If you are a business owner, you may have come across the term “simple discount.” It is a method of calculating discounts on products or services. For instance, it is widely used in retail to move seasonal products by offering reductions on the marked price of goods. Simple discount is calculated by multiplying the discount rate (expressed as a percentage) by the original price of the item and then subtracting the result from the original price.

Calculating simple discount is a fundamental skill in commerce and finance, empowering individuals to make informed decisions regarding their purchases. Understanding this concept has been critical in managing finances throughout history, from early barter systems to modern e-commerce platforms.

In this article, we will delve into the intricacies of simple discount calculations, providing a comprehensive guide to help you master this essential concept.

How to Calculate Simple Discount

Simple discount calculation involves several key aspects that are crucial for accurate computation. These elements include:

- Present Value

- Maturity Value

- Discount Rate

- Discount Period

- Simple Interest

- Future Value

- Net Price

- Trade Discount

- Cash Discount

Understanding these aspects is essential for proficiency in simple discount calculations. They encompass the fundamental concepts and principles that govern the process, providing a comprehensive framework for analysis and application in various financial contexts.

Present Value

In the context of simple discount calculation, Present Value plays a pivotal role. It represents the current worth of a future sum of money, discounted back to the present day. Understanding the relationship between Present Value and simple discount is crucial for accurate financial planning and decision-making.

Simple discount is calculated as the difference between the Present Value and the Maturity Value (future sum) of a financial instrument. The discount rate and the time period over which the discount is applied determine the Present Value. A higher discount rate or a longer time period results in a lower Present Value.

In real-world applications, Present Value is used extensively in various financial transactions, including the pricing of bonds, loans, and annuities. For instance, banks use Present Value calculations to determine the amount of a loan that can be approved based on an individual’s income and expenses. Similarly, investors use Present Value to evaluate the potential return on investment opportunities, comparing the Present Value of future cash flows to the initial investment.

By understanding the connection between Present Value and simple discount, individuals and businesses can make informed financial decisions. It empowers them to assess the time value of money, compare investment options, and plan for future financial obligations effectively.

Maturity Value

Maturity Value, also known as the Face Value, is a crucial aspect of simple discount calculation. It represents the total amount that will be repaid at the end of the loan or investment period. Understanding the concept of Maturity Value is essential for accurate financial planning and decision-making.

- Principal: The principal is the initial amount borrowed or invested. It forms the basis for calculating the simple discount and is a key component of the Maturity Value.

- Interest: Interest is the cost of borrowing money or the return on an investment. It is typically expressed as a percentage of the principal and is added to the principal to determine the Maturity Value.

- Time: The time period over which the loan or investment is held directly influences the Maturity Value. A longer time period generally results in a higher Maturity Value due to the accumulation of interest.

- Discount: The discount, if applicable, is subtracted from the Maturity Value to arrive at the Present Value. It represents a reduction in the amount that will be repaid at the end of the period.

Maturity Value plays a significant role in simple discount calculation as it determines the final amount that will be received or repaid. By understanding the various facets and implications of Maturity Value, individuals can make informed financial decisions, compare investment options, and plan for future financial obligations effectively.

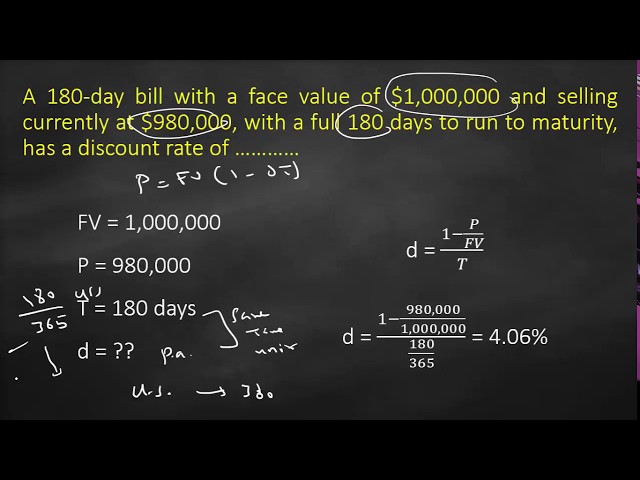

Discount Rate

Discount Rate, expressed as a percentage, is a pivotal component of simple discount calculation. It represents the cost of borrowing money or the return on an investment over a specific period. Understanding the connection between Discount Rate and simple discount is crucial for making sound financial decisions.

