Calculating net income in Excel is a crucial financial task for businesses. Net income, or profit, is the amount of money left over after subtracting expenses from revenue. It’s used to assess a company’s profitability and financial health.

Knowing how to calculate net income in Excel is essential for financial planning, budgeting, and decision-making. The concept has been used for centuries, with early iterations dating back to Luca Pacioli’s work in accounting.

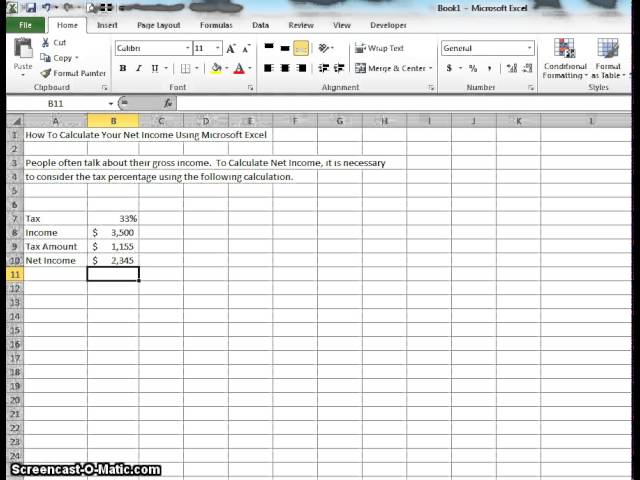

This article will guide you through the steps of calculating net income in Excel, covering essential formulas, functions, and best practices. We’ll also explore advanced techniques for managing complex financial data.

How to Calculate Net Income in Excel

Calculating net income in Excel is a critical task for businesses to assess their financial performance. Key aspects to consider include:

- Revenue

- Expenses

- Cost of Goods Sold

- Depreciation

- Taxes

- Interest

- Net Income Formula

- Financial Statements

Understanding these aspects allows for accurate calculation of net income, which is crucial for decision-making, budgeting, and forecasting. By considering revenue, expenses, and other factors, businesses can assess their profitability and financial health.

Revenue

Revenue is a critical component of calculating net income in Excel, as it represents the income earned by a business through its operations. Understanding the relationship between revenue and net income is essential for accurate financial reporting and analysis.

Revenue is directly related to net income. Higher revenue typically leads to higher net income, all else being equal. This is because revenue is the primary source of income for a business, and increased revenue means more money is available to cover expenses and generate profit. Conversely, lower revenue can lead to lower net income or even losses.

In Excel, revenue is typically entered in the income statement as the first line item. It can be derived from various sources, such as sales of products or services, interest income, or rental income. Once revenue is entered, Excel can be used to automatically calculate net income using formulas and functions. By understanding the connection between revenue and net income, businesses can better manage their finances and make informed decisions to maximize profitability.

Expenses

In the context of calculating net income in Excel, expenses play a crucial role in determining a company’s profitability. Expenses represent the costs incurred by a business in generating revenue. Accurately tracking and categorizing expenses is essential for accurate financial reporting and analysis.

- Operating Expenses

These are ongoing expenses directly related to the day-to-day operations of a business, such as salaries, rent, utilities, and marketing costs.

- Cost of Goods Sold (COGS)

COGS represents the direct costs associated with producing or acquiring the products or services sold by a business, including raw materials, labor, and manufacturing overhead.

- Depreciation and Amortization

These are non-cash expenses that allocate the cost of long-term assets, such as buildings and equipment, over their useful lives.

- Interest Expense

Interest expense represents the cost of borrowing money, such as interest paid on loans or bonds.

Understanding the different types of expenses and their impact on net income is crucial for businesses to make informed decisions about resource allocation, cost management, and profitability. By accurately calculating and analyzing expenses in Excel, businesses can gain valuable insights into their financial performance and identify areas for improvement.

Cost of Goods Sold

Cost of Goods Sold (COGS) is a crucial component in calculating net income in Excel, representing the direct costs associated with producing or acquiring the products or services sold by a business. Understanding COGS and its various facets is essential for accurate financial reporting and analysis.

- Raw Materials

Raw materials are the basic components used in the production of goods. Their cost is included in COGS, such as wood for furniture or flour for bread. - Labor Costs

Labor costs represent the wages and benefits paid to employees directly involved in the production process, such as factory workers or assembly line personnel. - Manufacturing Overhead

Manufacturing overhead encompasses indirect costs related to production, such as rent for the factory, depreciation on machinery, and utilities. - Freight-Out Costs

Freight-out costs are the expenses associated with delivering the finished goods to customers, such as shipping and postage.

