Obtaining an accurate discount rate for bonds is a crucial skill in finance. It involves understanding the factors that influence the present value of a bond and applying mathematical formulas to determine the rate at which it trades below its face value. For instance, a bond with a face value of $1,000 that trades at $900 would have a discount rate of 10%.

Calculating the discount rate is essential for making informed investment decisions, such as evaluating the attractiveness of a bond relative to other fixed-income investments. It also plays a significant role in corporate finance, as companies use discount rates to assess the viability of investment projects and determine the cost of capital.

The development of sophisticated financial models and the widespread availability of financial calculators have made it easier to calculate discount rates. In this comprehensive guide, we will delve into the intricacies of calculating the discount rate of a bond, examining the various formulas and factors that influence its value.

How to Calculate the Discount Rate of a Bond

Understanding the key aspects of calculating the discount rate of a bond is essential for making informed investment decisions. These aspects encompass:

- Face value

- Current market price

- Maturity date

- Coupon rate

- Yield to maturity

- Time to maturity

- Interest rate environment

- Credit risk

- Tax implications

Each of these aspects plays a crucial role in determining the discount rate of a bond. By considering these factors, investors can accurately assess the value of a bond and make optimal investment choices. For example, bonds with longer maturities tend to have higher discount rates due to the increased uncertainty associated with distant cash flows. Similarly, bonds issued by companies with lower credit ratings carry higher discount rates to compensate for the increased risk of default.

Face Value

In the context of calculating the discount rate of a bond, the face value serves as a crucial reference point. It represents the principal amount of the bond, which is repaid to the investor at the maturity date. Understanding the significance and implications of face value is essential for accurate discount rate calculations.

- Nominal Value: The face value is often referred to as the nominal value of the bond. It represents the amount borrowed by the issuer and forms the basis for calculating interest payments and the final repayment.

- Par Value: When a bond trades at its face value, it is said to be trading at par. In this scenario, the bond’s market price aligns with its nominal value.

- Discount: Bonds that trade below their face value are said to be trading at a discount. The discount rate is influenced by various factors such as interest rate fluctuations, credit risk, and market demand.

- Premium: Bonds that trade above their face value are said to be trading at a premium. This typically occurs when interest rates decline, making the fixed coupon payments of the bond more attractive to investors.

The face value of a bond plays a fundamental role in determining its discount rate. By understanding the relationship between face value and other factors such as market price and yield to maturity, investors can make informed decisions about bond investments.

Current Market Price

The current market price of a bond is a fundamental factor in calculating its discount rate. It reflects the prevailing market sentiment towards the bond’s issuer, its creditworthiness, and the overall interest rate environment. Several key aspects of the current market price are:

- Traded Price: The traded price represents the actual price at which the bond is bought or sold in the secondary market. It fluctuates constantly based on supply and demand.

- Bid-Ask Spread: The bid-ask spread refers to the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept for the bond. It indicates the liquidity of the bond in the market.

- Accrued Interest: Accrued interest represents the interest that has accumulated on the bond since the last interest payment date but has not yet been paid. It is added to the traded price to determine the total cost of the bond.

- Yield to Maturity: Yield to maturity is a key metric that reflects the annualized return an investor can expect to receive if they hold the bond until its maturity date. It is closely related to the current market price of the bond.

By considering these aspects of the current market price, investors can gain a comprehensive understanding of the bond’s value and make informed decisions about whether to buy, sell, or hold the bond.

Maturity date

The maturity date of a bond is the date on which the issuer of the bond repays the principal amount to the bondholder. It is a critical component of calculating the discount rate of a bond because it determines the length of time over which the bondholder will receive interest payments and ultimately be repaid the principal. The maturity date, along with the coupon rate, influences the yield to maturity, which is a key factor in determining the bond’s price.

For example, a bond with a long maturity date will typically have a higher yield to maturity than a bond with a short maturity date, because investors require a higher return for lending their money for a longer period. As a result, bonds with longer maturities tend to trade at a discount to their face value, while bonds with shorter maturities tend to trade at a premium.

