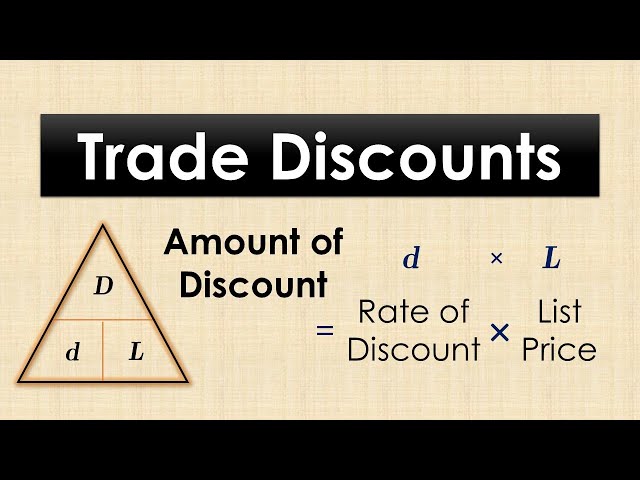

The trade discount formula is an accounting tool used to calculate the amount of a discount offered to a customer when they purchase goods. For instance, a customer may be offered a 10% trade discount on an item that costs $100. The trade discount formula, in this case, would be $100 * 0.10 = $10.00, resulting in a discounted price of $90.00.

Understanding the trade discount formula is crucial for businesses as it offers numerous benefits, helps in inventory management, and improves profitability. Historically, trade discounts have been a common practice in various industries, with their usage dating back to the early days of commerce.

Delving into the intricacies of the trade discount formula, this article will explore its components, applications, and the key factors that impact its calculation.

Trade Discount Formula in Accounting

The trade discount formula holds significant importance in accounting as it provides a structured approach to calculating discounts offered to customers. Understanding its key aspects is crucial for effective inventory management and maximizing profitability.

- Calculation: Determining the discount amount based on the list price and discount rate.

- Impact on Revenue: Recognizing the reduction in revenue due to discounts offered.

- Inventory Valuation: Adjusting inventory values to reflect discounted prices.

- Customer Relationships: Building and maintaining strong relationships by offering competitive discounts.

- Pricing Strategy: Setting optimal prices that consider both profit margins and customer demand.

- Cash Flow: Managing cash flow by ensuring timely collection of discounted payments.

- Financial Reporting: Disclosing trade discounts in financial statements to provide transparency.

- Tax Implications: Understanding the impact of trade discounts on tax calculations.

- Industry Practices: Adhering to industry norms and best practices related to trade discounts.

These aspects collectively contribute to the effective use of the trade discount formula in accounting. By considering these factors, businesses can optimize their pricing strategies, enhance customer satisfaction, and maintain accurate financial records.

Calculation

The calculation of the discount amount based on the list price and discount rate is the cornerstone of the trade discount formula in accounting. Without this critical component, businesses would lack a standardized method to determine the discounted price offered to customers. This calculation directly influences the revenue recognition, inventory valuation, and customer pricing strategies within a company’s accounting practices.

In practice, the trade discount formula is applied in various scenarios. For instance, a clothing retailer may offer a 20% trade discount to a wholesale customer on a dress with a list price of $100. Using the formula, the discount amount is calculated as $100 x 0.20 = $20. Consequently, the discounted price for the wholesale customer becomes $80.

Understanding this calculation is imperative for businesses to optimize their pricing strategies. By accurately determining the discount amount, companies can ensure they maintain healthy profit margins while remaining competitive in the market. Moreover, it helps them manage inventory levels effectively, as discounted items may require different storage and handling considerations.

In conclusion, the calculation of the discount amount based on the list price and discount rate is an essential aspect of the trade discount formula in accounting. It serves as the foundation for revenue recognition, inventory valuation, and pricing decisions. By comprehending this calculation, businesses can enhance their financial reporting accuracy and make informed choices that drive profitability and customer satisfaction.

Impact on Revenue

The impact of trade discounts on revenue is a crucial aspect of the trade discount formula in accounting. It involves recognizing the reduction in revenue due to discounts offered to customers, which can affect a company’s financial performance and decision-making.

