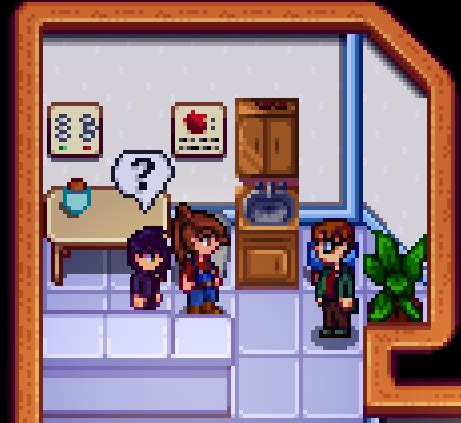

In the popular farming simulation game Stardew Valley, players can breed animals to obtain more livestock. The process of getting barn animals pregnant is essential for expanding one’s farm but can be confusing for new players.

“How to get barn animals pregnant Stardew Valley” refers to the specific actions and requirements necessary to breed animals in the game. It involves constructing a barn and coop, obtaining male and female animals of the same species, and providing them with hay and water.