Trade Discount Percentage Calculation: A Comprehensive Guide

Calculating trade discount percentage is a critical skill in business operations, enabling businesses to determine the discounted price of goods purchased from suppliers. This calculation, expressed as a percentage reduction from the list price, represents the amount saved by the buyer. For example, a 10% trade discount would reduce the cost of a $100 item to $90.

Understanding how to calculate trade discount percentage holds significant importance. It empowers businesses to optimize financial decisions, negotiate favorable terms with suppliers, and enhance profitability. Historically, trade discounts have been a cornerstone of commerce, facilitating efficient and mutually beneficial transactions.

In this article, we will delve into the intricacies of calculating trade discount percentage, exploring various methods and real-world scenarios. By equipping you with this knowledge, we aim to empower you to make informed decisions and maximize the benefits of trade discounts for your business.

How to Calculate Trade Discount Percentage

Understanding the essential aspects of calculating trade discount percentage is crucial for businesses to optimize financial decisions, negotiate favorable terms with suppliers, and enhance profitability.

- Discount Rate: The percentage reduction from the list price.

- Net Price: The price after applying the trade discount.

- Invoice Price: The total amount, including the trade discount.

- Trade Discount Amount: The monetary value of the discount.

- Complementary Discount: An additional discount offered on top of the trade discount.

- Cash Discount: A discount for early payment.

- Quantity Discount: A discount for purchasing larger quantities.

- Seasonal Discount: A discount offered during specific seasons.

These aspects are interconnected and play a vital role in determining the final cost of goods purchased. A thorough understanding of each aspect empowers businesses to maximize the benefits of trade discounts while maintaining strong supplier relationships. By considering factors such as order volume, payment terms, and market conditions, businesses can effectively calculate trade discount percentages and make informed purchasing decisions.

Discount Rate

Discount rate, the percentage reduction from the list price, plays a central role in calculating trade discount percentage. It directly determines the amount of savings a buyer receives on a purchase. Understanding the relationship between discount rate and trade discount percentage is crucial for businesses seeking to optimize their purchasing strategies.

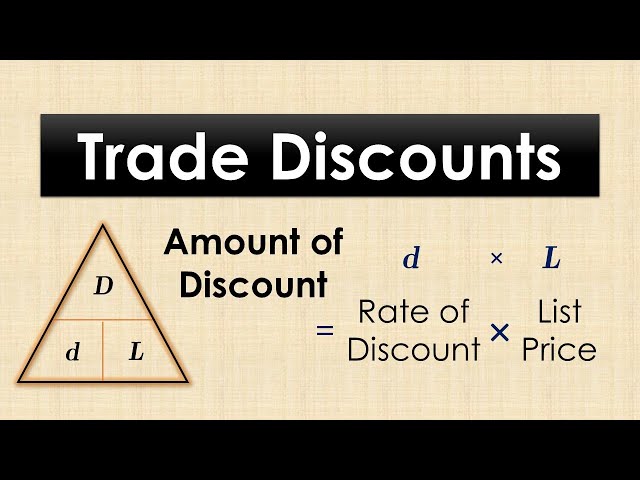

To calculate the trade discount percentage, one must first determine the discount rate offered by the supplier. This rate is typically expressed as a percentage, such as 10%, 15%, or 20%. Once the discount rate is known, it can be applied to the list price to calculate the net price, which is the price after the discount has been applied. The formula for calculating the trade discount percentage is: Trade Discount Percentage = (Discount Rate / List Price) 100

For example, if a supplier offers a 10% discount rate on a product with a list price of $100, the trade discount percentage would be calculated as follows:

Trade Discount Percentage = (10% / $100) 100 = 10%

This means that the buyer would pay $90 for the product, which is a savings of $10.

In conclusion, discount rate is a critical component of calculating trade discount percentage. By understanding the relationship between these two concepts, businesses can make informed decisions about their purchases and maximize their savings.

Net Price

In the realm of trade discount calculation, net price holds immense significance as the bedrock upon which all other aspects rest. It represents the final price paid by the buyer after the trade discount has been applied, making it a crucial factor in determining the overall cost and profitability of a transaction.

- Discounted Amount: The trade discount, expressed as a percentage, is deducted from the list price to arrive at the net price. This amount represents the monetary value of the discount received by the buyer.