Understanding the relationship between maturity date and discount rate is essential for investors when making investment decisions. By considering the maturity date in conjunction with other factors such as the coupon rate and yield to maturity, investors can assess the potential return and risk associated with a bond investment and make informed choices about which bonds to buy or sell.

Coupon rate

The coupon rate is a critical component of how to calculate the discount rate of a bond. It represents the annual interest payment made by the issuer to the bondholder, typically expressed as a percentage of the face value. The coupon rate directly influences the bond’s price and yield.

A higher coupon rate generally indicates a higher yield to maturity, making the bond more attractive to investors. This is because investors are willing to pay a premium for a bond with a higher coupon rate, as they will receive a greater stream of interest payments over the life of the bond. Conversely, a lower coupon rate typically results in a lower yield to maturity, making the bond less attractive to investors.

For example, consider two bonds with the same face value and maturity date, but different coupon rates. A bond with a 5% coupon rate will typically trade at a higher price and have a lower yield to maturity than a bond with a 3% coupon rate. This is because investors are willing to pay more for the bond with the higher coupon rate, as they will receive a greater total return over the life of the bond.

Understanding the relationship between coupon rate and discount rate is essential for investors when making investment decisions. By considering the coupon rate in conjunction with other factors such as the maturity date and yield to maturity, investors can assess the potential return and risk associated with a bond investment and make informed choices about which bonds to buy or sell.

Yield to maturity

Yield to maturity (YTM) is a crucial concept closely tied to calculating the discount rate of a bond. It represents the annualized rate of return an investor can expect to receive if they hold the bond until its maturity date, taking into account both the coupon payments and the repayment of the principal at maturity.

- Current yield: This measures the annual return based solely on the current market price of the bond and its coupon payments, without considering the change in the bond’s price.

- Simple yield to maturity: This is a basic calculation of the YTM, assuming the bond’s price remains constant until maturity.

- Effective yield to maturity: This is a more precise calculation that takes into account the compounding of interest over the life of the bond.

- Callable yield to maturity: This considers the possibility of the bond being called back by the issuer before maturity, which can affect the overall YTM.

Understanding the components and implications of yield to maturity is essential when calculating the discount rate of a bond. By considering factors such as the current market price, coupon payments, and maturity date, investors can make informed decisions about the potential return and risk associated with a bond investment.

Time to maturity

Time to maturity is a critical aspect of calculating the discount rate of a bond, as it represents the period over which the bondholder will receive interest payments and ultimately be repaid the principal. It encompasses several facets that influence the calculation and interpretation of bond yields.

- Maturity date: This is the specific date on which the bond matures and the principal is repaid to the holder. It serves as the endpoint for calculating the bond’s yield to maturity.

- Long-term vs. short-term bonds: Bonds with longer maturities generally carry higher yields due to the increased uncertainty and interest rate risk associated with longer investment horizons.

- Callable bonds: Some bonds include a call feature that allows the issuer to redeem the bond before maturity. This can affect the calculation of yield to maturity and the overall attractiveness of the bond to investors.

- Refinancing risk: For bonds with longer maturities, there is a risk that the issuer may need to refinance the debt at higher interest rates in the future, which can impact the bond’s value.

Understanding the nuances of time to maturity is essential for accurate yield calculations and informed investment decisions. By considering the various facets outlined above, investors can assess the potential risks and returns associated with different bonds and make optimal choices that align with their investment goals and risk tolerance.

Interest rate environment

The interest rate environment is a critical component of calculating the discount rate of a bond. Interest rates have a direct impact on the present value of future cash flows, which in turn affects the discount rate used to calculate the bond’s price. When interest rates rise, the discount rate used to calculate the present value of the bond’s future cash flows increases, leading to a decrease in the bond’s price. Conversely, when interest rates fall, the discount rate decreases, resulting in an increase in the bond’s price.