Accurately calculating COGS in Excel is essential for determining the gross profit margin, which measures the profitability of a company’s core operations. COGS also impacts key financial ratios, such as gross profit percentage and inventory turnover, providing insights into a company’s operational efficiency and inventory management practices. By understanding the components of COGS and its implications in calculating net income, businesses can make informed decisions to optimize their production processes, manage costs, and improve financial performance.

Depreciation

Depreciation is a critical component in calculating net income in Excel, and understanding its impact is crucial for accurate financial reporting and analysis. Depreciation represents the systematic allocation of the cost of long-term assets, such as buildings, equipment, and vehicles, over their useful lives. It recognizes that these assets gradually lose value due to wear and tear, technological advancements, or obsolescence.

Depreciation is a non-cash expense that reduces the asset’s book value each year, affecting the calculation of net income. By spreading the cost of the asset over its useful life, businesses can match the expense to the periods that benefit from the asset’s use. This provides a more accurate representation of the company’s financial performance and profitability.

A common method of calculating depreciation is the straight-line method, where the asset’s cost is divided equally over its estimated useful life. For example, if a machine costing $10,000 has a useful life of 5 years, the annual depreciation expense would be $2,000. Excel provides built-in functions like the DB() or SLN() to automate depreciation calculations, ensuring accuracy and efficiency.

Understanding depreciation is essential for businesses to assess their financial health and make informed decisions. It impacts key financial ratios, such as return on assets (ROA) and debt-to-equity ratio, which provide insights into a company’s profitability, efficiency, and financial leverage. By accurately calculating depreciation in Excel, businesses can ensure reliable financial statements and make informed decisions regarding capital budgeting, asset management, and tax planning.

Taxes

Taxes are a crucial aspect of calculating net income in Excel, as they represent the portion of a company’s profits that is owed to government entities. Understanding how taxes are calculated and applied is essential for accurate financial reporting and tax compliance.

- Income Tax

Income tax is levied on a company’s taxable income, which is calculated by subtracting allowable deductions and exemptions from its total revenue. The tax rate varies depending on the jurisdiction and the amount of taxable income.

- Sales Tax

Sales tax is an indirect tax imposed on the sale of goods and services. It is typically calculated as a percentage of the purchase price and collected by the seller, who then remits it to the relevant tax authority.

- Property Tax

Property tax is levied on real estate and other types of property owned by a company. The amount of property tax is determined by the assessed value of the property and the local tax rate.

- Payroll Tax

Payroll tax is levied on wages and salaries paid to employees. It includes various components, such as Social Security tax, Medicare tax, and unemployment insurance tax. Payroll tax is typically withheld from employees’ paychecks and remitted to the relevant tax authorities by the employer.

Accurately calculating taxes in Excel is essential for determining a company’s net income and ensuring compliance with tax regulations. By understanding the different types of taxes and their impact on net income, businesses can make informed decisions regarding tax planning and financial management.

Interest

Interest plays a significant role in the calculation of net income in Excel. It represents the cost of borrowing money, such as interest paid on loans or bonds. Understanding how interest is incorporated into net income calculations is crucial for accurate financial reporting and analysis.

Interest expense is a deductible expense for businesses, meaning it reduces taxable income. By reducing taxable income, interest expense indirectly increases net income. Conversely, interest income, such as interest earned on savings accounts or investments, is added to revenue and increases net income.

A real-life example of interest in the context of net income calculation is a company taking out a loan to finance a new project. The interest paid on the loan would be recorded as an interest expense, reducing the company’s net income. Alternatively, if a company invests excess cash in a high-yield savings account, the interest earned would be recorded as interest income, increasing net income.

Understanding the relationship between interest and net income is essential for businesses to make informed decisions regarding borrowing, investing, and financial planning. By accurately calculating interest in Excel, businesses can ensure reliable financial statements, optimize their financial performance, and comply with accounting standards.

Net Income Formula

The net income formula is a cornerstone of calculating net income in Excel. It outlines the mathematical steps involved in determining a company’s profit or loss over a specific period. Understanding the formula and its components is essential for accurate financial reporting and analysis.

- Revenue

Revenue represents the total income generated by a company from its core operations and other sources, such as sales of goods or services.

- Expenses

Expenses encompass all costs incurred by a company in generating revenue, including operating expenses, cost of goods sold, and depreciation.

- Taxes

Taxes, such as income tax and sales tax, represent the portion of a company’s profits that is owed to government entities.

- Interest

Interest expense reflects the cost of borrowing money, while interest income represents earnings from investments or savings.

The net income formula incorporates these components as follows: Net Income = Revenue – Expenses – Taxes + Interest Income – Interest Expense. By understanding each component and its impact on net income, businesses can accurately assess their financial performance, make informed decisions, and comply with accounting standards.

