A discount bond yield to maturity calculator is a tool that computes the yield to maturity (YTM) of a discount bond. A discount bond is a bond that trades below its face value. The YTM is the annual rate of return an investor can expect to earn if they hold the bond until maturity. For instance, if a $1,000 face value bond is purchased for $900 and matures in 5 years, the YTM calculator can determine the annual percentage return.

Calculating discount bond YTM is crucial because it offers valuable insights into the bond’s investment potential. It aids investors in making informed decisions about bond purchases and managing their portfolios. Historically, the development of electronic calculators and financial software has simplified and enhanced the process of YTM calculation for various types of bonds.

This article delves into the intricacies of discount bond yield to maturity calculators, exploring their significance, benefits, and practical applications. By understanding the nuances of YTM calculations, investors can optimize their bond investment strategies and navigate the complexities of the bond market.

discount bond yield to maturity calculator

The discount bond yield to maturity calculator plays a pivotal role in understanding the dynamics of discount bonds. It offers insights into crucial aspects like present value, future value, coupon payments, and maturity dates. These aspects are fundamental to assessing the profitability and risk associated with discount bond investments.

- Present Value

- Future Value

- Coupon Payments

- Maturity Date

- Discount Rate

- Yield to Maturity

- Bond Pricing

- Investment Analysis

- Portfolio Management

By considering these aspects, investors can make informed decisions about buying, selling, or holding discount bonds. The calculator provides a comprehensive analysis of these factors, enabling investors to optimize their investment strategies. It helps them evaluate the potential returns, risks, and cash flow patterns associated with discount bond investments.

Present Value

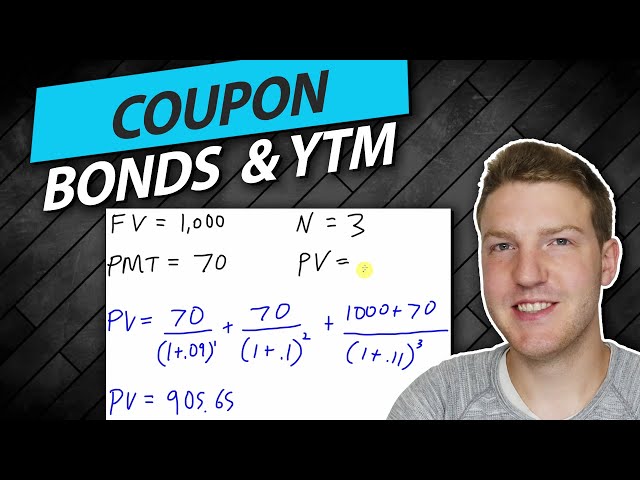

Present Value (PV) plays a pivotal role in the realm of discount bond yield to maturity calculators. It represents the current worth of a future sum of money, discounted at a specific rate. In the context of discount bonds, PV is crucial for determining the bond’s yield to maturity (YTM), which is essential for evaluating its profitability and risk.

The discount bond yield to maturity calculator leverages PV to determine the YTM by iteratively adjusting the discount rate until the PV of the bond’s future cash flows (coupon payments and face value at maturity) equals the bond’s purchase price. This process is critical because it allows investors to assess the bond’s potential return and compare it to other investment opportunities.

Understanding the connection between PV and the discount bond yield to maturity calculator is essential for investors seeking to make informed decisions about discount bond investments. By considering the impact of different discount rates on the PV of the bond’s cash flows, investors can determine the YTM that aligns with their investment goals and risk tolerance. This understanding empowers investors to optimize their portfolio allocation and maximize returns.

Future Value

Future Value (FV) holds great significance in the realm of discount bond yield to maturity calculators. It represents the value of an investment at a specific point in the future, taking into account the effects of compounding interest. In the context of discount bonds, FV is a critical component in calculating the bond’s yield to maturity (YTM), which is a key metric for assessing its profitability and risk.

- Maturity Value

The Maturity Value is the face value of the bond, which is paid to the bondholder upon maturity. It is a key input in calculating the FV of the bond.

- Coupon Payments

Coupon Payments are periodic interest payments made to the bondholder throughout the life of the bond. They are added to the Maturity Value to determine the total FV.

- Time to Maturity

Time to Maturity refers to the period between the purchase date and the maturity date of the bond. It is a crucial factor in determining the FV, as it influences the impact of compounding interest.

- Discount Rate

The Discount Rate is the rate at which the bond’s future cash flows are discounted to calculate its present value. It is closely related to the YTM, and both values influence the FV of the bond.

