Accounting, specifically the calculation of interest, is a fundamental aspect of finance. Interest represents the cost of borrowing money or the return on lending it. In simple terms, it is the fee paid for the use of borrowed funds over time.

Calculating interest accurately is crucial for businesses, individuals, and the economy as a whole. It influences financial decisions, such as loan repayments, investment returns, and budgeting. Historically, the development of compound interest in the 17th century revolutionized finance by allowing interest to accrue on previously earned interest, leading to exponential growth.

This article delves into the various methods used to calculate interest, exploring the concepts of simple interest, compound interest, and effective interest rates. We will examine their applications, limitations, and implications for financial planning.

Accounting

Understanding the essential aspects of calculating interest is crucial for accurate financial planning and decision-making.

- Principal

- Rate

- Time

- Simple Interest

- Compound Interest

- Effective Interest Rate

- Present Value

- Future Value

- Amortization

These aspects are interconnected. Principal represents the amount borrowed or invested, while the rate determines the cost or return on that amount. Time specifies the duration over which interest accrues. Simple interest is calculated on the original principal only, while compound interest considers interest earned on previously earned interest. Effective interest rate represents the true cost or return of a loan or investment, taking into account the compounding effect. Present and future values help determine the worth of money at different points in time. Amortization involves gradually reducing the principal balance of a loan through regular payments.

Principal

In the calculation of interest, the principal amount holds significant relevance. Principal refers to the initial sum borrowed or invested, upon which interest is applied over time.

- Original Principal: The original amount borrowed or invested, which serves as the base for calculating interest.

- Outstanding Principal: The remaining balance of the principal that has not yet been repaid or withdrawn, which changes as interest accumulates.

- Face Value: The nominal or stated value of a bond or other debt instrument, which often represents the principal amount.

- Loan Principal: The primary amount borrowed from a lender, excluding any interest or fees, which is gradually repaid over the loan term.

Understanding the principal amount is crucial for accurate interest calculations and financial planning. It determines the total cost of borrowing or the potential return on investments, influencing decisions such as loan repayments and investment strategies.

Rate

The rate, often expressed as a percentage, plays a pivotal role in accounting for interest calculations. It represents the cost of borrowing money or the return on lending it, determining the amount of interest accrued over time. Interest rates fluctuate based on various economic factors and influence financial decisions such as loan terms, investment yields, and savings account returns.

In the context of accounting, the rate is a critical component of interest calculations. It directly affects the total interest expense or income recognized over the life of a loan or investment. For instance, a higher interest rate on a loan translates to a greater interest expense for the borrower, while a higher interest rate on an investment leads to higher interest income for the lender.

Understanding the relationship between rate and interest calculations is essential for accurate financial planning and analysis. It enables individuals and businesses to make informed decisions regarding borrowing and lending, assess the impact of interest rates on financial obligations, and optimize investment returns. Moreover, comprehending the role of rate empowers accountants, financial analysts, and investors to evaluate and compare financial instruments, such as bonds and loans, based on their interest rate characteristics.

Time

Time is a crucial aspect in the calculation of interest, influencing the total amount of interest accrued or earned over a specific period. Various facets of time play significant roles in accounting for interest.

- Duration: The length of time over which interest is calculated. It can be measured in days, months, or years, and determines the period for which interest is applied to the principal.

- Maturity Date: The specific date on which a loan or investment matures, marking the end of the interest accrual period.

- Day Count Conventions: Methods used to calculate the number of days in a given period for the purpose of interest calculations. Different conventions, such as “30/360” or “actual/365,” can result in variations in interest calculations.

- Compounding Frequency: The number of times per year that interest is added to the principal, affecting the overall interest earned or paid.

Understanding the concept of time and its various components is essential for accurate interest calculations. It enables accountants, financial analysts, and individuals to correctly determine interest expenses and income, assess the impact of time value of money, and make informed decisions regarding financial planning and investments.

Simple Interest

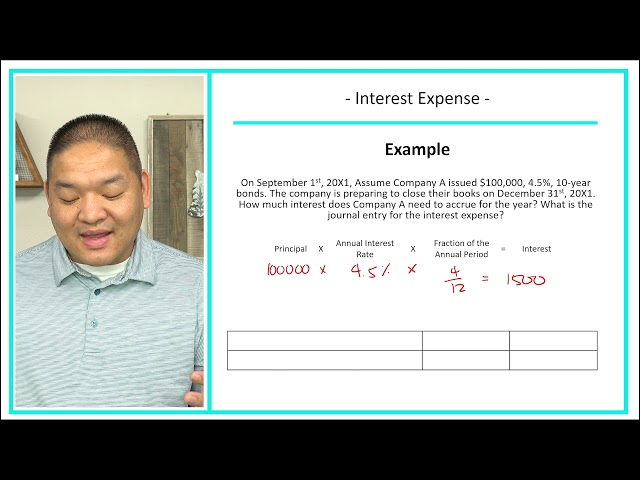

Simple interest is a fundamental concept in accounting and finance. It refers to the calculation of interest on a loan or investment based solely on the principal amount and the time period, without considering the effect of compounding. Simple interest is calculated using the following formula:

Interest = Principal Rate Time

Where:

- Principal is the initial amount borrowed or invested.

