Understanding Implied Discount Rates: A Comprehensive Guide

An implied discount rate, a critical concept in finance, represents the rate at which future cash flows are discounted back to their present value. It plays a crucial role in investment analysis, capital budgeting, and financial modeling. Historically, the concept of present value and discounting was developed by renowned economists such as Irving Fisher and John Maynard Keynes, providing a foundation for modern financial theory.

In this article, we will delve into the intricacies of implied discount rates, exploring their calculation methods, significance, and practical applications. Our goal is to equip readers with a comprehensive understanding of this vital financial concept.

How to Calculate Implied Discount Rate

Accurately calculating implied discount rates is essential for sound financial decision-making. Key aspects to consider include:

- Present Value

- Future Cash Flows

- Discount Rate

- Time Value of Money

- Risk-Adjusted Return

- Weighted Average Cost of Capital (WACC)

- Capital Budgeting

- Investment Analysis

- Financial Modeling

- Historical Data

Understanding the interconnections between these aspects is crucial. For instance, the discount rate should reflect the time value of money and the risk-adjusted return required by investors. WACC, a blend of debt and equity costs, is a common discount rate in capital budgeting. Additionally, historical data on interest rates and inflation can provide valuable insights for implied discount rate calculations.

Present Value

Present Value (PV) plays a pivotal role in calculating implied discount rates. PV represents the current worth of future cash flows, discounted back to the present using an appropriate discount rate. This concept is fundamental to understanding how the time value of money impacts financial decisions.

In the context of implied discount rate calculation, PV serves as a critical component. By knowing the PV of future cash flows and the discount rate used, one can solve for the implied discount rate. This process is commonly employed in capital budgeting, where project cash flows are discounted back to the present using the WACC as the discount rate, allowing for the evaluation of a project’s profitability.

In real-world applications, calculating implied discount rates is crucial for various financial decisions. For instance, in evaluating the acquisition of a new asset, the implied discount rate helps determine whether the expected future cash flows justify the upfront investment. Moreover, in assessing the performance of an investment portfolio, the implied discount rate provides insights into the return on investment over a specific period.

In summary, understanding the connection between Present Value and implied discount rate calculation is essential for sound financial decision-making. PV serves as a fundamental component in this process, enabling the evaluation of future cash flows in the context of time value of money and risk-adjusted returns.

Future Cash Flows

Future Cash Flows stand as the cornerstone of calculating implied discount rates. They represent the anticipated cash inflows and outflows associated with an investment or project, occurring at specific points in time in the future.

- Predictive Nature: Future Cash Flows are inherently uncertain, relying on forecasts and assumptions. These predictions should be grounded in sound financial modeling and analysis.

- Timing: The timing of Future Cash Flows is crucial, as it directly impacts their present value. Cash flows occurring sooner have a higher present value than those occurring later due to the time value of money.

- Risk Assessment: The risk associated with Future Cash Flows affects the implied discount rate. Riskier cash flows, such as those from unproven ventures, demand a higher discount rate to compensate for the uncertainty.

- Inflation Impact: Inflation erodes the purchasing power of future cash flows. Ignoring inflation can lead to underestimation of the implied discount rate.

In summary, Future Cash Flows are the lifeblood of implied discount rate calculations. Their predictive nature, timing, risk profile, and inflation impact must be carefully considered to accurately determine the appropriate discount rate for evaluating investments and making sound financial decisions.

Discount Rate

Discount Rate plays a pivotal role in calculating implied discount rates. It represents the rate at which future cash flows are discounted back to their present value, reflecting the time value of money and the risk associated with the investment. The Discount Rate is a critical component of the implied discount rate calculation, as it directly affects the present value of future cash flows.

In real-life applications, the Discount Rate is often determined based on the Weighted Average Cost of Capital (WACC) for a company or project. WACC considers both the cost of debt and equity financing, providing a blended rate that reflects the overall cost of capital. The Discount Rate should also incorporate a risk premium to account for the uncertainty and risk associated with the future cash flows being discounted.

Understanding the relationship between Discount Rate and implied discount rate calculation is crucial for accurate financial decision-making. By carefully considering the appropriate Discount Rate, investors and analysts can make informed judgments about the value of future cash flows and the viability of investment opportunities. This understanding enables sound capital budgeting, investment analysis, and financial modeling, ultimately contributing to better financial outcomes.

Time Value of Money

Time Value of Money (TVM) holds a significant connection with calculating implied discount rates. TVM recognizes that the value of money changes over time, primarily due to inflation and the potential for investment growth. Implied discount rates, in turn, reflect the rate at which future cash flows are discounted back to their present value, considering both the time value of money and the risk associated with the investment.