Understanding the interplay between Future Value and the discount bond yield to maturity calculator is essential for investors seeking to evaluate and compare discount bond investments. By considering the impact of different factors such as maturity value, coupon payments, time to maturity, and discount rate, investors can gain insights into the potential returns and risks associated with these bonds. This understanding empowers them to make informed investment decisions and optimize their portfolio allocation for maximum returns.

Coupon Payments

Coupon Payments are an integral part of discount bond yield to maturity calculators, as they represent the periodic interest payments made to the bondholder throughout the life of the bond. These payments are a crucial factor in determining the bond’s overall yield and attractiveness to investors.

- Frequency of Payments

Coupon payments can be made annually, semi-annually, quarterly, or even monthly. The frequency of payments affects the bond’s yield and liquidity.

- Coupon Rate

The coupon rate is the fixed interest rate that is paid on the bond’s face value. It is a key determinant of the bond’s yield and is used in conjunction with the discount rate to calculate the bond’s present value.

- Payment Dates

Coupon payments are typically made on specific dates throughout the life of the bond. These dates are specified in the bond’s prospectus and are used to calculate the bond’s yield to maturity.

- Default Risk

The risk that the bond issuer may default on its obligation to make coupon payments is a crucial consideration for investors. Default risk can affect the bond’s yield and marketability.

Understanding the various facets of Coupon Payments is essential for investors seeking to evaluate and compare discount bond investments. By considering the frequency of payments, coupon rate, payment dates, and default risk, investors can gain a comprehensive view of the bond’s potential returns and risks. This understanding empowers them to make informed investment decisions and optimize their portfolio allocation for maximum returns.

Maturity Date

Maturity Date holds significance in the context of discount bond yield to maturity calculators as it represents the specific date on which the bond matures and the principal amount is repaid to the bondholder. This date is a crucial component of the calculation, as it determines the time horizon over which the bond’s cash flows will be received. The maturity date, along with other factors such as coupon payments and the discount rate, directly impacts the bond’s yield to maturity (YTM).

In practice, the maturity date influences the YTM through its effect on the present value of the bond’s future cash flows. Bonds with longer maturities typically have higher present values due to the extended period over which interest payments are received. Consequently, they tend to have lower YTMs compared to bonds with shorter maturities. This relationship highlights the inverse correlation between maturity date and YTM.

Understanding the connection between maturity date and the discount bond yield to maturity calculator is essential for investors seeking to evaluate and compare discount bond investments. By considering the impact of maturity date on YTM, investors can make informed decisions about the bonds that align with their investment goals and risk tolerance. This understanding empowers them to optimize their portfolio allocation and maximize returns.

Discount Rate

Discount Rate, a crucial element in discount bond yield to maturity calculators, plays a significant role in determining the present value of future cash flows associated with discount bonds. By incorporating this rate, investors can assess the bond’s potential return and make informed investment decisions.

- Prevailing Market Rates

Discount rates often reflect prevailing market interest rates, influenced by factors such as economic conditions, inflation expectations, and central bank policies. These rates serve as benchmarks against which the bond’s yield to maturity is compared.

- Investor’s Required Rate of Return

Investors establish a minimum acceptable rate of return based on their risk tolerance and investment goals. The discount rate should align with this required return to ensure that the bond meets the investor’s financial objectives.

- Bond’s Creditworthiness

The creditworthiness of the bond issuer directly impacts the discount rate. Bonds issued by entities with higher credit ratings typically have lower discount rates, reflecting lower default risk.

- Term to Maturity

The time horizon until the bond’s maturity date influences the discount rate. Generally, longer-term bonds have higher discount rates due to the increased uncertainty and risk associated with longer investment periods.

Understanding the facets of Discount Rate empowers investors to effectively utilize discount bond yield to maturity calculators. By considering the prevailing market rates, their required rate of return, the bond’s creditworthiness, and the term to maturity, investors can accurately assess the potential yield and suitability of discount bonds for their investment portfolios.

Yield to Maturity

Yield to Maturity (YTM) is a critical concept in the realm of discount bond yield to maturity calculators, representing the annualized rate of return an investor can expect to earn if they hold the bond until its maturity date. Understanding the facets of YTM is essential for investors seeking to make informed decisions about discount bond investments.

- Bond Pricing

YTM plays a pivotal role in determining the price of a discount bond. Bonds with higher YTMs tend to trade at lower prices, making them attractive to investors seeking higher returns.

- Maturity Date

The maturity date of a bond significantly influences its YTM. Generally, bonds with longer maturities have higher YTMs due to the increased uncertainty and risk associated with longer investment horizons.