Financial Statements

Financial statements are a crucial aspect of calculating net income in Excel, providing a comprehensive overview of a company’s financial performance and position. They encompass various components that contribute to the determination of net income and offer valuable insights for decision-making.

- Income Statement

The income statement summarizes a company’s revenues, expenses, and net income over a specific period, typically a quarter or a year. It provides insights into a company’s profitability and operating performance, allowing for comparisons across different periods and peer companies.

- Balance Sheet

The balance sheet presents a snapshot of a company’s financial position at a specific point in time. It outlines the company’s assets, liabilities, and equity, providing insights into its financial health, solvency, and liquidity.

- Statement of Cash Flows

The statement of cash flows tracks the movement of cash and cash equivalents within and out of a company over a specific period. It categorizes cash flows into operating, investing, and financing activities, providing insights into a company’s cash generation and utilization.

- Statement of Shareholders’ Equity

The statement of shareholders’ equity outlines the changes in a company’s equity over a specific period. It includes transactions such as issuance of shares, payment of dividends, and retained earnings, providing insights into a company’s capital structure and ownership.

Analyzing these financial statements in conjunction with the net income calculation in Excel enables a deeper understanding of a company’s financial performance, liquidity, solvency, and overall health. Financial statements serve as a foundation for making informed financial decisions, evaluating investment opportunities, and assessing a company’s financial risk.

Frequently Asked Questions (FAQs) on Calculating Net Income in Excel

This section addresses common questions and clarifies essential aspects of calculating net income in Excel.

Question 1: What is net income, and why is it important?

Net income, also known as profit, represents a company’s financial performance over a specific period. It is crucial for assessing profitability, making informed decisions, and complying with accounting standards.

Question 2: What is the formula for calculating net income?

Net Income = Revenue – Expenses – Taxes + Interest Income – Interest Expense

Question 3: How do I account for expenses in net income calculations?

Expenses include operating expenses, cost of goods sold, and depreciation. Accurately categorizing and recording expenses is essential for calculating net income.

Question 4: How do I consider taxes when calculating net income?

Taxes, such as income tax and sales tax, are deducted from revenue to arrive at net income. Understanding tax implications is crucial for accurate financial reporting.

Question 5: Why is interest relevant to net income calculations?

Interest expense reduces net income, while interest income increases it. Accurately accounting for interest ensures a comprehensive view of a company’s financial performance.

Question 6: How can Excel help me calculate net income?

Excel provides formulas and functions to automate net income calculations. Utilizing Excel’s capabilities enhances accuracy and efficiency in financial analysis.

These FAQs provide a foundation for understanding the intricacies of calculating net income in Excel. The next section will delve into advanced techniques for managing complex financial data and maximizing the accuracy of your calculations.

Tips for Accurate Net Income Calculation in Excel

To ensure the accuracy and reliability of net income calculations in Excel, consider the following practical tips:

Tip 1: Utilize Excel Formulas

Leverage Excel’s built-in formulas, such as SUM, AVERAGE, and IF, to automate calculations and minimize errors.

Tip 2: Categorize Expenses Diligently

Accurately categorize expenses into appropriate accounts, such as operating expenses, cost of goods sold, and depreciation, to ensure proper expense allocation.

Tip 3: Reconcile Financial Statements

Cross-check the net income figure against the income statement, balance sheet, and statement of cash flows to ensure consistency and identify any discrepancies.

Tip 4: Consider Non-Cash Expenses

Remember to include non-cash expenses, such as depreciation and amortization, in net income calculations, as they impact profitability.

Tip 5: Review Tax Implications

Stay updated on tax laws and regulations to accurately calculate taxes and their impact on net income.

Tip 6: Audit Regularly

Periodically review and audit net income calculations to ensure accuracy and identify areas for improvement.

By implementing these tips, businesses can enhance the accuracy and reliability of their net income calculations in Excel, leading to more informed decision-making and improved financial performance. These practices contribute to the overall goal of maintaining accurate and transparent financial records, which is essential for stakeholders’ trust and confidence.

The concluding section of this article will explore advanced techniques for managing complex financial data in Excel

Conclusion

In summary, this comprehensive guide to calculating net income in Excel provides a detailed examination of the fundamental concepts, formulas, and best practices involved in determining a company’s financial performance. Key points highlighted throughout the article include the significance of revenue, expenses, taxes, and interest in net income calculations. Additionally, the article emphasizes the importance of accurate expense categorization, tax considerations, and leveraging Excel’s capabilities for efficient and reliable calculations.

As businesses navigate complex financial landscapes, adopting these advanced techniques can empower them to manage intricate financial data effectively. By embracing automation, data validation, and scenario analysis, organizations can gain deeper insights into their financial performance, make informed decisions, and stay competitive in today’s dynamic business environment.