Understanding taxation of zero coupon bonds is crucial for investors seeking tax-efficient investments. Zero Coupon Bonds, debt securities that pay no regular interest, accumulate interest that is only paid at maturity. To calculate the tax on these bonds, investors must consider the difference between the purchase price and the maturity value.

The taxation of zero coupon bonds holds significance due to their unique characteristics. They offer tax-deferred growth potential, allowing investors to defer paying taxes on interest income until the bond matures. Additionally, zero coupon bonds provide an inflation hedge as they typically have longer maturities than traditional coupon bonds.

Historically, the taxation of zero coupon bonds has been a subject of debate. In the past, these bonds were often used for tax avoidance strategies. However, the Tax Reform Act of 1986 introduced the market discount rule, which eliminated many of these strategies and clarified the tax treatment of zero coupon bonds.

How to Calculate Tax on Zero Coupon Bond

Understanding how to calculate tax on zero coupon bonds is crucial for investors. These bonds offer unique characteristics and tax implications.

- Purchase Price

- Maturity Value

- Holding Period

- Tax Rate

- Market Discount Rule

- Tax-Deferred Growth

- Inflation Hedge

- Original Issue Discount

- Accrued Interest

- Capital Gains Tax

Calculating tax on zero coupon bonds involves considering the purchase price, maturity value, holding period, and applicable tax rate. The Market Discount Rule plays a key role in determining the taxable income. Zero coupon bonds offer tax-deferred growth potential and can serve as an inflation hedge. Understanding these aspects is essential for investors seeking tax-efficient investments.

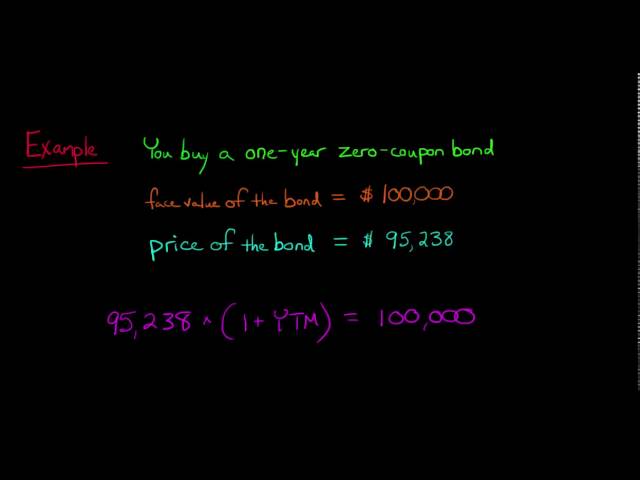

Purchase Price

In the context of calculating tax on zero coupon bonds, the purchase price plays a crucial role. Zero coupon bonds are debt securities that pay no regular interest payments, meaning that the return on investment comes from the difference between the purchase price and the maturity value. The purchase price is the initial cost of acquiring the bond, and it directly affects the calculation of taxable income.

The purchase price is a critical component of calculating the tax on zero coupon bonds because it determines the amount of original issue discount (OID) that is subject to taxation. OID is the difference between the issue price of a bond and its maturity value. For zero coupon bonds, the entire purchase price is considered OID. The Market Discount Rule mandates that OID be recognized as taxable income over the life of the bond, even though no cash interest payments are received. This means that the purchase price directly influences the amount of taxable income generated by the bond.

Real-life examples illustrate the impact of the purchase price on tax calculations. Consider a zero coupon bond with a maturity value of $1,000 and a purchase price of $600. The OID for this bond is $400, which is the difference between the purchase price and the maturity value. Over the life of the bond, the investor will recognize $400 of taxable income, even though they will not receive any cash payments until maturity. This demonstrates how the purchase price affects the tax liability associated with zero coupon bonds.

Understanding the connection between purchase price and tax calculations is crucial for investors seeking to make informed decisions about zero coupon bonds. By considering the purchase price and its impact on OID and taxable income, investors can better evaluate the potential tax implications of these investments.

Maturity Value

In calculating tax on zero coupon bonds, the maturity value plays a crucial role. Maturity value refers to the face value of the bond at its maturity date, representing the amount the bondholder will receive upon redemption. It is a critical component in determining the taxable income generated by the bond.

The relationship between maturity value and tax calculation is directly tied to the concept of original issue discount (OID). OID is the difference between the issue price of a bond and its maturity value. For zero coupon bonds, the entire purchase price is considered OID. The Market Discount Rule mandates that OID be recognized as taxable income over the life of the bond, even though no cash interest payments are received.