Discount Rate directly influences the simple discount amount. A higher Discount Rate results in a greater discount, while a lower Discount Rate leads to a smaller discount. This relationship is inversely proportional, meaning that as one increases, the other decreases. Thus, Discount Rate is a critical factor in determining the Present Value of a future sum, which is the basis of simple discount calculation.

In real-life applications, Discount Rate plays a significant role in various financial transactions. For instance, banks use Discount Rate to set interest rates on loans, determining the cost of borrowing for individuals and businesses. Similarly, investors use Discount Rate to evaluate investment opportunities, comparing the Present Value of future cash flows to the initial investment. By understanding the impact of Discount Rate on simple discount, individuals can make informed decisions, compare financial products, and plan for future financial obligations effectively.

In summary, Discount Rate is a fundamental element of simple discount calculation, directly affecting the amount of discount and the Present Value of future sums. Its practical applications extend to a wide range of financial transactions, empowering individuals and businesses to make informed decisions and plan for their financial future.

Discount Period

In the context of simple discount calculation, Discount Period is a fundamental aspect that directly influences the outcome. It refers to the duration over which the discount is applied, typically expressed in years or fractions of a year. Understanding the relationship between Discount Period and simple discount is vital for accurate financial planning and decision-making.

The Discount Period is inversely proportional to the simple discount amount. A longer Discount Period results in a greater discount, while a shorter Discount Period leads to a smaller discount. This relationship is due to the time value of money, which states that the present value of a future sum decreases as the time period increases. As a result, Discount Period is a critical component of simple discount calculation, as it determines the Present Value of the future sum, which is the basis of simple discount.

In real-life applications, Discount Period plays a significant role in various financial transactions. For instance, banks consider Discount Period when setting interest rates on loans, determining the cost of borrowing for individuals and businesses. Similarly, investors use Discount Period to evaluate investment opportunities, comparing the Present Value of future cash flows to the initial investment. By understanding the impact of Discount Period on simple discount, individuals can make informed decisions, compare financial products, and plan for future financial obligations effectively.

In summary, Discount Period is a crucial element of simple discount calculation, directly affecting the amount of discount and the Present Value of future sums. Its practical applications extend to a wide range of financial transactions, empowering individuals and businesses to make informed decisions and plan for their financial future.

Simple Interest

In the context of simple discount calculation, Simple Interest plays a fundamental role. It represents the interest charged on a loan or earned on an investment over a specific period, calculated as a percentage of the principal. Understanding the relationship between Simple Interest and simple discount is crucial for accurate financial planning and decision-making.

- Rate: The interest rate, expressed as a percentage, determines the amount of interest charged or earned. It is a key factor in calculating simple discount.

- Time: The time period over which the interest is calculated affects the total Simple Interest. A longer time period generally results in more interest.

- Principal: The principal is the initial amount borrowed or invested. It forms the base for calculating Simple Interest.

- Present Value: Simple Interest is closely tied to the Present Value of a future sum. It represents the value of the interest earned or charged today.

In summary, Simple Interest is an integral part of simple discount calculation, influencing the amount of discount and the Present Value of future sums. Its practical applications extend to a wide range of financial transactions, empowering individuals and businesses to make informed decisions and plan for their financial future.

Future Value

In the context of “how to calculate simple discount,” Future Value plays a significant role. It represents the value of a sum of money at a future date, taking into account the effects of interest and discounting. Understanding the relationship between Future Value and simple discount is essential for accurate financial planning and decision-making.