- Rate is the annual interest rate expressed as a decimal.

- Time is the duration of the loan or investment period expressed in years.

Simple interest is most commonly used in short-term loans, such as personal loans or lines of credit, where the loan period is typically less than a year. It is also used in certain types of investments, such as certificates of deposit (CDs) that have a fixed interest rate and maturity date.

Understanding the concept of simple interest is essential for individuals and businesses to make informed financial decisions. It allows for the accurate calculation of interest expenses and income, assessment of the time value of money, and comparison of different investment options. Simple interest also plays a role in determining loan repayments, savings goals, and budgeting.

Compound Interest

Compound interest holds significant importance in accounting and finance, extending the concept of simple interest by factoring in the effect of compounding. Compounding refers to the accrual of interest not only on the principal amount but also on the previously accumulated interest, leading to exponential growth over time.

- Growth Potential: Compound interest has the potential to generate substantial growth over extended periods, making it a powerful tool for long-term investments and retirement planning.

- Time Value of Money: Understanding compound interest is crucial for comprehending the time value of money, which highlights the importance of considering the impact of time on the value of money, both in present and future terms.

- Investment Returns: Compound interest plays a vital role in calculating returns on investments, especially in scenarios involving long-term growth and reinvestment of earnings.

- Loan Repayments: Compound interest is applied in calculating loan repayments, determining the total cost of borrowing over the loan period, including both the principal and the accumulated interest.

In accounting, compound interest calculations are used in various contexts, such as the valuation of bonds, the assessment of investment performance, and the determination of loan amortization schedules. Understanding the concept of compound interest empowers accountants, financial analysts, and individuals to make informed decisions regarding financial planning, investment strategies, and debt management.

Effective Interest Rate

In the realm of accounting, the effective interest rate (EIR) holds significant importance in the calculation of interest. Unlike simple interest or compound interest, which focus solely on the nominal interest rate, EIR considers the impact of compounding and provides a more accurate representation of the true cost or return of borrowing or lending money.

EIR plays a crucial role in accounting practices as it influences various financial calculations, including the valuation of bonds, the assessment of loan repayments, and the determination of investment returns. By incorporating the effect of compounding, EIR provides a more realistic view of interest accrual and helps in making informed financial decisions.

Real-life examples of EIR’s application in accounting include the calculation of the present value of a bond, where the EIR is used to discount future cash flows to determine the bond’s current worth. Additionally, in determining loan repayments, EIR is employed to calculate the periodic payments required to repay the loan, considering both the principal and the interest.

Understanding the effective interest rate is essential for accountants, financial analysts, and individuals seeking to accurately assess the cost or return of financial transactions. It provides a comprehensive and realistic measure of interest accrual, enabling informed decision-making in various financial contexts.

Present Value

Present value (PV) is a crucial concept in accounting and finance, particularly when calculating interest. It represents the current worth of a future sum of money, discounted at a specified interest rate. PV plays a significant role in various financial applications, including investment analysis, loan evaluation, and bond valuation.

- Time Value of Money: PV embodies the time value of money, acknowledging that the value of money diminishes over time due to inflation and opportunity cost.

- Discounted Cash Flows: PV involves discounting future cash flows to determine their present value, enabling comparisons of investment options with varying cash flow patterns.

- Investment Appraisal: PV is used in evaluating investment proposals by determining the present value of expected future cash inflows and outflows, aiding in capital budgeting decisions.

- Loan Assessment: PV is employed in assessing loan applications by calculating the present value of future loan payments, considering the time value of money and the cost of borrowing.

In summary, present value is a fundamental concept in accounting that helps quantify the value of future cash flows in the present, considering the impact of time and interest rates. It is widely applied in investment analysis, loan evaluation, and other financial decision-making processes.

Future Value

Future value (FV) holds significant importance in accounting, particularly in the calculation of interest. FV represents the value of a current sum of money at a specified future date, taking into account the effect of compounding interest. Understanding FV is crucial for making informed financial decisions, such as investment planning and loan assessment.

- Compound Interest: FV incorporates the effect of compound interest, which allows interest to accrue not only on the principal but also on the accumulated interest, resulting in exponential growth over time.

- Time Value of Money: FV considers the time value of money, acknowledging that the value of money diminishes over time due to inflation and opportunity cost. By calculating FV, we can compare the value of money today to its value in the future.

- Investment Analysis: FV plays a vital role in investment analysis, as it helps determine the potential return on investment. By calculating the FV of future cash flows, investors can assess the profitability of investment opportunities.

- Loan Repayment Planning: FV is used in loan repayment planning to determine the total amount that will be owed in the future, including both the principal and the accumulated interest. This information is crucial for budgeting and ensuring that sufficient funds are available to meet loan obligations.