TVM serves as a critical component in calculating implied discount rates because it provides a framework for understanding how the timing of cash flows impacts their present value. Future cash flows are discounted back to the present using an appropriate discount rate, which incorporates both the time value of money and risk premium. By considering TVM, investors and analysts can accurately compare the present value of cash flows occurring at different points in time, enabling informed investment decisions.

A real-life example of TVM within implied discount rate calculation can be seen in capital budgeting. When evaluating potential projects, companies use discounted cash flow analysis to assess the profitability of an investment. The discount rate applied in this analysis considers both the time value of money and the risk associated with the project. By incorporating TVM, companies can make informed decisions about whether to proceed with an investment based on its projected future cash flows and the implied discount rate.

Understanding the connection between TVM and implied discount rate calculation is crucial for various financial applications, including investment analysis, project evaluation, and financial planning. By considering the time value of money, investors and analysts can make well-informed decisions about the value of future cash flows and the viability of investment opportunities. This understanding contributes to sound financial decision-making, risk management, and long-term financial success.

Risk-Adjusted Return

In the context of calculating implied discount rates, Risk-Adjusted Return plays a crucial role in determining the appropriate discount rate to apply. It reflects the required return on an investment, adjusted for the level of risk associated with that investment.

- Expected Return: Represents the anticipated return on an investment over a specific period, considering potential gains and losses.

- Risk Premium: The additional return required to compensate investors for taking on additional risk. Higher risk investments demand a higher risk premium.

- Standard Deviation: A statistical measure of the volatility or risk associated with an investment. Higher standard deviation indicates greater risk.

- Correlation: Measures the relationship between the investment’s return and the overall market’s return. Low correlation implies diversification benefits.

In calculating implied discount rates, these components of Risk-Adjusted Return are considered to determine a discount rate that reflects both the time value of money and the riskiness of the investment. By incorporating Risk-Adjusted Return, investors can make informed decisions about the required return on their investments and assess the viability of investment opportunities given the associated risks.

Weighted Average Cost of Capital (WACC)

In calculating implied discount rates, Weighted Average Cost of Capital (WACC) plays a pivotal role. It represents the average cost of capital for a company, considering both debt and equity financing. WACC is crucial in determining the appropriate discount rate to apply to future cash flows, as it reflects the overall cost of financing the investment.

- Cost of Debt: The interest rate a company pays on its outstanding debt, including bonds and loans. It reflects the cost of borrowing capital from lenders.

- Cost of Equity: The return required by investors for providing equity financing to a company, typically determined using the Capital Asset Pricing Model (CAPM) or comparable company analysis.

- Debt-to-Equity Ratio: The proportion of debt financing relative to equity financing. It affects the overall WACC, as debt financing typically carries a lower cost than equity financing.

- Tax Rate: The corporate tax rate applicable to the company’s earnings. Interest payments on debt are tax-deductible, which can reduce the effective cost of debt.

Understanding the components of WACC is essential for calculating implied discount rates accurately. By considering the cost of debt, cost of equity, debt-to-equity ratio, and tax rate, companies can determine the appropriate WACC to apply to their future cash flows, ensuring a fair and accurate assessment of investment opportunities.

Capital Budgeting

Capital Budgeting plays a critical role in the process of calculating implied discount rates. It involves the evaluation and selection of long-term investment projects that align with a company’s strategic objectives. The primary goal of Capital Budgeting is to maximize shareholder value by investing in projects that promise a positive return on investment (ROI), considering the time value of money and the risk associated with each project.

A crucial step in Capital Budgeting is determining the appropriate discount rate to apply to future cash flows. The discount rate serves as a benchmark against which project cash flows are discounted back to their present value. This process allows companies to compare projects on an equal footing, taking into account the time value of money and the risk-adjusted return required by investors. Implied discount rates are often derived from the Weighted Average Cost of Capital (WACC), which represents the average cost of capital for a company considering both debt and equity financing.

Real-life examples of Capital Budgeting within the context of implied discount rate calculation include project evaluation and investment analysis. Companies use discounted cash flow analysis to assess the profitability of potential projects and determine whether they meet the required return threshold. The discount rate applied in this analysis is often derived from the implied discount rate, ensuring that projects are evaluated based on their risk-adjusted present value.