To illustrate, consider a zero coupon bond with a maturity value of $1,000 purchased for $600. The OID for this bond is $400, which will be recognized as taxable income over the life of the bond. Upon maturity, the bondholder will receive the full maturity value of $1,000, resulting in a capital gain of $400. This gain is subject to capital gains tax, which is typically more favorable than the ordinary income tax rate.

Understanding the connection between maturity value and tax calculation is crucial for investors seeking to make informed decisions about zero coupon bonds. By considering the maturity value and its impact on OID and taxable income, investors can better evaluate the potential tax implications of these investments and make strategic decisions to optimize their financial outcomes.

Holding Period

In the context of calculating tax on zero coupon bonds, the holding period plays a significant role. Holding period refers to the duration for which an investor holds a bond before selling or redeeming it. It directly influences the tax treatment of the bond and the amount of tax the investor will owe.

Zero coupon bonds are unique in that they pay no regular interest payments. Instead, the return on investment comes from the difference between the purchase price and the maturity value. The Market Discount Rule mandates that the difference, known as original issue discount (OID), be recognized as taxable income over the life of the bond, regardless of whether the investor receives any cash payments.

The holding period determines how the OID is recognized for tax purposes. If the bond is held for less than one year, the OID is considered short-term capital gain and taxed at the investor’s ordinary income tax rate. However, if the bond is held for more than one year, the OID is considered long-term capital gain and taxed at a more favorable rate. This distinction can result in significant tax savings for investors who hold zero coupon bonds for longer periods.

To illustrate, consider an investor who purchases a zero coupon bond with a maturity value of $1,000 for $600. The OID for this bond is $400. If the investor sells the bond after holding it for six months, the $400 OID will be taxed as short-term capital gain at their ordinary income tax rate. However, if the investor holds the bond for more than one year, the $400 OID will be taxed as long-term capital gain at a lower rate. This demonstrates how the holding period can impact the tax treatment of zero coupon bonds and highlights the importance of considering this factor when making investment decisions.

Tax Rate

Tax rate is a critical element in calculating the tax liability associated with zero coupon bonds. Understanding the different aspects of tax rate is essential for investors seeking to optimize their tax strategies.

- Ordinary Income Tax Rate

The ordinary income tax rate is the marginal tax rate applicable to an individual’s taxable income. For zero coupon bonds, if the holding period is less than one year, the original issue discount (OID) is taxed as short-term capital gain and subject to the ordinary income tax rate. - Capital Gains Tax Rate

The capital gains tax rate is the marginal tax rate applicable to an individual’s capital gains. For zero coupon bonds, if the holding period is more than one year, the OID is taxed as long-term capital gain and subject to the capital gains tax rate, which is typically lower than the ordinary income tax rate. - State and Local Tax Rates

In addition to federal tax rates, investors may also be subject to state and local tax rates on zero coupon bonds. These rates vary depending on the jurisdiction and can impact the overall tax liability. - Effective Tax Rate

The effective tax rate is the actual tax rate paid on an investment, taking into account all applicable tax rates and deductions. For zero coupon bonds, the effective tax rate can vary depending on the investor’s individual circumstances and the specific tax rates applicable to their situation.

Understanding the different facets of tax rate is crucial for investors seeking to make informed decisions about zero coupon bonds. By considering the potential impact of tax rates on their investment returns, investors can optimize their tax strategies and maximize their after-tax.

Market Discount Rule

The Market Discount Rule plays a critical role in calculating tax on zero coupon bonds. This rule governs the tax treatment of bonds that are issued at a discount, such as zero coupon bonds. According to the rule, the difference between the purchase price of a bond and its maturity value, known as original issue discount (OID), is recognized as taxable income over the life of the bond. This is true even though the bondholder does not receive any cash interest payments.

The Market Discount Rule is important because it provides a clear framework for determining the taxable income generated by zero coupon bonds. Without this rule, investors could potentially defer paying taxes on OID until the bond matures, which could result in a significant tax liability. The rule ensures that investors recognize the income over the life of the bond, regardless of when they receive cash payments.

To illustrate the Market Discount Rule, consider a zero coupon bond with a purchase price of $600 and a maturity value of $1,000. The OID for this bond is $400. Over the life of the bond, the investor will recognize $400 of taxable income, even though they will not receive any cash payments until maturity. This income is taxed annually at the investor’s ordinary income tax rate.

Understanding the Market Discount Rule is essential for investors who are considering investing in zero coupon bonds. By understanding how this rule affects the taxation of these bonds, investors can make informed decisions about their investment strategies.

Tax-Deferred Growth

Tax-deferred growth is a critical component of calculating tax on zero coupon bonds. Zero coupon bonds are debt securities that pay no regular interest payments, which means that all of the return on investment comes from the difference between the purchase price and the maturity value. The Market Discount Rule mandates that the difference, known as original issue discount (OID), be recognized as taxable income over the life of the bond, even though the bondholder does not receive any cash payments.