- Reduced Sales Revenue: Discounts directly reduce the sales revenue generated from each transaction, impacting the overall revenue recognized by the business.

- Cost of Goods Sold (COGS): Discounts may affect the COGS if inventory is valued at discounted prices. This can impact gross profit margins and profitability.

- Financial Statements: Trade discounts are typically disclosed in financial statements, such as the income statement and balance sheet, to provide transparency about the impact on revenue and expenses.

- Tax Implications: Discounts can impact tax calculations, as they affect the taxable income and sales tax liability of a business.

Understanding the impact on revenue is essential for businesses to make informed decisions regarding pricing, inventory management, and customer relationships. By recognizing and analyzing the reduction in revenue due to discounts offered, companies can optimize their strategies to maintain profitability while fostering customer loyalty.

Inventory Valuation

Inventory valuation plays a critical role in accounting, and the trade discount formula significantly impacts this process. Businesses need to adjust their inventory values to reflect the discounted prices offered to customers. This adjustment ensures accurate financial reporting and has several implications for businesses.

- Cost of Goods Sold (COGS): Discounts directly affect COGS, as the discounted prices are used to calculate the cost of goods sold. This impacts gross profit margins and profitability.

- Balance Sheet Valuation: Inventory is typically valued at the lower of cost or market value. Trade discounts can impact the market value of inventory, which affects the balance sheet valuation.

- FIFO vs. Weighted Average Costing: The inventory costing method used can influence the impact of trade discounts on inventory valuation. FIFO assumes the oldest inventory is sold first, while weighted average costing considers all inventory purchases.

- Tax Implications: Inventory valuation can affect taxable income and sales tax liability, as discounts reduce the taxable value of inventory.

Adjusting inventory values to reflect discounted prices is crucial for maintaining accurate financial records and making informed decisions. By considering the impact on COGS, balance sheet valuation, inventory costing methods, and tax implications, businesses can effectively manage their inventory and optimize their financial performance.

Customer Relationships

Within the realm of “trade discount formula in accounting,” fostering customer relationships through competitive discounts holds significant importance. Offering discounts not only attracts new customers but also strengthens existing relationships, leading to increased customer loyalty and repeat business.

- Customer Acquisition: Competitive discounts can entice potential customers to make their first purchase, expanding the customer base and creating opportunities for future sales.

- Customer Retention: Offering discounts to existing customers shows appreciation and encourages them to continue doing business with the company, building long-term relationships.

- Increased Sales Volume: Discounts can incentivize customers to purchase larger quantities or more frequently, resulting in increased sales volume and revenue.

- Positive Customer Perception: Customers perceive businesses that offer competitive discounts as being customer-centric and value-driven, enhancing the company’s reputation and brand image.

In conclusion, leveraging the trade discount formula to offer competitive discounts is a strategic approach to building and maintaining strong customer relationships. By attracting new customers, retaining existing ones, increasing sales volume, and shaping positive customer perceptions, businesses can drive growth, enhance profitability, and gain a competitive edge in the marketplace.

Pricing Strategy

The trade discount formula in accounting is closely linked to pricing strategy, which involves setting optimal prices that consider both profit margins and customer demand. Pricing strategy plays a critical role in determining the effectiveness of trade discounts offered to customers.

When setting prices, businesses need to strike a balance between maximizing profit margins and attracting customers. Offering trade discounts can be an effective way to attract customers and increase sales volume, but it’s important to ensure that the discounts offered do not significantly erode profit margins.

Real-life examples of pricing strategy within the context of trade discounts include:

- A clothing retailer offering a 20% trade discount to wholesale customers to incentivize bulk purchases.

- A software company offering a subscription-based pricing model with discounts for annual or multi-year commitments.

Understanding the relationship between pricing strategy and trade discounts is crucial for businesses to optimize their pricing and discount strategies. By considering both profit margins and customer demand, businesses can set optimal prices that attract customers, increase sales volume, and maintain healthy profit margins.

Cash Flow

The connection between “Cash Flow: Managing cash flow by ensuring timely collection of discounted payments.” and “trade discount formula in accounting” is crucial for businesses to maintain a healthy financial position. Discounts offered to customers through the trade discount formula can impact cash flow if payments are not collected promptly.