Practical applications of understanding the connection between Capital Budgeting and implied discount rate calculation extend to various financial and investment decisions. By accurately calculating implied discount rates, companies can make informed choices about capital allocation, project selection, and investment opportunities. This understanding enables them to optimize their capital structure, mitigate financial risks, and create long-term shareholder value.

Investment Analysis

Investment Analysis is a critical component of calculating implied discount rates. It involves evaluating potential investments to determine their viability and potential return. This analysis considers various factors that influence the risk and return profile of an investment, enabling investors to make informed decisions about capital allocation.

- Financial Statement Analysis: Assessing a company’s financial health and performance by examining its financial statements, including balance sheet, income statement, and cash flow statement.

- Industry Analysis: Evaluating the overall industry landscape, including market size, growth potential, competitive intensity, and regulatory environment.

- Company Analysis: Examining a company’s management team, business strategy, competitive advantages, and financial performance.

- Valuation Techniques: Applying valuation methods such as discounted cash flow analysis, comparable company analysis, and asset-based valuation to determine the intrinsic value of an investment.

Investment Analysis provides valuable insights for calculating implied discount rates, as it helps investors understand the risk and return characteristics of an investment. By thoroughly analyzing financial statements, industry dynamics, company fundamentals, and valuation metrics, investors can make informed decisions about the appropriate discount rate to apply to future cash flows. This analysis is crucial for maximizing returns and mitigating risks in investment portfolios.

Financial Modeling

Financial Modeling plays a pivotal role in the calculation of implied discount rates, serving as a tool to forecast future cash flows, project financial performance, and assess investment opportunities. It provides a structured approach to understanding the financial implications of various scenarios and decisions.

- Scenario Analysis: Creating multiple financial models to evaluate the impact of different assumptions and variables on future cash flows. This allows for a comprehensive understanding of potential outcomes and risks.

- Sensitivity Analysis: Examining how changes in key input parameters affect the implied discount rate and investment value. This helps identify critical factors and assess the robustness of financial projections.

- Pro Forma Statements: Developing financial statements, such as projected income statements and balance sheets, to forecast the financial performance of a company or project. These statements serve as the basis for calculating future cash flows.

- Valuation Analysis: Incorporating implied discount rates into financial models to determine the intrinsic value of an investment. This analysis provides insights into the potential return on investment and helps inform investment decisions.

By integrating Financial Modeling into the process of calculating implied discount rates, investors and analysts can gain deeper insights into the risk and return profiles of investments. It enables them to make more informed decisions, optimize capital allocation, and mitigate potential financial risks.

Historical Data

Historical Data forms a critical foundation for calculating implied discount rates, providing insights into past economic trends, interest rate fluctuations, and market behavior. This data serves as a benchmark against which current and future cash flows can be evaluated, enabling investors and analysts to make informed decisions about appropriate discount rates.

Real-life examples of Historical Data used in calculating implied discount rates include time series data of interest rates, inflation rates, and economic growth rates. By analyzing historical trends in these variables, investors can gain a better understanding of the relationship between risk and return, and how it has evolved over time. This knowledge allows them to make more accurate predictions about future cash flows and the appropriate discount rate to apply.

The practical significance of understanding the connection between Historical Data and implied discount rate calculation extends to various financial applications, including investment analysis, project evaluation, and capital budgeting. By incorporating Historical Data into their calculations, investors can mitigate risks, optimize returns, and make more informed decisions about capital allocation. This understanding is particularly important in volatile and uncertain market conditions, where historical patterns can provide valuable insights into potential future scenarios.

Frequently Asked Questions on Implied Discount Rate Calculation

This section addresses common questions and clarifies concepts related to calculating implied discount rates. It provides concise and informative answers to assist readers in gaining a better understanding of this critical financial concept.

Question 1: What is the significance of implied discount rates in financial analysis?

Answer: Implied discount rates play a crucial role in investment analysis, capital budgeting, and financial modeling. They provide a benchmark for evaluating the present value of future cash flows, considering both the time value of money and the risk associated with the investment.

Question 2: How is the implied discount rate different from the stated discount rate?

Answer: The stated discount rate is an explicitly provided rate, often used in financial contracts. In contrast, the implied discount rate is not explicitly stated but can be derived from the present value of future cash flows and the timing of those cash flows.

Question 3: What factors influence the implied discount rate?

Answer: Factors influencing the implied discount rate include the risk-free rate, inflation expectations, market conditions, creditworthiness of the borrower, and the specific industry or project being evaluated.

Question 4: How can historical data be used to calculate implied discount rates?