- Market Conditions

YTMs are influenced by prevailing market conditions, such as interest rates and economic forecasts. Bonds with YTMs that are higher than prevailing market rates are considered attractive investment opportunities.

- Creditworthiness

The creditworthiness of the bond issuer directly impacts its YTM. Bonds issued by entities with higher credit ratings typically have lower YTMs, reflecting lower default risk.

In summary, YTM is a multifaceted concept that encompasses bond pricing, maturity date, market conditions, and creditworthiness. By considering these facets, investors can harness the power of discount bond yield to maturity calculators to evaluate and compare investment opportunities, optimize their portfolio allocation, and maximize returns.

Bond Pricing

Bond Pricing plays a crucial role in the context of discount bond yield to maturity calculators. It involves determining the fair market value of a bond based on various factors, including the bond’s yield to maturity (YTM), maturity date, coupon payments, and creditworthiness of the issuer. Understanding the intricacies of Bond Pricing is essential for investors to make informed decisions about discount bond investments and optimize their portfolio allocation.

- Face Value

The face value, also known as the par value, represents the principal amount of the bond that the issuer promises to repay at maturity. It serves as a reference point for calculating interest payments and determining the bond’s overall value.

- Coupon Payments

Coupon payments refer to the periodic interest payments made to bondholders throughout the life of the bond. The frequency and amount of these payments influence the bond’s attractiveness to investors and its overall yield.

- Maturity Date

The maturity date indicates the specific date on which the bond matures and the face value is repaid. The time remaining until maturity impacts the bond’s present value and, consequently, its yield to maturity.

- Creditworthiness

The creditworthiness of the bond issuer is a key factor in determining the bond’s risk profile and yield to maturity. Bonds issued by entities with higher credit ratings typically have lower yields, as they pose less risk to investors.

In summary, Bond Pricing is a multifaceted concept that considers the bond’s face value, coupon payments, maturity date, and the issuer’s creditworthiness. By understanding the interplay of these factors and their impact on yield to maturity, investors can effectively evaluate and compare discount bond investments, enabling them to make informed decisions and maximize returns.

Investment Analysis

Investment Analysis plays a pivotal role in the context of discount bond yield to maturity calculators, empowering investors with the insights needed to make informed decisions about potential bond investments. By evaluating various aspects of a discount bond, investors can assess its potential risks and rewards, aligning their investment choices with their financial objectives.

- Risk Assessment

Investment analysis involves assessing the potential risks associated with a discount bond investment. This includes evaluating the creditworthiness of the issuer, the sensitivity of the bond’s price to interest rate changes, and the overall market conditions.

- Return Potential

Investors use investment analysis to determine the potential return they can expect from a discount bond investment. This involves considering the bond’s yield to maturity, the frequency and amount of coupon payments, and the potential for capital appreciation.

- Liquidity Analysis

Investment analysis also considers the liquidity of a discount bond, which refers to the ease with which it can be bought or sold in the market. This aspect is important for investors who may need to adjust their portfolio or access funds quickly.

- Comparison and Selection

Investment analysis enables investors to compare different discount bond options and select the ones that best meet their investment goals. By evaluating the risk, return, and liquidity characteristics of various bonds, investors can make informed decisions and optimize their portfolio allocation.

In summary, Investment Analysis provides a comprehensive framework for evaluating discount bond investments, empowering investors to make informed decisions that align with their financial objectives. By considering the risk, return, liquidity, and comparative aspects of discount bonds, investors can increase their chances of achieving successful investment outcomes.

Portfolio Management

Portfolio Management plays a crucial role in the realm of discount bond yield to maturity calculators. It involves making informed decisions about the selection, allocation, and management of discount bonds within an investment portfolio. Understanding the connection between Portfolio Management and discount bond yield to maturity calculators is essential for investors seeking to optimize their returns and manage their risk exposure.

As a critical component of discount bond yield to maturity calculators, Portfolio Management allows investors to determine the optimal mix of discount bonds based on their individual investment goals, risk tolerance, and time horizon. By considering the yield to maturity, maturity date, and creditworthiness of various discount bonds, investors can create a diversified portfolio that aligns with their financial objectives.

In practice, Portfolio Management involves ongoing monitoring and adjustment of the bond portfolio to respond to changing market conditions and economic factors. Discount bond yield to maturity calculators provide valuable insights into the potential impact of interest rate fluctuations and market volatility on the portfolio’s overall yield and risk profile. This enables investors to make proactive decisions to rebalance their portfolio, hedge against potential risks, and maximize returns.