For example, consider a bond with a face value of $1,000 and a 5% annual coupon rate. If the prevailing interest rate is 4%, the bond’s price would be approximately $1,046.30. However, if the interest rate rises to 6%, the bond’s price would fall to approximately $961.54. This is because the higher interest rate increases the discount rate used to calculate the present value of the bond’s future cash flows.

Understanding the relationship between the interest rate environment and the discount rate of a bond is crucial for investors. By considering the prevailing interest rate environment, investors can make informed decisions about the value and attractiveness of different bonds. This understanding also enables investors to anticipate the potential impact of interest rate changes on their bond investments and make adjustments to their portfolios accordingly.

Credit risk

Credit risk is a crucial component in calculating the discount rate of a bond. It represents the possibility that the issuer of the bond may default on their obligation to make interest payments or repay the principal amount. This risk is assessed by evaluating the financial health and stability of the issuer, their industry, and the overall economic environment.

A higher credit risk generally leads to a higher discount rate. This is because investors demand a higher return to compensate for the increased likelihood of not receiving the promised cash flows. For example, a bond issued by a company with a low credit rating will typically have a higher discount rate than a bond issued by a company with a high credit rating. This is because investors perceive the higher-rated company as being less likely to default.

Understanding the relationship between credit risk and the discount rate is essential for investors when making investment decisions. By considering the credit risk of the issuer, investors can assess the potential return and risk associated with a bond investment and make informed choices about which bonds to buy or sell. This understanding also enables investors to anticipate the potential impact of changes in the issuer’s creditworthiness on their bond investments and make adjustments to their portfolios accordingly.

Tax implications

Tax implications play a crucial role in determining the discount rate of a bond. Investors need to consider how taxes will affect the real returns they receive from bond investments, making it an important aspect of calculating the true cost of borrowing for issuers.

- Tax-Exempt Bonds: Income from municipal bonds is often exempt from federal income tax, making them attractive to investors in higher tax brackets. This tax exemption can significantly reduce the effective discount rate for tax-exempt bonds.

- Capital Gains Tax: When bonds are sold for a profit, the capital gains are subject to taxation. The tax rate on capital gains depends on the investor’s holding period and their overall tax bracket.

- Tax-Deferred Accounts: Holding bonds in tax-deferred accounts, such as IRAs and 401(k)s, can defer capital gains tax until the funds are withdrawn. This deferral can provide significant tax savings over time.

- Original Issue Discount (OID): OID bonds are issued at a discount to their face value and pay interest payments that are less than the stated coupon rate. The difference between the purchase price and the maturity value is treated as taxable income over the life of the bond, affecting the effective discount rate.

Understanding the tax implications associated with bond investments enables investors to make informed decisions about their fixed-income portfolios. By considering the potential tax savings or liabilities, investors can optimize their returns and minimize their overall tax burden.

Frequently Asked Questions on Calculating the Discount Rate of a Bond

This section provides answers to some common questions and clarifications regarding the calculation of a bond’s discount rate.

Question 1: What is the significance of the discount rate in bond valuation?

Answer: The discount rate is crucial in determining the present value of a bond’s future cash flows, ultimately affecting the bond’s market price and yield.

Question 2: How does the maturity date impact the discount rate?

Answer: Longer maturities generally lead to higher discount rates due to increased uncertainty and interest rate risk.

Question 3: What role does the creditworthiness of the issuer play in discount rate calculation?

Answer: Higher credit risk corresponds to higher discount rates, as investors demand a premium for the increased likelihood of default.

Question 4: How do prevailing interest rates influence the discount rate?

Answer: Rising interest rates result in higher discount rates, decreasing bond prices, while falling interest rates have the opposite effect.

Question 5: Are there any tax implications to consider when calculating the discount rate?

Answer: Tax-exempt bonds offer lower effective discount rates, while capital gains and Original Issue Discount (OID) can impact the after-tax returns.

Question 6: How can investors use the discount rate to make informed investment decisions?