Answer: Historical data on interest rates, inflation, and economic growth can provide insights into past trends and help investors make informed assumptions about future cash flows and appropriate discount rates.

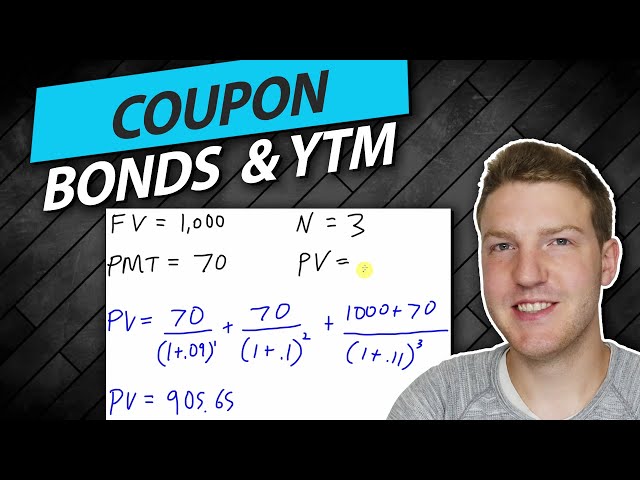

Question 5: What are some common methods for calculating implied discount rates?

Answer: Common methods include the yield-to-maturity method, the internal rate of return (IRR) method, and the weighted average cost of capital (WACC) method.

Question 6: How can I ensure the accuracy of my implied discount rate calculations?

Answer: To ensure accuracy, consider using multiple methods, examining historical data, and seeking professional guidance if necessary. Regularly review and adjust your implied discount rates as market conditions or investment objectives change.

In summary, understanding the concept of implied discount rates and how to calculate them is crucial for sound financial decision-making. By considering the factors that influence implied discount rates and using appropriate calculation methods, investors and analysts can make informed judgments about the value of future cash flows and the viability of investment opportunities.

In the following section, we will delve deeper into the applications of implied discount rate calculation, exploring its role in investment analysis, project evaluation, and financial modeling.

Tips for Calculating Implied Discount Rates

This section provides practical and actionable tips to assist you in accurately calculating implied discount rates for sound financial decision-making.

Tip 1: Understand the Key Concepts

Grasp the fundamental principles of present value, future cash flows, time value of money, risk-adjusted return, and weighted average cost of capital to lay a solid foundation for calculating implied discount rates.

Tip 2: Use Multiple Methods

Employ various calculation methods, such as the yield-to-maturity method, internal rate of return (IRR) method, and weighted average cost of capital (WACC) method, to cross-check your results and enhance accuracy.

Tip 3: Incorporate Historical Data

Analyze historical data on interest rates, inflation, and economic growth to gain insights into past trends and make informed assumptions about future cash flows and appropriate discount rates.

Tip 4: Consider Risk Factors

Assess the risk associated with the investment or project and adjust the discount rate accordingly. Higher risk typically warrants a higher discount rate to compensate for the increased uncertainty.

Tip 5: Use Sensitivity Analysis

Perform sensitivity analysis to determine how changes in input parameters, such as cash flows or discount rates, affect the implied discount rate. This helps you understand the impact of various scenarios.

Tip 6: Seek Professional Guidance

If needed, consult with a financial advisor or expert to ensure the accuracy of your implied discount rate calculations, especially for complex investments or projects.

Tip 7: Regularly Review and Adjust

Monitor market conditions and investment objectives, and adjust your implied discount rates periodically to reflect changes in the economic landscape or your investment strategy.

Summary: By following these tips, you can enhance the accuracy and reliability of your implied discount rate calculations. This will support informed investment decisions, effective project evaluation, and robust financial modeling.

Transition to Conclusion: Armed with these practical tips, let’s explore the applications of implied discount rate calculation in investment analysis, project evaluation, and financial modeling.

Conclusion

Throughout this article, we have delved into the intricacies of calculating implied discount rates, exploring their significance, methods, and applications. We have emphasized the importance of considering present value, future cash flows, time value of money, risk-adjusted return, and weighted average cost of capital in this process. The article has highlighted the interconnectedness of these concepts and their impact on the accuracy of implied discount rate calculations.

As we conclude, it is imperative to remember that understanding and accurately calculating implied discount rates is crucial for sound financial decision-making. By employing the methods and tips discussed in this article, investors, analysts, and financial professionals can make informed judgments about the value of future cash flows and the viability of investment opportunities. In essence, the ability to calculate implied discount rates empowers individuals to navigate the complexities of financial markets and make strategic choices that align with their financial goals.