- Effective Price: The net price serves as the effective price paid by the buyer, taking into account the discount. It forms the basis for subsequent calculations, such as tax and shipping costs, and ultimately affects the total cost of the purchase.

- Profit Margin Analysis: Businesses can analyze their profit margins by comparing the net price to the cost of goods sold (COGS). A higher net price relative to COGS indicates a greater profit margin, while a lower net price may necessitate adjustments to pricing or cost structure.

- Competitive Advantage: Offering competitive net prices can provide businesses with a strategic advantage by attracting and retaining customers. By carefully calculating trade discounts, businesses can strike a balance between maintaining profitability and meeting market demands.

In essence, net price serves as the cornerstone of trade discount calculation, influencing everything from the buyer’s cost to the seller’s profit margin. Understanding the intricacies of net price empowers businesses to make informed decisions about pricing, discounts, and overall financial strategy.

Invoice Price

Understanding the relationship between “Invoice Price: The total amount, including the trade discount” and “how to calculate trade discount percentage” is essential for businesses to optimize their financial operations and make informed purchasing decisions. Invoice price plays a pivotal role in the calculation of trade discount percentage, as it represents the final amount paid by the buyer after the discount has been applied.

The calculation of trade discount percentage begins with determining the discount rate offered by the supplier. This rate is then applied to the list price of the product or service to arrive at the net price, which is the price before any additional discounts or charges are applied. The invoice price is then calculated by adding the net price and any applicable taxes or shipping costs.

Real-life examples of invoice price within the context of trade discount calculation are abundant. Consider a business that purchases $10,000 worth of inventory from a supplier. The supplier offers a 10% trade discount, resulting in a net price of $9,000. If the business also incurs $500 in shipping costs, the invoice price would be $9,500.

Practical applications of understanding the connection between invoice price and trade discount percentage extend to various aspects of business operations. Businesses can leverage this knowledge to:

- Negotiate favorable trade discounts with suppliers.

- Accurately track and manage inventory costs.

- Identify opportunities to reduce overall purchasing expenses.

- Enhance financial planning and budgeting.

In conclusion, invoice price is a critical component of calculating trade discount percentage and plays a significant role in determining the final cost of goods or services purchased. By understanding this relationship, businesses can make informed decisions, optimize their financial performance, and gain a competitive edge in the marketplace.

Trade Discount Amount

Within the context of calculating trade discount percentage, understanding the “Trade Discount Amount: The monetary value of the discount” holds significant importance. It represents the actual reduction in price that a buyer receives when purchasing goods or services from a supplier. Accurately determining the trade discount amount is crucial for businesses to optimize their financial operations and make informed purchasing decisions.

- Discount Rate: The trade discount amount is directly related to the discount rate offered by the supplier. A higher discount rate results in a larger trade discount amount, leading to greater savings for the buyer.

- List Price: The list price of the product or service serves as the basis for calculating the trade discount amount. The trade discount amount is determined by multiplying the list price by the discount rate.

- Net Price: The net price, which is the price after applying the trade discount, is directly influenced by the trade discount amount. A larger trade discount amount results in a lower net price, benefiting the buyer.

- Invoice Price: The invoice price, which includes the net price plus any applicable taxes or shipping costs, is affected by the trade discount amount. Understanding the trade discount amount allows businesses to accurately calculate the total cost of their purchases.

By recognizing the interconnections between these facets, businesses can effectively calculate trade discount percentages and leverage them to maximize their profitability. Furthermore, businesses can negotiate favorable trade discounts with suppliers, track inventory costs accurately, and make informed decisions regarding their purchasing strategies. Ultimately, understanding the “Trade Discount Amount: The monetary value of the discount” empowers businesses to optimize their financial performance and gain a competitive edge in the marketplace.

Complementary Discount

Understanding the concept of “Complementary Discount: An additional discount offered on top of the trade discount” is essential when calculating trade discount percentage. It represents an extra layer of savings that can significantly reduce the cost of goods or services purchased from a supplier. Exploring various facets of complementary discounts empowers businesses to optimize their financial performance and make informed purchasing decisions.