Answer: Comparing the discount rates of different bonds allows investors to assess risk-adjusted returns and make optimal choices based on their investment goals.

These FAQs provide a concise overview of key considerations in calculating the discount rate of a bond, helping investors navigate the complexities of bond valuation.

In the next section, we delve into the practical steps involved in calculating the discount rate using various formulas and examples, further empowering investors to make informed bond investment decisions.

Tips for Calculating the Discount Rate of a Bond

To ensure accurate and informed decision-making in bond investments, it is crucial to approach the calculation of the discount rate with a methodical and comprehensive approach. Here are eight essential tips to guide you through this process:

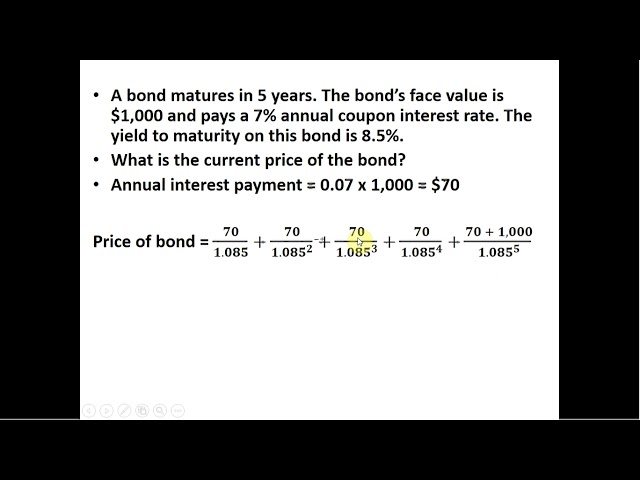

Tip 1: Determine relevant cash flows: Identify all future cash flows associated with the bond, including coupon payments and the repayment of principal at maturity.

Tip 2: Estimate a yield to maturity: Use market data or comparable bond yields to approximate the expected yield to maturity, which serves as the initial discount rate.

Tip 3: Calculate present value: Discount each future cash flow back to the present using the estimated yield to maturity as the discount rate and sum the present values to obtain the bond’s present value.

Tip 4: Adjust the yield to maturity: Compare the calculated present value to the bond’s current market price. If they differ significantly, adjust the yield to maturity and repeat steps 3 and 4 until the present value closely matches the market price.

Tip 5: Consider credit risk: Assess the creditworthiness of the bond issuer and incorporate a credit risk premium into the discount rate if necessary.

Tip 6: Factor in tax implications: Determine the taxability of bond income and adjust the discount rate accordingly to reflect the after-tax returns.

Tip 7: Use a financial calculator or spreadsheet: Utilize specialized tools to simplify the calculation process and enhance accuracy.

Tip 8: Seek professional advice: For complex bond investments or when in doubt, consult a financial advisor for guidance on calculating the discount rate.

By following these tips, investors can effectively calculate the discount rate of a bond, enabling them to make well-informed decisions about potential investments and manage their fixed-income portfolios with greater confidence.

In the concluding section, we will explore advanced techniques and strategies for bond valuation, building upon the foundation established by these essential principles.

Conclusion

This comprehensive guide to calculating the discount rate of a bond has explored various aspects influencing its value and the practical steps involved in its computation. Understanding the intricacies of discount rate calculation equips investors with the knowledge to make informed bond investment decisions.

Key points to remember include:

- The discount rate is a crucial factor in determining the present value of a bond’s future cash flows, and thus its market price.

- Several factors affect the discount rate, including the bond’s maturity date, credit risk, prevailing interest rates, and tax implications.

- Accurate discount rate calculation requires careful consideration of these factors and the use of appropriate formulas and tools.

The ability to calculate the discount rate empowers investors to evaluate bonds, compare their risk-adjusted returns, and construct well-diversified fixed-income portfolios. By mastering this skill, investors can navigate the bond market with greater confidence and make decisions that align with their financial goals.