Tax-deferred growth comes into play because the OID is not taxed until the bond matures or is sold. This means that investors can defer paying taxes on the income generated by the bond until a later date, potentially saving a significant amount of money in taxes. The longer the bond is held, the greater the tax savings will be.

For example, consider an investor who purchases a zero coupon bond with a purchase price of $600 and a maturity value of $1,000. The OID for this bond is $400. If the investor holds the bond until maturity, they will not pay any taxes on the OID until the bond matures. This could result in significant tax savings, especially if the investor is in a higher tax bracket at the time of maturity.

Understanding the connection between tax-deferred growth and calculating tax on zero coupon bonds is essential for investors who are considering investing in these types of bonds. By understanding how tax-deferred growth works, investors can make informed decisions about their investment strategies and potentially save a significant amount of money in taxes.

Inflation Hedge

When calculating tax on zero coupon bonds, it’s essential to consider inflation. Inflation is a general increase in prices and a decrease in the purchasing power of money. Zero coupon bonds offer protection against inflation because they provide a fixed return over the life of the bond. This fixed return is not subject to erosion by inflation, unlike investments that are tied to variable interest rates.

For example, consider an investor who purchases a zero coupon bond with a 10-year maturity and a face value of $1,000. The investor purchases the bond for $600. If the inflation rate over the 10-year period is 3% per year, the value of $1,000 at maturity will be worth approximately $732 in today’s dollars. However, the investor will still receive the full face value of $1,000 at maturity, regardless of the inflation rate. This demonstrates how zero coupon bonds can serve as an inflation hedge.

Understanding the relationship between inflation and zero coupon bonds is crucial for investors seeking to preserve the purchasing power of their investments. By considering inflation when calculating tax on zero coupon bonds, investors can make informed decisions about their investment strategies and potentially mitigate the negative effects of inflation on their returns.

Original Issue Discount

Original Issue Discount (OID) is a crucial concept in calculating tax on zero coupon bonds. It represents the difference between the issue price of a bond and its maturity value. Since zero coupon bonds pay no regular interest, OID is the primary source of return for investors.

- OID Accrual

OID is recognized as taxable income over the life of the bond, even though no cash payments are received. This is known as OID accrual.

- Compounding Effect

OID is compounded over time. This means that the amount of OID recognized as income increases each year, resulting in a higher tax liability.

- Tax Deferral

Although OID is recognized as income, it is not subject to taxation until the bond matures or is sold. This provides investors with tax deferral benefits.

- Maturity Value

At maturity, the investor receives the full face value of the bond. This amount is typically greater than the purchase price, resulting in a capital gain. The capital gain is taxed at a different rate than OID income.

Understanding OID is essential for calculating tax on zero coupon bonds. By considering the facets discussed above, investors can determine the taxable income generated by these bonds and make informed investment decisions.

Accrued Interest

Accrued interest plays a vital role in calculating tax on zero coupon bonds. Zero coupon bonds do not pay regular interest payments, so all interest is accrued over the life of the bond and paid at maturity. This accrued interest is subject to taxation, even though it has not been received in cash.

- Recognizing Accrued Interest

Accrued interest is recognized on a daily basis and added to the bondholder’s income. This is regardless of the bond’s holding period or whether the bond has been sold.

- OID Accrual Method

The most common method used to calculate accrued interest on zero coupon bonds is the Original Issue Discount (OID) accrual method. This method allocates the bond’s discount (difference between the purchase price and maturity value) over the bond’s life.

- Tax Implications

Accrued interest on zero coupon bonds is taxed as ordinary income. However, if the bond is held for more than one year before being sold, the accrued interest may be eligible for capital gains tax rates.

- Impact on Bond Value

Accrued interest affects the bond’s value. As accrued interest increases, the bond’s value also increases.

Understanding accrued interest is essential for calculating tax on zero coupon bonds. By considering the facets discussed above, investors can accurately determine their tax liability and make informed investment decisions.

Capital Gains Tax

Capital Gains Tax holds significant relevance when calculating tax on zero coupon bonds. It encompasses the tax levied on profits earned from the sale of assets, including bonds, held for more than one year. Understanding its components and implications is crucial for investors seeking to optimize their tax strategies.

- Tax Rate

Capital Gains Tax rates vary depending on the investor’s taxable income and the type of asset sold. Zero coupon bonds typically qualify for favorable long-term capital gains rates if held for the required period.

- Holding Period

The length of time an investor holds a zero coupon bond before selling it determines whether it qualifies for long-term or short-term capital gains treatment. Holding for over one year typically results in more favorable tax rates.