Future Value is inversely related to simple discount. A higher Future Value results in a smaller simple discount, and vice versa. This relationship stems from the time value of money, which states that the present value of a future sum decreases as the time period increases. As such, Future Value is a critical component of simple discount calculation, as it determines the Present Value of the future sum, which is the basis for calculating the simple discount.

In real-life applications, Future Value is used in various financial transactions, including loans, investments, and annuities. For instance, banks use Future Value calculations to determine the maturity value of loans, ensuring that they receive the principal amount plus interest at the end of the loan term. Similarly, investors use Future Value to evaluate investment opportunities, comparing the Future Value of potential returns to the initial investment. By understanding the connection between Future Value and simple discount, individuals and businesses can make informed financial decisions, compare financial products, and plan for future financial obligations effectively.

In summary, Future Value is an integral part of “how to calculate simple discount,” influencing the amount of discount and the Present Value of future sums. Its practical applications extend to a wide range of financial transactions, empowering individuals and businesses to make informed decisions and plan for their financial future.

Net Price

Within the context of “how to calculate simple discount,” “Net Price” holds a pivotal position. It represents the final price of a product or service after deducting all applicable discounts, markdowns, or rebates. Understanding the relationship between “Net Price” and “how to calculate simple discount” is crucial for accurate financial planning and decision-making.

The connection between “Net Price” and “how to calculate simple discount” is primarily causal. Simple discount is calculated as a percentage reduction from the original price of an item. Therefore, the “Net Price” is directly influenced by the simple discount applied. A higher simple discount results in a lower “Net Price,” and vice versa. This relationship is fundamental to understanding how discounts impact the final price of goods and services.

In real-life applications, “Net Price” plays a significant role in various financial transactions, including retail sales, invoice settlements, and promotional campaigns. For instance, businesses use “Net Price” to determine the actual amount they will receive after offering discounts to customers. Similarly, consumers use “Net Price” to compare prices and make informed purchasing decisions. By understanding the impact of simple discount on “Net Price,” individuals and businesses can effectively manage their finances and optimize their spending.

In summary, “Net Price” is an integral component of “how to calculate simple discount,” directly affected by the discount rate applied. Its practical applications extend to a wide range of financial transactions, empowering individuals and businesses to make informed decisions and plan for future financial obligations effectively.

Trade Discount

Trade Discount, a critical aspect of “how to calculate simple discount,” plays a key role in determining the final price of goods and services. Rooted in wholesale and retail transactions, it represents price reductions offered to businesses or individuals purchasing in bulk quantities or establishing long-term business relationships.

- Volume Discount: A discount offered to customers who purchase large quantities of a particular product or service, encouraging bulk purchases and increasing sales volume.

- Cash Discount: A discount incentivizing prompt payment, often expressed as a percentage reduction for payments made within a specific time frame, promoting timely settlements and improving cash flow.

- Seasonal Discount: A temporary price reduction offered during specific seasons or periods to clear out inventory, stimulate demand, and align with seasonal trends.

- Loyalty Discount: A discount offered to repeat customers as a reward for their continued patronage, fostering customer loyalty and encouraging repeat purchases.

These facets of Trade Discount work in conjunction with simple discount calculations, influencing the final price paid by the customer. Understanding the interplay between Trade Discount and simple discount is crucial for businesses to optimize their pricing strategies and for consumers to make informed purchasing decisions. Whether it’s maximizing profits through volume discounts or securing favorable terms with loyalty discounts, Trade Discount plays a significant role in the dynamics of “how to calculate simple discount.”

Cash Discount

Cash Discount, an integral part of “how to calculate simple discount,” is a price reduction offered to customers who make prompt payments. This incentive encourages timely settlements and improves cash flow for businesses, impacting the overall calculation of simple discount.

- Early Payment Discount (EPD): A discount offered for payments made before a specified due date, motivating customers to settle invoices early and reducing the risk of late payments.

- Fixed Percentage Discount: A predetermined discount applied to the invoice amount, providing a fixed reduction regardless of the payment terms, simplifying calculations and encouraging timely payments.