- Negotiation Strategy: Complementary discounts can be negotiated with suppliers as part of the overall pricing strategy. By leveraging their purchasing power and building strong supplier relationships, businesses can secure favorable complementary discounts that enhance their profitability.

- Volume-Based Discounts: Suppliers may offer complementary discounts for larger order quantities. This encourages businesses to purchase in bulk, resulting in cost savings and reduced inventory management costs.

- Seasonal Discounts: Complementary discounts are sometimes offered during specific seasons or periods to promote sales and clear inventory. Businesses can time their purchases strategically to take advantage of these discounts and minimize their expenses.

- Loyalty Rewards: Suppliers may provide complementary discounts to loyal customers as a token of appreciation for their continued business. These discounts can incentivize repeat purchases and strengthen supplier-buyer relationships.

In conclusion, complementary discounts play a significant role in calculating trade discount percentage and optimizing purchasing strategies. By understanding the different facets of complementary discounts, businesses can effectively negotiate favorable terms with suppliers, reduce their overall costs, and gain a competitive edge in the marketplace.

Cash Discount

Cash discount, offered as an incentive for early payment, plays a significant role in calculating trade discount percentage. It directly impacts the net price paid by the buyer and can influence purchasing decisions. Understanding the connection between cash discount and trade discount percentage is crucial for businesses seeking to optimize their financial performance.

The relationship between cash discount and trade discount percentage is reciprocal. Cash discount is typically calculated as a percentage of the invoice price, which includes the trade discount. By offering a cash discount, suppliers encourage buyers to pay their invoices early, improving their cash flow and reducing the risk of late payments. In return, buyers benefit from additional savings beyond the trade discount, leading to a lower net price.

For example, consider a supplier offering a 2% cash discount for payments made within 10 days and a trade discount of 5%. If the invoice price is $1,000, the buyer would save $20 by paying within the discount period. The effective trade discount percentage, considering both the cash discount and trade discount, would be 7% (i.e., ($20 + $50)/$1000 * 100).

Understanding the interplay between cash discount and trade discount percentage empowers businesses to make informed decisions. By leveraging cash discounts, businesses can reduce their overall purchasing costs and improve their cash flow. Suppliers, on the other hand, can incentivize timely payments and enhance their financial stability. This mutually beneficial arrangement fosters stronger supplier-buyer relationships.

Quantity Discount

Quantity discount, as an integral part of calculating trade discount percentage, plays a pivotal role in optimizing purchasing decisions. It incentivizes buyers to purchase larger quantities, offering cost savings and improved profitability.

- Volume Thresholds: Suppliers establish specific volume thresholds to qualify for quantity discounts. These thresholds vary depending on the industry, product, and supplier’s pricing strategy.

- Tiered Discounts: Quantity discounts can be structured as tiered discounts, where buyers receive progressively larger discounts as their purchase volume increases.

- Negotiated Discounts: Buyers with significant purchasing power can negotiate customized quantity discounts with suppliers, securing even more favorable terms.

- Inventory Considerations: Quantity discounts encourage buyers to purchase in bulk, which can impact inventory management and storage costs. Careful planning is necessary to balance the benefits of quantity discounts with potential inventory risks.

In conclusion, understanding quantity discounts and their implications is crucial for calculating trade discount percentage effectively. By considering volume thresholds, tiered discounts, negotiation strategies, and inventory implications, businesses can leverage quantity discounts to optimize their purchasing costs, enhance their profitability, and build stronger supplier relationships.

Seasonal Discount

In calculating trade discount percentage, seasonal discounts hold significance as they offer unique opportunities for businesses to optimize their purchasing strategies. These discounts are provided by suppliers during specific seasons or periods to promote sales and clear inventory.

- Timing and Duration: Seasonal discounts are offered for a limited time, typically coinciding with seasonal changes, holidays, or end-of-season sales. Businesses can align their purchases with these periods to take advantage of substantial savings.

- Product Categories: Seasonal discounts often apply to specific product categories that are in high demand during certain seasons. For instance, winter apparel may be discounted during the winter season.

- Negotiation Potential: Businesses with strong supplier relationships may be able to negotiate more favorable seasonal discount terms. This can involve securing higher discount rates or longer discount periods.