- Basis

The basis of a zero coupon bond is its purchase price. When calculating capital gains, the difference between the sale price and the basis determines the taxable gain.

- Indexation

Indexation adjusts the basis of a zero coupon bond for inflation, which can reduce the capital gains tax liability over time.

Understanding these facets of Capital Gains Tax empowers investors to make informed decisions about the timing of zero coupon bond sales and minimize their tax liability. By considering the holding period, tax rates, basis, and indexation, investors can optimize their investment strategies and maximize their after-tax returns.

Frequently Asked Questions on Calculating Tax for Zero Coupon Bonds

This section addresses common questions and misconceptions concerning the calculation of tax on zero coupon bonds, providing clarity and guidance for investors seeking to optimize their tax strategies.

Question 1: What is the significance of the holding period when calculating tax on zero coupon bonds?

Answer: The holding period determines whether the accrued interest qualifies for long-term or short-term capital gains treatment, with long-term typically resulting in more favorable tax rates.

Question 2: How does the Market Discount Rule affect the taxation of zero coupon bonds?

Answer: The Market Discount Rule mandates that the difference between the purchase price and maturity value, known as original issue discount (OID), is recognized as taxable income over the bond’s life, regardless of cash payments received.

Question 3: What is the relationship between accrued interest and the bond’s value?

Answer: Accrued interest is added to the bondholder’s income and increases the bond’s value over time.

Question 4: How is capital gains tax calculated for zero coupon bonds?

Answer: Capital gains tax on zero coupon bonds is levied on the difference between the sale price and the basis (purchase price), with long-term holdings typically qualifying for lower tax rates.

Question 5: What is the impact of inflation on zero coupon bonds?

Answer: Zero coupon bonds offer protection against inflation as the fixed return is not subject to erosion by rising prices.

Question 6: How can investors defer paying taxes on zero coupon bonds?

Answer: Investors can defer paying taxes on zero coupon bonds by holding them until maturity, as OID is not taxed until the bond matures or is sold.

In summary, understanding the nuances of calculating tax on zero coupon bonds empowers investors to make informed decisions about their investment strategies. By considering aspects such as the holding period, Market Discount Rule, accrued interest, capital gains tax, inflation, and tax deferral, investors can optimize their after-tax returns and navigate the complexities of bond taxation.

The next section delves into advanced strategies for maximizing tax efficiency with zero coupon bonds, exploring techniques such as yield-to-maturity calculations and tax-loss harvesting.

Expert Tips for Maximizing Tax Efficiency with Zero Coupon Bonds

This section provides insightful tips to help investors optimize their tax strategies when investing in zero coupon bonds.

Tip 1: Calculate Yield-to-Maturity (YTM)

YTM considers the present value of all future cash flows, including accrued interest and the maturity value, providing a comprehensive measure of a bond’s return.

Tip 2: Leverage Tax-Loss Harvesting

Selling zero coupon bonds at a loss can offset capital gains from other investments, reducing overall tax liability.

Tip 3: Utilize Tax-Advantaged Accounts

Investing in zero coupon bonds within tax-advantaged accounts, such as IRAs or 401(k) plans, allows for tax-deferred or tax-free growth.

Tip 4: Consider Bond Ladders

Creating a ladder of zero coupon bonds with varying maturities can provide a steady stream of tax-advantaged income over time.

Tip 5: Monitor Accrued Interest

Tracking accrued interest helps investors understand the taxable income generated over the bond’s life, enabling better tax planning.

Tip 6: Consult a Tax Professional

Seeking guidance from a qualified tax professional ensures compliance with tax regulations and optimizes tax-saving strategies.

Summary

Implementing these tips empowers investors to maximize the tax efficiency of their zero coupon bond investments. By employing these strategies, investors can minimize their tax liability and enhance their after-tax returns.

Transition

The following section explores advanced techniques for further optimizing bond portfolios, focusing on strategies that align with the specific needs and goals of individual investors.

Conclusion

Calculating tax on zero coupon bonds involves a unique set of considerations compared to traditional coupon bonds. Understanding the concepts of original issue discount, accrued interest, and the Market Discount Rule is crucial for accurate tax calculation. Proper tax planning and optimization strategies, such as yield-to-maturity calculations, tax-loss harvesting, and bond ladders, can help investors maximize their after-tax returns.

In summary, investors seeking to invest in zero coupon bonds must consider the tax implications and explore advanced techniques to optimize their portfolio’s tax efficiency. By leveraging the insights provided in this article, investors can navigate the complexities of zero coupon bond taxation and make informed decisions to enhance their investment outcomes.