer the time to maturity, the higher the discount rate, and vice versa. This is because investors demand a higher return for tying up their money for a longer period, as there is a greater risk that interest rates will rise or that the issuer will default before the paper matures.

For example, a commercial paper with a one-month maturity may have a discount rate of 1%, while a paper with a one-year maturity may have a discount rate of 3%. This difference in discount rates reflects the increased risk associated with the longer-term paper.

Understanding the relationship between time to maturity and the discount rate is essential for investors when making decisions about purchasing or selling commercial paper. It allows them to calculate the yield to maturity, which is the annualized return on the paper, and compare it to other investment options. It also helps investors to manage their risk by choosing paper with maturities that align with their investment goals and risk tolerance.

Risk-Free Rate

The risk-free rate is a crucial component in calculating the discount rate on commercial paper. It represents the rate of return on a hypothetical investment with no risk of default. This rate serves as a benchmark against which the returns on other investments, including commercial paper, are compared.

The risk-free rate is typically derived from government bonds, which are considered to be the safest type of investment. The yield on a government bond is often used as a proxy for the risk-free rate. In the United States, the Treasury bill rate is commonly used as the risk-free rate.

The relationship between the risk-free rate and the discount rate on commercial paper is directly proportional. This means that as the risk-free rate increases, the discount rate on commercial paper also tends to increase. This is because investors demand a higher return for taking on the additional risk of default associated with commercial paper.

Understanding the relationship between the risk-free rate and the discount rate on commercial paper is essential for investors when making decisions about purchasing or selling commercial paper. It allows them to calculate the yield to maturity, which is the annualized return on the paper, and compare it to other investment options. It also helps investors to manage their risk by choosing paper with discount rates that are appropriate for their risk tolerance.

Default Risk Premium

Default risk premium is a critical component of how to calculate the discount rate on commercial paper. It represents the additional yield that investors demand over and above the risk-free rate to compensate them for the risk that the issuer of the commercial paper will default on their obligation to repay the principal and interest. The default risk premium is determined by a number of factors, including the creditworthiness of the issuer, the maturity of the commercial paper, and the overall economic environment.

The higher the perceived risk of default, the higher the default risk premium will be. This is because investors demand a higher return for taking on more risk. For example, a commercial paper issued by a company with a low credit rating will have a higher default risk premium than a commercial paper issued by a company with a high credit rating. Similarly, a commercial paper with a longer maturity will have a higher default risk premium than a commercial paper with a shorter maturity. This is because the longer the maturity, the greater the chance that the issuer will default before the paper matures.

The default risk premium is an important consideration for investors when making decisions about purchasing or selling commercial paper. By understanding the factors that affect the default risk premium, investors can make more informed decisions about the risks and rewards of investing in commercial paper.

Liquidity Premium

Liquidity premium plays a significant role in calculating the discount rate on commercial paper, representing the additional yield that investors demand to compensate for the risk of holding less liquid assets. Understanding this premium is crucial for accurate discount rate calculations and informed investment decisions.

- Market Depth: The depth of the market for a particular commercial paper affects its liquidity. Deeper markets, with a higher volume of trades, offer greater liquidity and lower liquidity premiums.

- Tradability: The ease with which commercial paper can be bought and sold impacts its liquidity. More easily tradable paper attracts lower liquidity premiums.

- Issuer Reputation: The reputation of the issuer can influence the liquidity of their commercial paper. Issuers with a strong track record of timely payments and low default risk enjoy lower liquidity premiums.

- Maturity: The maturity date of commercial paper affects its liquidity. Shorter-term paper, with maturities of a few months or less, typically has higher liquidity and lower liquidity premiums.

In summary, liquidity premium is a critical component of calculating the discount rate on commercial paper. It compensates investors for the reduced liquidity of commercial paper compared to more liquid assets, such as government bonds. By considering the factors that influence liquidity premium, investors can accurately assess the discount rate and make informed decisions about investing in commercial paper.

Tax Implications

Tax implications play a significant role in calculating the discount rate on commercial paper. The treatment of commercial paper for tax purposes can affect its after-tax yield, which is a critical consideration for investors.

One of the key tax implications of commercial paper is related to its classification as a debt instrument. Interest payments made on commercial paper are generally tax-deductible for the issuer. This tax deductibility reduces the issuer’s after-tax cost of borrowing, which can make commercial paper a more attractive financing option compared to other forms of debt.