- Net Due Date: The date by which the invoice amount is due without any discounts or penalties, serving as a reference point for calculating the cash discount period.

- Credit Period: The duration between the invoice date and the net due date, providing customers with a grace period to make payments and potentially take advantage of cash discounts.

These facets of Cash Discount interplay with simple discount calculations, directly influencing the final amount due. By understanding how Cash Discount impacts the “how to calculate simple discount” formula, businesses can optimize their payment terms to improve cash flow and customers can make informed decisions to take advantage of these incentives while managing their payment obligations effectively.

Frequently Asked Questions

This section addresses common questions and clarifications regarding “how to calculate simple discount.” These FAQs aim to enhance understanding and provide practical guidance.

Question 1: What is the formula for calculating simple discount?

Answer: Simple Discount = (Principal Amount x Discount Rate x Time Period) / 100

Question 2: How does the discount rate affect the simple discount?

Answer: A higher discount rate results in a greater discount, while a lower discount rate leads to a smaller discount. The discount rate is inversely proportional to the simple discount amount.

Question 3: Can simple discount be applied to any amount?

Answer: Yes, simple discount can be applied to any amount, regardless of its value or currency.

Question 4: What is the difference between simple discount and compound discount?

Answer: Simple discount is calculated on the original principal amount only, while compound discount is calculated on the principal amount plus the interest accrued in previous periods.

Question 5: How can I use simple discount to compare different investment options?

Answer: By calculating the simple discount for each investment option, you can compare the effective returns and make informed decisions based on the best returns offered.

Question 6: Are there any limitations to using simple discount?

Answer: Simple discount assumes a constant discount rate over the entire time period, which may not always be realistic. For long-term investments or in situations where interest rates fluctuate, compound discount may be more appropriate.

In summary, these FAQs have covered the essential aspects of “how to calculate simple discount,” providing practical guidance and addressing common concerns. Understanding these concepts is crucial for making informed financial decisions and effectively managing your finances.

In the next section, we will explore advanced concepts related to discounting, including compound discounting and its applications in various financial scenarios.

Tips for Calculating Simple Discount Effectively

The following tips provide practical guidance to help you accurately calculate simple discount and make well-informed financial decisions.

Tip 1: Clearly Identify Key Variables

Before calculating simple discount, ensure you have, including the principal amount, discount rate, and time period.

Tip 2: Use the Correct Formula

Remember the simple discount formula: Simple Discount = (Principal Amount x Discount Rate x Time Period) / 100. Apply this formula accurately to calculate the discount.

Tip 3: Consider the Discount Rate

The discount rate significantly impacts the discount amount. Understand how a higher or lower discount rate affects the final result.

Tip 4: Calculate Discount for Partial Periods

When the time period is not a whole number, calculate the discount for the partial period.

Tip 5: Check Your Calculations

Double-check your calculations to ensure accuracy. Use a calculator or spreadsheet to minimize errors.

Tip 6: Apply Simple Discount Appropriately

Simple discount is suitable for short-term transactions with a constant discount rate. Consider other methods for more complex scenarios.

By following these tips, you can ensure the accuracy and effectiveness of your simple discount calculations. This understanding empowers you to make informed financial decisions and effectively manage your finances.

In the next section, we will delve into the practical applications of simple discount in various financial contexts, demonstrating its significance in real-world scenarios.

Conclusion

In summary, this article has explored the intricacies of “how to calculate simple discount,” providing a comprehensive guide to this fundamental financial concept. We have examined the key elements involved in simple discount calculations, including present value, maturity value, discount rate, and time period. Furthermore, we have discussed the practical applications of simple discount in various financial transactions, such as pricing, investments, and loans.

Understanding “how to calculate simple discount” is crucial for making informed financial decisions. It empowers individuals and businesses to evaluate investment opportunities, compare loan terms, and effectively manage their finances. By grasping the concepts of simple discount, you can navigate the financial landscape with greater confidence and make choices that align with your financial goals.