When trade discounts are offered, the business extends credit to its customers, allowing them to purchase goods or services at a reduced price. However, if customers do not pay their invoices on time, it can lead to cash flow problems for the business.

To mitigate this risk, businesses need to have a robust system for managing cash flow and ensuring timely collection of discounted payments. This involves:

- Establishing clear payment terms and communicating them to customers.

- Sending invoices promptly and following up on overdue payments.

- Offering incentives for early payment, such as additional discounts or loyalty rewards.

- Having a collections policy in place and following it consistently.

By effectively managing cash flow and ensuring timely collection of discounted payments, businesses can avoid potential cash flow problems and maintain a healthy financial position.

Financial Reporting

Financial Reporting: Disclosing trade discounts in financial statements to provide transparency is a critical component of the trade discount formula in accounting. Trade discounts are reductions in the list price of goods or services offered to customers, and they are typically disclosed in the notes to financial statements. This disclosure provides transparency to users of the financial statements, allowing them to understand the impact of trade discounts on the company’s revenue and profitability.

The trade discount formula is used to calculate the amount of the discount that is offered to customers. This formula takes into account the list price of the goods or services, the discount rate, and any other relevant factors. The resulting discount amount is then deducted from the list price to arrive at the net price that the customer will pay.

Real-life examples of Financial Reporting: Disclosing trade discounts in financial statements to provide transparency include:

- A company that offers a 10% trade discount to all customers who purchase more than $1,000 of goods or services in a single transaction.

- A company that offers a 5% trade discount to all customers who pay their invoices within 30 days of the invoice date.

Understanding the connection between Financial Reporting: Disclosing trade discounts in financial statements to provide transparency and the trade discount formula in accounting is important for several reasons. First, it allows users of financial statements to understand the impact of trade discounts on the company’s revenue and profitability. Second, it helps users of financial statements to make more informed decisions about the company.

Tax Implications

Within the framework of “trade discount formula in accounting,” comprehending “Tax Implications: Understanding the impact of trade discounts on tax calculations” is critical. Trade discounts, while reducing revenue, can have intricate effects on tax calculations, affecting a company’s tax liability and financial reporting.

- Sales Tax Implications: Trade discounts directly impact sales tax calculations. When discounts are offered, the taxable amount is reduced, potentially lowering the sales tax liability.

- Income Tax Implications: Discounts granted may affect a company’s taxable income. Lower revenue due to discounts can result in reduced income tax liability.

- Transfer Pricing: In the context of intercompany transactions, trade discounts can influence transfer pricing strategies, impacting the allocation of taxable income among different entities within a corporate group.

- Tax Audits: Understanding the tax implications of trade discounts is crucial during tax audits. Auditors may scrutinize trade discount practices to ensure compliance with tax regulations.

In conclusion, “Tax Implications: Understanding the impact of trade discounts on tax calculations” is an integral aspect of “trade discount formula in accounting.” By considering the facets discussed above, businesses can navigate the complexities of tax regulations, optimize their tax strategies, and maintain accurate financial reporting.

Industry Practices

Within the realm of “trade discount formula in accounting,” comprehending “Industry Practices: Adhering to industry norms and best practices related to trade discounts” is paramount. Trade discounts, while offering competitive advantages, should align with established industry norms and ethical guidelines to foster transparency and fair market practices.

- Standardized Terminology: Adhering to uniform terminology ensures clear communication and understanding of trade discount terms and conditions, minimizing confusion and disputes.

- Ethical Disclosure: Transparency in disclosing trade discounts is crucial. Customers have the right to know the actual price of goods or services, including any discounts or rebates offered.

- Competitive Parity: Industry practices often dictate the range of trade discounts offered. Deviating significantly from established norms can raise concerns about unfair competition or predatory pricing.

- Legal Compliance: Trade discount practices should comply with applicable laws and regulations. Antitrust laws, for instance, aim to prevent monopolies and promote fair competition.

Understanding and adhering to “Industry Practices: Adhering to industry norms and best practices related to trade discounts” not only enhances the accuracy and reliability of “trade discount formula in accounting” but also promotes ethical conduct, maintains a level playing field, and safeguards the interests of both businesses and consumers.