In summary, future value is a fundamental concept in accounting that enables us to calculate the value of money in the future, considering the impact of compounding interest and inflation. It plays a crucial role in investment analysis, loan assessment, and other financial planning activities, providing valuable insights for making informed financial decisions.

Amortization

Amortization holds a pivotal connection to the realm of accounting and the calculation of interest. It represents the systematic allocation of the cost of an intangible asset or a loan over its useful life or the loan term. This process involves spreading the asset’s cost or the loan’s principal amount over the relevant period, resulting in a series of amortization expenses or interest payments.

Amortization plays a critical role in accounting, providing a more accurate picture of a company’s financial performance and position. By allocating the cost of intangible assets over their useful life, amortization ensures that expenses are matched to the periods in which the assets generate revenue. Similarly, in the case of loans, amortization allows for the gradual reduction of the loan balance, reflecting the repayment of the principal over the loan term.

Real-life examples of amortization in accounting include the amortization of goodwill, patents, and trademarks. For instance, if a company acquires another company and records goodwill on its balance sheet, that goodwill must be amortized over its estimated useful life, typically not exceeding 40 years. The amortization expense is recorded on the income statement, reducing the company’s net income.

Understanding the connection between amortization and the calculation of interest is essential for accountants, financial analysts, and individuals seeking to accurately assess a company’s financial health and make informed decisions. It provides insights into the allocation of costs and the repayment of debt, enabling stakeholders to evaluate a company’s long-term financial prospects and risk profile.

Frequently Asked Questions about Accounting

This section addresses common questions and clarifies key concepts related to the calculation of interest in accounting.

Question 1: What is the difference between simple and compound interest?

Simple interest is calculated on the principal amount only, while compound interest considers interest earned on both the principal and the previously earned interest.

Question 2: How is the effective interest rate calculated?

The effective interest rate is calculated using a formula that incorporates the nominal interest rate, the compounding frequency, and the time period.

Question 3: What is the present value of a future sum of money?

The present value is the current worth of a future sum of money, discounted at a specified interest rate.

Question 4: How is future value calculated?

Future value is the value of a current sum of money at a specified future date, taking into account the effect of compounding interest.

Question 5: What is amortization in the context of interest calculation?

Amortization is the systematic allocation of the cost of an intangible asset or a loan over its useful life or the loan term, resulting in periodic amortization expenses or interest payments.

Question 6: How does the calculation of interest impact financial decision-making?

Accurate interest calculations are crucial for making informed financial decisions, such as evaluating investment opportunities, assessing loan terms, and planning for future financial obligations.

These FAQs provide a concise overview of the key concepts and calculations related to interest in accounting. For a more in-depth exploration of these topics, please refer to the subsequent sections of this article.

Tips on Calculating Interest Accurately

To ensure precise interest calculations, consider these crucial tips:

Tip 1: Identify the Type of Interest: Determine whether simple or compound interest applies, as each method yields different results.

Tip 2: Determine the Principal and Rate: Clearly establish the principal amount and the applicable interest rate.

Tip 3: Calculate the Time Period: Accurately determine the duration over which interest will accrue.

Tip 4: Consider Compounding Frequency: For compound interest, identify how often interest is added to the principal.

Tip 5: Utilize Financial Calculators or Spreadsheets: Leverage technology to simplify calculations and minimize errors.

Tip 6: Double-Check Calculations: Verify the accuracy of your calculations using alternative methods.

Tip 7: Understand the Impact on Financial Decisions: Recognize how interest calculations influence financial choices, such as loan repayments and investments.

Tip 8: Seek Professional Advice if Needed: Consult financial experts for guidance on complex interest calculations or scenarios.

Following these tips can significantly enhance the accuracy and reliability of your interest calculations. By adhering to these principles, you can make informed financial decisions and ensure proper accounting practices.

The precise calculation of interest is a cornerstone of sound financial management. It empowers individuals and businesses to make informed decisions, optimize financial outcomes, and maintain accurate financial records. As we delve into the concluding section of this article, we will explore additional strategies for effective interest management, building upon the foundation established by these crucial tips.

Conclusion

This comprehensive exploration of “Accounting: How to Calculate Interest” has illuminated the fundamental concepts, methods, and applications of interest calculations in accounting. We have examined the nuances of simple and compound interest, explored the significance of effective interest rates, and delved into the practicalities of present value and future value calculations.

Throughout this article, three key points have emerged as interconnected pillars of interest calculation in accounting: accuracy, time value of money, and financial decision-making. Accurate interest calculations are crucial for reliable financial reporting and decision-making. Understanding the time value of money enables us to compare the worth of money at different points in time, a concept that underpins many financial transactions. Finally, interest calculations play a pivotal role in evaluating investments, assessing loan terms, and planning for future financial obligations.

As we conclude, it is imperative to recognize that proficiency in calculating interest is not merely a technical skill but a cornerstone of financial literacy. By mastering these concepts, individuals and businesses can make informed financial decisions, optimize their financial strategies, and navigate the complexities of the financial world with confidence.