- Inventory Management: Seasonal discounts encourage businesses to purchase inventory in advance of peak demand periods. Careful planning is required to avoid overstocking and ensure efficient inventory management.

In summary, understanding seasonal discounts and their implications in calculating trade discount percentage enables businesses to make informed purchasing decisions. By considering timing, product categories, negotiation potential, and inventory management, businesses can leverage seasonal discounts to reduce costs, increase profitability, and meet customer demands effectively.

Frequently Asked Questions About Calculating Trade Discount Percentage

This FAQ section aims to address common queries and clarify various aspects related to calculating trade discount percentage, providing valuable insights for better understanding and implementation.

Question 1: What is the formula for calculating trade discount percentage?

Answer: Trade discount percentage = (Discount amount / List price) * 100

Question 2: How does a complementary discount differ from a trade discount?

Answer: A complementary discount is an additional discount offered on top of the trade discount, typically for larger order quantities or early payments.

Question 3: Can a business negotiate trade discounts with suppliers?

Answer: Yes, businesses with strong relationships and significant purchasing power can negotiate favorable trade discount terms with suppliers.

Question 4: How do seasonal discounts impact trade discount percentage calculations?

Answer: Seasonal discounts, offered during specific periods, can lead to substantial savings when incorporated into trade discount percentage calculations.

Question 5: What is the role of quantity discounts in calculating trade discount percentage?

Answer: Quantity discounts incentivize larger purchases by offering reduced prices per unit, influencing the overall trade discount percentage.

Question 6: How can businesses optimize their trade discount strategies?

Answer: Analyzing supplier offerings, negotiating favorable terms, understanding discount types, and planning purchases strategically can help businesses optimize their trade discount strategies.

These FAQs provide a solid foundation for understanding the intricacies of calculating trade discount percentage. In the next section, we will delve deeper into practical applications and explore effective strategies for maximizing the benefits of trade discounts.

Tips for Calculating Trade Discount Percentage

This section provides practical tips and strategies to help businesses effectively calculate trade discount percentage, optimize their purchasing decisions, and maximize their profitability. By implementing these tips, businesses can harness the full benefits of trade discounts and gain a competitive edge in the marketplace.

Tip 1: Establish Strong Supplier Relationships: Building strong relationships with suppliers can lead to more favorable trade discount terms, including higher discount rates and flexible payment options.

Tip 2: Negotiate Favorable Discounts: Businesses should not hesitate to negotiate trade discounts with suppliers, especially when purchasing large quantities or making repeat orders.

Tip 3: Understand Different Discount Types: Familiarize yourself with various types of discounts, such as complementary discounts, cash discounts, and seasonal discounts, to maximize savings opportunities.

Tip 4: Plan Purchases Strategically: Time your purchases to coincide with seasonal discounts or promotions to secure the best possible prices.

Tip 5: Consider Quantity Discounts: Take advantage of quantity discounts offered by suppliers to reduce the per-unit cost when purchasing larger volumes.

Tip 6: Calculate Net Price Accurately: Always calculate the net price after applying trade discounts to determine the actual cost of goods or services.

Tip 7: Track and Monitor Discounts: Maintain a record of all trade discounts received to ensure accurate accounting and identify potential discrepancies.

By following these tips, businesses can confidently calculate trade discount percentage, optimize their purchasing strategies, and improve their overall financial performance.

In the concluding section, we will discuss the importance of ongoing monitoring and evaluation to maximize the benefits of trade discounts and maintain strong supplier relationships over the long term.

Conclusion

Calculating trade discount percentage is essential for businesses to optimize their purchasing strategies and enhance profitability. Understanding the various types of discounts, including trade discounts, complementary discounts, and quantity discounts, empowers businesses to negotiate favorable terms with suppliers and secure the best possible prices. Careful planning and monitoring of trade discounts, coupled with strong supplier relationships, are crucial for maximizing the benefits and achieving long-term financial success.

In today’s competitive business environment, effectively calculating trade discount percentage is no longer merely an accounting exercise but a strategic imperative. By leveraging the insights and strategies outlined in this article, businesses can unlock significant cost savings, strengthen supplier partnerships, and gain a competitive edge in the marketplace. As market dynamics continue to evolve, staying abreast of trade discount best practices and trends will be essential for businesses to thrive and achieve sustainable growth.