Frequently Asked Questions about Trade Discount Formula in Accounting

This FAQ section addresses common queries and clarifies aspects of the trade discount formula in accounting, providing valuable insights for enhanced understanding and practical application.

Question 1: What is the purpose of the trade discount formula?

Answer: The trade discount formula calculates the discounted price of goods or services, considering the list price and the trade discount rate. It helps businesses determine the actual price paid by customers after accounting for discounts.

Question 2: How is the trade discount formula applied in real-world scenarios?

Answer: In practice, businesses offer trade discounts to incentivize purchases, such as a 10% discount on bulk orders or a 5% discount for early payments.

Question 3: What are the benefits of using the trade discount formula?

Answer: The formula enhances accuracy in calculating discounted prices, optimizes pricing strategies, improves inventory management, and facilitates better decision-making.

Question 4: How does the trade discount formula impact financial statements?

Answer: Trade discounts reduce revenue and may affect inventory valuation. Proper disclosure in financial statements ensures transparency and accurate reporting.

Question 5: What are some common industry practices related to trade discounts?

Answer: Industries often have established norms and ethical guidelines for trade discounts, including standardized terminology, ethical disclosure, and adherence to competition laws.

Question 6: How can businesses optimize the use of the trade discount formula?

Answer: Businesses can optimize this formula by considering industry practices, analyzing customer behavior, and regularly reviewing and adjusting discount strategies.

These FAQs provide a concise overview of key aspects related to the trade discount formula in accounting. Understanding and effectively utilizing this formula empowers businesses to optimize pricing, enhance customer relationships, and make informed decisions that drive profitability.

In the following sections, we will delve deeper into the intricacies of the trade discount formula, exploring advanced concepts and practical applications for maximizing its benefits in accounting practices.

Tips for Utilizing the Trade Discount Formula in Accounting

This section provides practical tips to help you harness the potential of the trade discount formula in accounting practices.

Tip 1: Understand the Basics: Grasp the fundamental concepts of trade discounts, including list price, discount rate, and net price, to ensure accurate calculations.

Tip 2: Consider Industry Practices: Familiarize yourself with industry norms and ethical guidelines for trade discounts to maintain transparency and fair competition.

Tip 3: Analyze Customer Behavior: Study customer purchasing patterns and preferences to tailor trade discount strategies that resonate with your target audience.

Tip 4: Optimize Pricing: Leverage the trade discount formula to determine optimal pricing strategies that maximize profitability while attracting customers.

Tip 5: Enhance Inventory Management: Utilize trade discounts to manage inventory levels effectively, minimizing the risk of overstocking or stockouts.

Tip 6: Improve Cash Flow: Offer early payment discounts to incentivize timely payments and improve cash flow, ensuring financial stability.

Tip 7: Maintain Accurate Records: Keep meticulous records of trade discounts offered to ensure transparency, facilitate audits, and maintain compliance.

Tip 8: Regularly Review and Adjust: Periodically assess the effectiveness of your trade discount strategies and make necessary adjustments based on market dynamics and customer feedback.

By following these tips, you can effectively utilize the trade discount formula to enhance your accounting practices, optimize pricing, strengthen customer relationships, and drive profitability.

The insights gained from this section will serve as a solid foundation as we delve into the intricacies of the trade discount formula in the concluding section of this article.

Conclusion

This comprehensive exploration of the trade discount formula in accounting has illuminated its significance in optimizing pricing strategies, managing customer relationships, and maintaining accurate financial records. Key takeaways include:

- Impact on Revenue and Profitability: Understanding the impact of trade discounts on revenue and profitability enables businesses to make informed decisions regarding pricing and discount strategies.

- Inventory Valuation and Cash Flow: The trade discount formula plays a crucial role in inventory valuation and cash flow management, ensuring accurate financial reporting and optimizing business operations.

- Customer Relationships and Industry Practices: Offering competitive trade discounts can foster strong customer relationships, while adhering to industry practices promotes transparency and fair competition.

The trade discount formula remains a fundamental tool in accounting practices, empowering businesses to navigate the complexities of pricing and customer incentives. By embracing its versatility and considering the insights outlined in this article, organizations can unlock its full potential to drive growth, enhance profitability, and build lasting customer relationships.