In summary, Portfolio Management is a vital aspect of discount bond yield to maturity calculators, empowering investors to construct and manage diversified bond portfolios. It provides a framework for evaluating investment opportunities, assessing risk, and optimizing returns, enabling investors to achieve their financial goals and navigate the complexities of the bond market.

Discount Bond Yield to Maturity Calculator FAQs

This section addresses frequently asked questions (FAQs) about discount bond yield to maturity calculators, providing concise and informative answers to clarify common queries and misconceptions. These FAQs aim to enhance the understanding and practical application of discount bond yield to maturity calculators for effective investment decisions.

Question 1: What is the purpose of a discount bond yield to maturity calculator?

Answer: A discount bond yield to maturity calculator is a tool that computes the yield to maturity (YTM) of a discount bond, providing insights into the bond’s potential return and risk.

Question 2: How do I use a discount bond yield to maturity calculator?

Answer: Using a discount bond yield to maturity calculator typically involves entering the bond’s face value, purchase price, coupon payments, and maturity date. The calculator then computes the YTM based on these inputs.

Question 3: What factors influence the yield to maturity of a discount bond?

Answer: The YTM of a discount bond is influenced by factors such as the bond’s face value, purchase price, coupon payments, maturity date, and prevailing market interest rates.

Question 4: How can I interpret the yield to maturity calculated by a discount bond yield to maturity calculator?

Answer: The YTM represents the annualized rate of return an investor can expect to earn if they hold the bond until maturity, considering the bond’s purchase price and future cash flows.

Question 5: What are the limitations of using a discount bond yield to maturity calculator?

Answer: While discount bond yield to maturity calculators provide valuable insights, they do not consider all factors that may affect the bond’s actual return, such as market volatility and the issuer’s creditworthiness.

Question 6: How can I choose the right discount bond yield to maturity calculator?

Answer: When selecting a discount bond yield to maturity calculator, consider factors such as accuracy, ease of use, and the ability to handle various bond types and scenarios.

In summary, discount bond yield to maturity calculators serve as useful tools for evaluating potential bond investments, but it is essential to understand their limitations and use them in conjunction with other analysis methods to make informed investment decisions.

The next section will delve into the practical applications of discount bond yield to maturity calculators, exploring how investors can leverage these tools to maximize returns and manage risk in their bond portfolios.

TIPS for Using Discount Bond Yield to Maturity Calculators

To harness the full potential of discount bond yield to maturity calculators, it is essential to adopt a strategic approach. This section provides practical tips to guide investors in effectively utilizing these tools and maximizing their investment outcomes.

1. Input Accurate Bond Parameters

Ensure that all the bond parameters, including face value, purchase price, coupon payments, and maturity date, are entered correctly. Inaccurate inputs can lead to misleading YTM calculations.

2. Consider Market Interest Rates

Yield to maturity should be evaluated in the context of prevailing market interest rates. Compare the calculated YTM with current rates to assess the bond’s attractiveness and potential return.

3. Assess Creditworthiness of the Issuer

The creditworthiness of the bond issuer significantly influences the YTM. Use credit rating agencies’ assessments or other indicators to gauge the issuer’s ability to fulfill its obligations.

4. Factor in Reinvestment Risk

Consider the reinvestment risk associated with coupon payments. If interest rates decline, reinvesting these payments may result in lower returns than the calculated YTM.

5. Use Multiple Calculators

Cross-check your results by utilizing different discount bond yield to maturity calculators. Slight variations in calculations can occur due to different methodologies.

6. Understand Limitations

Recognize that discount bond yield to maturity calculators provide an estimate based on certain assumptions. They do not account for all factors that may affect the bond’s actual return.

7. Seek Professional Advice

If needed, consult with a financial advisor or investment professional to interpret the results and make informed investment decisions.

By implementing these tips, investors can enhance the accuracy and effectiveness of their discount bond yield to maturity calculations, leading to more informed investment decisions and potentially improved portfolio performance.

The following section discusses advanced strategies for utilizing discount bond yield to maturity calculators, building upon the foundational tips provided here.

Conclusion

In-depth exploration of discount bond yield to maturity calculators reveals their significance as multifaceted tools for evaluating bond investments. These calculators provide insights into crucial aspects such as present value, future value, and yield to maturity, empowering investors to make informed decisions. By considering factors like coupon payments, maturity date, and discount rate, investors can assess the potential returns and risks associated with discount bonds.

Key takeaways include understanding the interplay between present value and yield to maturity, recognizing the influence of future value on investment decisions, and leveraging the impact of discount rate on bond pricing. These concepts are interconnected and collectively contribute to the effective use of discount bond yield to maturity calculators.