For investors, the tax implications of commercial paper depend on their individual tax situation. Interest earned on commercial paper is generally taxable as ordinary income. However, there are certain exceptions and tax-advantaged accounts that can provide investors with tax savings on their commercial paper investments.

Understanding the tax implications of commercial paper is crucial for both issuers and investors. By considering the tax consequences, they can make informed decisions about the issuance and purchase of commercial paper, optimizing their financial outcomes.

Frequently Asked Questions on Calculating the Discount Rate on Commercial Paper

This section addresses common questions or concerns that arise when calculating the discount rate on commercial paper, providing clear and concise answers to aid understanding.

Question 1: What is the purpose of calculating the discount rate on commercial paper?

Answer: Calculating the discount rate determines the present value of future cash flows associated with commercial paper, allowing investors to assess its worth and make informed investment decisions.

Question 2: What factors influence the discount rate on commercial paper?

Answer: The discount rate is influenced by factors such as the maturity date, face value, coupon rate, market price, time to maturity, risk-free rate, default risk premium, liquidity premium, and tax implications.

Question 3: How does the maturity date impact the discount rate?

Answer: Longer maturities typically lead to higher discount rates due to increased risk and uncertainty associated with longer-term investments.

Question 4: What is the relationship between the risk-free rate and the discount rate?

Answer: The discount rate is directly proportional to the risk-free rate, meaning that as the risk-free rate increases, so does the discount rate.

Question 5: How does the liquidity premium affect the discount rate?

Answer: The liquidity premium compensates investors for holding less liquid assets, leading to a higher discount rate for commercial paper with lower liquidity.

Question 6: Are there any tax implications to consider when calculating the discount rate?

Answer: Interest payments on commercial paper are generally tax-deductible for issuers, while interest earned is taxable for investors. Understanding these tax implications is crucial for optimizing financial outcomes.

In summary, the discount rate on commercial paper is a crucial factor in determining its value and should be calculated carefully considering various factors. By addressing these frequently asked questions, we have shed light on key concepts and provided a foundation for further exploration of this important topic.

Proceed to the next section to delve deeper into the complexities of calculating the discount rate on commercial paper.

Tips for Calculating the Discount Rate on Commercial Paper

This section provides practical tips to assist in accurately calculating the discount rate on commercial paper, empowering you to make informed investment decisions.

Tip 1: Determine Relevant Factors: Identify all factors that influence the discount rate, such as maturity date, face value, coupon rate, market price, and risk-free rate.

Tip 2: Utilize Market Data: Leverage current market data to inform your calculations. Consider the prevailing yield curve and credit spreads to assess market conditions.

Tip 3: Consider Issuer Creditworthiness: Evaluate the financial strength and credit history of the issuer to determine the appropriate default risk premium.

Tip 4: Assess Market Liquidity: Determine the liquidity of the commercial paper market. Lower liquidity may warrant a higher liquidity premium.

Tip 5: Calculate Time-Weighted Average: If multiple cash flows are involved, calculate the time-weighted average of the discount rates over the life of the commercial paper.

Tip 6: Utilize Spreadsheets or Calculators: Leverage financial calculators or spreadsheet templates to simplify the calculation process and enhance accuracy.

Tip 7: Monitor Market Changes: Regularly monitor market conditions and adjust the discount rate as necessary to reflect evolving risk and yield environments.

Tip 8: Consult with Experts: If needed, seek guidance from financial professionals or credit rating agencies to validate your calculations and gain insights.

By following these tips, you can enhance the accuracy and reliability of your discount rate calculations, enabling you to evaluate commercial paper investments with greater confidence.

Proceed to the next section to explore advanced techniques and strategies for calculating the discount rate on commercial paper.

Conclusion

In conclusion, this comprehensive guide has explored the intricacies of calculating the discount rate on commercial paper, providing a structured approach to assess its value and make informed investment decisions. By considering factors such as the maturity date, face value, coupon rate, market price, risk-free rate, and various premiums, we gain a deeper understanding of how to determine the present value of future cash flows associated with this financial instrument.

Key takeaways include the direct relationship between the discount rate and the risk-free rate, the impact of the maturity date on the discount rate, and the importance of considering market liquidity and issuer creditworthiness. These concepts are interconnected and must be carefully evaluated to ensure accurate calculations.